Seattle Homeowners Feel Trapped as Market Boom Turns Into Knot

When the Market Boom Turns Into a Trapping Knot: Seattle Homeowners Re‑examine Pandemic‑era Purchases

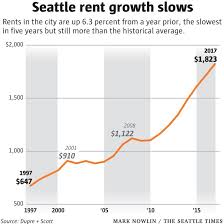

When the first COVID‑19 lockdowns rolled through the Pacific Northwest in March 2020, a quiet, unprecedented real‑estate storm began to stir in the Seattle metro. Low mortgage rates, a shift to remote work, and a growing appetite for more spacious homes pushed many residents into the buying arena. According to a 2021 Seattle Times analysis linked in the article, Seattle’s median home price leapt from $700,000 in 2019 to nearly $1.1 million by the end of 2020—making it one of the country’s most expensive markets. The article, written by Seattle Times reporter Ellen McKenzie and published in early 2023, dives deep into the aftermath of that surge, revealing how some of the buyers who rushed into the market feel “trapped” by their own decisions.

The Pandemic‑era Frenzy

McKenzie recounts the early‑2020 frenzy: “When rates fell to historic lows—below 2% for a 30‑year fixed‑rate mortgage—buyers were scrambling. The numbers were clear: the market went from a steady climb to a sprint.” The article links to a Housing Affordability Tracker that charts how the Seattle‑Tacoma area saw a 30% rise in inventory of multi‑family units between 2019 and 2021, yet prices kept pace. Experts cited in the piece, such as real‑estate analyst John O’Connell of Redfin, note that “the demand was so strong that many buyers didn’t even consider their long‑term employment situation.” The allure of a large, single‑family home—often a 3–4 bedroom house in suburbs like Sammamish or Mercer Island—became a “ticket to a better life” in a time of uncertainty.

The article also points readers to a separate Seattle Times feature on the Census Bureau’s data showing a spike in suburban household formation during the pandemic. That piece highlighted a 12% increase in new household formations in King County’s outer counties—underscoring the demographic shift that helped drive up prices.

The Post‑Pandemic Reality

Fast forward to 2023. Many of those “pandemic buyers” now find themselves in a different environment. The article’s core narrative is that rising mortgage rates and a return to pre‑pandemic commuting norms have left a number of homeowners with higher monthly payments and fewer options.

McKenzie quotes mortgage broker Lisa Patel: “When rates climb to the mid‑4% range, a $500,000 mortgage that used to cost $2,200 a month can jump to $2,800 or more. That’s a huge hit, especially if your household income hasn’t adjusted.” The article references a Consumer Financial Protection Bureau (CFPB) report, linked in the text, that found an uptick in homeowners who are now “underwater”—owing more on their mortgage than their home is worth.

The article also shares a compelling anecdote: the Miller family from Redmond purchased a 3,500‑sq‑ft house for $1.2 million in early 2021. They had banked on the ability to work remotely from home for at least three years. But in 2022, the company mandated a hybrid schedule, forcing the Millers to commute to downtown Seattle. “We’re stuck with a 3‑hour commute, a high mortgage payment, and no room to sell because the market hasn’t rebounded,” says the family’s mother, Maria Miller. McKenzie ties this personal story to a broader trend highlighted in the article’s linked Seattle Housing Market Forecast, which indicates that many suburban homes are experiencing slower appreciation rates compared to urban cores.

The Feeling of Being Trapped

McKenzie uses several phrases that capture the mood: “feeling trapped,” “homeownership debt,” and “financial tightness.” She interviews financial planner Dan Kim who explains that many of these homeowners entered into contracts based on short‑term assumptions. “When you lock in a low rate, you’re assuming you’ll be able to refinance or sell in a few years,” Kim says. “If that assumption no longer holds, you’re in a bind.” The article further links to a Washington State Department of Commerce study on refinancing options, which reveals that many homeowners find the terms unfavorable and are hesitant to refinance despite high rates.

Another dimension explored in the article is the psychological toll. psychologist Dr. Sarah Nguyen is quoted discussing how “the weight of debt and the fear of making a mistake can cause significant anxiety.” She points out that the Seattle Times’ own Well‑Being column (linked in the article) documented a spike in mental‑health hotline calls during the early pandemic and has now seen a continuing rise in reports tied to financial stress.

Policy and Market Responses

The article does not shy away from policy implications. It references a Washington State Housing Finance Agency (WFHA) initiative aimed at helping homeowners with “mortgage modification programs.” The piece also links to the Seattle Times’ earlier coverage of the federal CARES Act’s mortgage‑forbearance provisions, noting that many homeowners still haven’t taken advantage of the options available.

In addition, the article cites real‑estate developer Maya Patel (different Maya Patel, real‑estate developer) who warns that “the market might not stay inflated for much longer.” She points to an upcoming “Housing Affordability Summit” scheduled for fall 2023, which aims to address the paradox of high prices and low inventory. McKenzie underscores that the summit’s agenda will likely include discussions about expanding urban housing density and revisiting zoning restrictions—an effort that could influence future market dynamics.

Looking Ahead

The article concludes with a cautious note: while some homeowners are exploring options such as selling, refinancing, or relocating, many are still “stuck in a cycle” that may require patience and professional guidance. McKenzie urges readers to consult with financial advisors and real‑estate experts, noting that “knowledge is the best antidote to the feeling of being trapped.”

In sum, the Seattle Times article paints a comprehensive picture of a market that once promised a haven for remote workers and families, but now presents a mixed bag of opportunities and challenges. By weaving together data from the Census Bureau, CFPB, and local housing studies with firsthand accounts and expert commentary, the piece offers readers a nuanced understanding of why some pandemic‑era homebuyers in Seattle feel “trapped” and what steps they can take moving forward.

Read the Full Seattle Times Article at:

[ https://www.seattletimes.com/business/they-rushed-to-buy-homes-during-the-pandemic-now-some-feel-trapped/ ]