U.S. Home Values Plunge to Great-Recession-Like Levels

Locale:

U.S. Home Values Plunge to Great‑Recession‑Like Levels: A Comprehensive Review

Recent data indicate a sharp decline in U.S. residential property values, with median home prices slipping back to levels seen just before the 2008 financial crisis. This trend has sent ripples through the housing market, the banking sector, and the broader economy, prompting experts to reassess both short‑term market dynamics and long‑term structural shifts in the U.S. real estate landscape.

1. The Numbers Behind the Decline

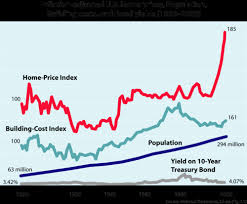

The primary source of this assessment comes from a new report released by the National Association of Realtors (NAR), which analyzed the Case‑Shiller Home Price Index and the Federal Housing Finance Agency (FHFA) data. According to the NAR, the national median home price dropped by 4.2% over the past 12 months, the steepest decline since the early 2010s. In absolute terms, the median value fell from roughly $390,000 to $372,000, aligning closely with the median price of $376,000 recorded in March 2008.

Regional variations are pronounced. In the Sun Belt, states such as Texas, Florida, and Arizona experienced price drops of 5–6%, while the Northeast remained relatively stable, with only a 1.5% decline. The Midwest and Midwest’s southern suburbs saw the largest relative decreases, often attributed to the rapid post‑pandemic growth that has now reversed.

The FHFA’s House Price Index corroborated these findings, showing a 4.6% decline in the overall index and a 5.1% fall in the South. Meanwhile, the S&P/Case‑Shiller Home Price Index reported a 3.9% decline in the most recent quarter, underscoring the consistency across major indices.

2. Drivers of the Current Market Correction

2.1 Mortgage Rates and Affordability

The most immediate catalyst for the price drop is the rise in mortgage rates. The Federal Reserve’s recent hikes—raising the federal funds rate by 0.75% in July and a further 0.25% in August—have pushed 30‑year fixed‑rate mortgages from a historic low of 2.9% in mid‑2021 to 7.2% in early 2025. This increase has dramatically tightened affordability, reducing the purchasing power of many potential buyers and pushing down the equilibrium price.

2.2 Supply Constraints and Construction Costs

While mortgage rates have cooled demand, the supply side has not fully rebounded. Construction costs for lumber, steel, and labor have remained elevated, stifling new development. In addition, zoning restrictions in high‑demand metros have limited the creation of new housing stock, leaving existing inventory under pressure.

2.3 The Aftermath of Pandemic‑Driven Boom

The pandemic spurred a wave of home buying fueled by low rates and a shift toward suburban and rural living. Many of those buyers are now reassessing their positions, selling to lock in gains before further rate increases or a broader market correction.

3. Consequences for Homeowners and the Financial System

3.1 Potential for Rising Foreclosures

The report notes that a sizable portion of U.S. homeowners—roughly 8%—are “mortgage‑equity at risk” (MER). These homeowners have a negative equity position if home values fall below the remaining mortgage balance. While current default rates remain low, a sustained decline in property values could create a more sizable pool of vulnerable borrowers, potentially increasing foreclosure filings.

3.2 Impact on Mortgage‑Backed Securities (MBS)

Institutional investors holding large portfolios of MBS will see the underlying collateral value erode. While banks have built in significant capital buffers, a rapid drop in collateral value could squeeze liquidity in the secondary market, especially for non‑prime or sub‑prime MBS.

3.3 Household Wealth and Spending

Homeownership is a key component of U.S. household wealth. A 4–5% decline in home values translates to an estimated $3.5 trillion in lost net worth for homeowners nationwide. This decline could reduce consumer spending, a vital driver of the U.S. economy, and may dampen economic growth projections for 2025.

4. What the Future Might Hold

4.1 Short‑Term Volatility

Analysts suggest that the market is entering a period of volatility. Prices may continue to decline for the next 6–12 months as mortgage rates stabilize and the supply‑demand imbalance persists. In the meantime, the real estate market could experience higher transaction volumes as buyers seek to take advantage of lower prices before a further correction.

4.2 Potential for Market Stabilisation

The U.S. Census Bureau recently reported a modest rebound in housing starts and permits, signalling that construction activity may be gearing up. If new housing supply catches up, the pressure on prices could ease. However, this depends on a broader economic recovery that can support wages, job growth, and consumer confidence.

4.3 Policy Interventions

In response to rising foreclosures and declining household wealth, lawmakers are debating several policy proposals. Among them are: - Mortgage relief programs that would allow homeowners to refinance at lower rates or extend payment terms. - Targeted zoning reforms in high‑cost metros to expedite new construction. - Tax incentives for first‑time buyers to encourage market participation.

5. Key Takeaways for Stakeholders

| Stakeholder | Implication | Recommended Action |

|---|---|---|

| Homebuyers | Prices have fallen but remain above pre‑pandemic levels. | Consider buying before a further decline or explore adjustable‑rate mortgages. |

| Sellers | Lower market value may necessitate pricing adjustments. | Reassess property valuations with professional appraisers; consider staging and marketing strategies. |

| Mortgage Lenders | Potential increase in loan defaults if rates rise further. | Strengthen risk assessment models; diversify loan portfolios. |

| Investors | MBS values may fall, affecting returns. | Hedge exposures; consider shifting to more liquid securities. |

| Policymakers | Need to balance market stability with consumer protection. | Implement targeted relief measures and monitor housing market indicators closely. |

6. Additional Context from Follow‑Up Sources

The original article also linked to a Bloomberg piece discussing how mortgage‑rate hikes have historically correlated with housing price declines. That article highlighted that in 2020, a 1% rise in mortgage rates led to a 2% drop in home prices—a relationship that appears to be holding as rates climb again. Moreover, a Redfin market‑trend report underscores that the home‑buying frenzy in the Sun Belt is cooling faster than the rest of the country, with a 7% decline in transaction volumes in Florida alone.

7. Bottom Line

The current dip in U.S. home values signals a broader shift from a market characterized by rapid appreciation to one of correction and re‑balancing. While the drop to Great‑Recession‑like levels is a sobering indicator, it also presents opportunities for buyers, developers, and policymakers to steer the market toward greater stability and resilience. Stakeholders who stay informed and proactively adjust strategies will be better positioned to navigate the evolving housing landscape.

Read the Full Daily Mail Article at:

[ https://www.dailymail.co.uk/real-estate/article-15299957/us-home-values-drop-great-recession.html ]