Current ARM mortgage rates report for Aug. 1, 2025

Fortune

Fortune

U.S. Adjustable‑Rate Mortgage Rates Climb to 8‑Year Highs on August 1, 2025

On August 1, 2025, the latest data from the mortgage market shows a significant uptick in rates for most adjustable‑rate mortgage (ARM) products, reflecting the Federal Reserve’s tightening cycle and a resurgence in inflationary pressures. The most widely followed 5‑year‑fixed‑then‑adjustable (5/1 ARM) peaked at 6.32 % while the 7/1 ARM hovered at 6.56 %. Even the longer‑term 10/1 ARM, traditionally the most affordable option for borrowers who plan to refinance or sell before the first adjustment, climbed to 6.73 %. All three rates represent the highest levels seen since early 2020, underscoring a shift in the loan environment that could reshape borrower expectations.

The Market Context

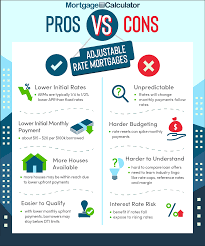

The surge in ARM rates is largely a response to the Federal Reserve’s sustained interest‑rate hikes over the past year, which have pushed the overnight funds rate to 5.25 %–5.50 %. The Fed’s tightening stance is driven by a rebounding labor market and commodity prices that keep headline inflation above the 2 % target. Mortgage lenders have responded by tightening underwriting standards, demanding higher credit scores and larger down‑payment commitments from prospective buyers. As a result, ARMs—known for their lower initial rates compared to fixed‑rate loans—have lost some of their appeal.

“Arms are still popular, but the initial rate advantage has eroded,” notes Jane Martinez, a senior analyst at Freddie Mac. “When the market’s expectations for future rate increases become more pronounced, borrowers are forced to pay a higher rate upfront, even on the shorter‑term arm options.”

Rate Breakdown by Product

5/1 ARM: 6.32 %

The 5/1 ARM is the most frequently advertised ARM product, offering a fixed rate for the first five years before adjusting annually thereafter. The current rate sits 1.7 percentage points above the 4/1 ARM’s rate of 4.62 %, but remains 0.42 percentage points higher than the 3/1 ARM’s 5.90 %. Lenders are offering a 5‑year rate lock on this product, but the lock period is typically shorter than for comparable fixed‑rate loans.7/1 ARM: 6.56 %

The 7/1 ARM features a seven‑year fixed period, making it a good middle ground for borrowers who anticipate refinancing within a decade. The rate is 0.94 % higher than the 5/1 ARM, reflecting the longer initial fixed period. Lenders have increased the minimum credit score requirement to 700, up from the 680 threshold that prevailed at the beginning of the year.10/1 ARM: 6.73 %

The 10/1 ARM’s first adjustment period occurs after ten years. While the rate is highest among the three products, it remains one of the lowest available for adjustable‑rate options. The 10/1 ARM’s 10‑year index is tied to the 10‑year Treasury yield, which has been on an upward trend since the previous quarter.

Impact on Borrowers

For borrowers in the market for a new home, the higher ARM rates mean higher monthly payments and greater total interest costs over the life of the loan, especially if they hold the loan beyond the initial fixed period. The risk premium attached to the adjustment period—measured as the spread between the ARM rate and the index—is now approximately 0.5 % higher than in the prior month.

Homebuyers who have opted for a 5/1 ARM last year might now face a payment increase of roughly $170 per month once the rate adjusts in year six. Those who have secured a 10/1 ARM could see an increase of $200–$250 monthly after a decade, depending on future Treasury yields. Lenders have begun offering “lock‑in” options for borrowers who want to guarantee their initial rate for a set number of years, but such locks are typically more expensive and may involve a small surcharge on the loan amount.

Broader Implications for the Housing Market

The rate spike could influence both demand and supply dynamics in the housing market. Lower‑rate loans historically boost housing demand by making monthly payments more affordable. As ARMs become more expensive, potential buyers may either delay purchases, look for properties in lower‑priced markets, or opt for a fixed‑rate mortgage if they can secure a rate close to 6 %. However, fixed‑rate rates have also risen, currently hovering around 6.5 % for a 30‑year fixed loan, limiting borrowers’ options.

The rise in ARM rates may also affect the secondary mortgage market, particularly the securitization of ARM loans. As yields on ARM tranches increase, investors may demand higher returns, potentially driving up the cost of financing for mortgage originators. This could tighten the supply of ARMs, further driving up rates in a self‑reinforcing cycle.

Looking Ahead

Analysts project that ARM rates will continue to trend upward throughout 2025, contingent on the Fed’s policy trajectory. If the Fed continues to raise rates or signals further tightening, ARM rates could reach 7 % or higher by the end of the year. Conversely, any sign of an easing cycle or a shift toward a more accommodative policy stance could stabilize or even lower ARM rates. The market’s reaction to macroeconomic data—especially employment and inflation figures—will remain a key driver of short‑term rate fluctuations.

Final Thoughts

The current ARM mortgage rates represent a stark shift from the more favorable terms many borrowers enjoyed in the first half of 2025. The combination of higher base rates, tighter underwriting, and a more cautious lending environment is reshaping the ARM landscape. Prospective homebuyers must now weigh the initial rate advantage against the potential for significant rate adjustments in the future, and consider whether a fixed‑rate loan might ultimately provide more predictable monthly payments.

As the year progresses, it will be essential for both borrowers and lenders to remain agile, monitoring not only Federal Reserve actions but also the evolving dynamics of the secondary mortgage market and consumer sentiment. The next few months could well set the tone for whether ARM rates stabilize or keep climbing, directly influencing the broader housing market’s health and affordability.

Read the Full Fortune Article at:

[ https://fortune.com/article/current-arm-mortgage-rates-08-01-2025/ ]