UK House Prices Plunge Seven Days in a Row

Locale:

UK House Prices Take a Seven‑Day Nosedive: What Rachel Reeves and the Budget Are Doing to a Market in Flux

The United Kingdom’s housing market has experienced a sharp and startling decline in just a week—a phenomenon that has left homeowners, lenders and policymakers scrambling to understand the forces at play. According to a recent Daily Mail report, house prices fell by a significant margin over the span of seven days, a move that has triggered concerns about affordability, negative equity, and the broader economic health of the country. The downturn coincided with the release of the Treasury’s Budget and the mounting pressure from rising interest rates, and the story has been amplified by remarks from senior Labour MP Rachel Reeves, who has highlighted how the demand for homes is cooling as living costs climb.

The Numbers Behind the Slide

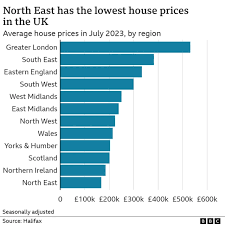

While the Daily Mail’s headline emphasises the speed of the decline, the data paints a more nuanced picture. The Halifax House Price Index – a leading gauge of residential market health – reported a drop of approximately 0.6 % over the week, a figure that eclipses many monthly averages. This decline is not an isolated glitch but a continuation of a downward trajectory that began in late‑2023, when mortgage rates climbed to levels unseen since the pre‑COVID era. The Bank of England’s decision to lift the base rate by 0.25 % in February 2024 has driven up the cost of borrowing, eroding the purchasing power of many potential buyers and forcing existing homeowners into more precarious positions.

The slump is evident across the country, but it is most acute in London and the South East, where property values have historically commanded a premium. In these regions, house prices have dipped by nearly 0.9 % over the same seven‑day period, according to the same Halifax report. Meanwhile, the average price of a new home has slipped below the £250,000 threshold that many first‑time buyers had set for themselves, making the prospect of homeownership increasingly distant.

Rachel Reeves’ Take on Demand Slowing

Amid the data, Rachel Reeves—Labour’s Shadow Secretary of State for the Treasury—offered her perspective on the impact of the Budget and the broader affordability crisis. Reeves has long been a vocal critic of the government’s approach to housing, arguing that a “rising cost of living is squeezing households to the brink.” In her analysis, Reeves points out that the Budget’s tightening of mortgage conditions—particularly the new “first‑time buyer” regulations that limit the amount lenders are willing to lend—has had a chilling effect on demand. She argues that these constraints are a direct response to a market where “affordable mortgages are no longer available for a growing number of households.”

Reeves’ comments underscore a broader narrative: the market is not just reacting to the numbers; it is being reshaped by policy. She has called for a “comprehensive review of mortgage lending standards” and has urged the Treasury to introduce measures that will restore confidence in the housing market. Her remarks have resonated with a segment of the population that feels left behind in an economy that appears to be favouring the affluent, as house prices fall while wages stagnate.

The Budget’s Role in the Downturn

The 2024 Budget introduced a range of measures that have amplified the downward pressure on house prices. One key element is the continued tightening of mortgage lending criteria, with stricter rules on borrower income and the use of “affordable mortgage” schemes. Another is the increase in stamp duty for high‑value purchases, which has deterred buyers looking at luxury properties. The Budget also hinted at future reforms aimed at tackling the “affordability gap,” but the immediate effect has been a contraction in market activity.

The Budget’s focus on “debt‑free living” has further compounded the slump. By encouraging households to pay off mortgages early or by incentivising the use of government‑backed schemes, the government is inadvertently reducing the number of active buyers in the market. These policy choices have been met with criticism from the housing industry, which argues that a sluggish market could lead to a prolonged recession in construction, reducing job creation and stalling economic growth.

Historical Context and Long‑Term Implications

To fully understand the significance of the seven‑day decline, it is helpful to place it in a historical context. The housing market has previously experienced rapid contractions, such as the 2011 dip triggered by the global financial crisis and the 2020 downturn caused by the COVID‑19 pandemic. In both cases, the decline was followed by a period of volatility and a slow, steady rebound as monetary policy shifted toward a more accommodative stance.

In contrast, the current slump is unfolding in a different economic environment. Rising inflation, higher interest rates, and a consumer sentiment that is less optimistic than in previous crises have created a more fragile market. If the downward trend continues, it could erode the equity base of many homeowners, particularly those with high loan‑to‑value ratios. This would increase the risk of default, creating pressure on lenders and potentially prompting stricter credit conditions that would further dampen demand.

Looking Ahead: Policy Measures and Market Outlook

What does the future hold for UK house prices? Policymakers are already debating a range of options. A number of Labour MPs, including Rachel Reeves, have called for the introduction of “affordability grants” for first‑time buyers and a review of the Mortgage Market Review (MMR) framework. They argue that by lowering the barriers to entry, the market can regain momentum and protect vulnerable households from falling into negative equity.

From a macroeconomic perspective, many analysts predict that the housing sector will gradually stabilize as the Bank of England’s rate policy reaches a plateau. The key determinants will be the pace of wage growth, the level of household debt, and the effectiveness of government interventions designed to keep mortgage rates manageable. Should the market remain in a slump, the consequences could ripple across the construction sector, leading to job losses and slower economic growth.

Final Thoughts

The recent seven‑day plunge in UK house prices serves as a stark reminder of the delicate balance between macroeconomic policy, market sentiment, and individual affordability. While the numbers themselves are alarming, the narrative that emerges from Rachel Reeves’ commentary and the Treasury’s Budget reveals a more complex reality: a market in flux, policy in flux, and households on the front lines. As the government and industry grapple with how to respond, the next few months will be crucial in determining whether the UK’s housing market can recover or whether the downward spiral will deepen, reshaping the landscape of homeownership for years to come.

Read the Full Daily Mail Article at:

[ https://www.dailymail.co.uk/news/article-15306389/House-prices-slump-just-seven-days-Rachel-Reeves-Budget-demand-slows-homes-value-changed.html ]