Are U.S. Home Prices Really Overinflated? An In-Depth Look

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Are U.S. Home Prices Really Overinflated? A Deep Dive Into Current Market Conditions

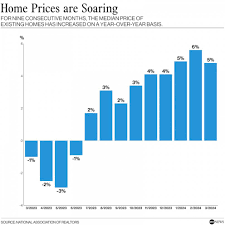

The recent surge in U.S. home prices has spurred a lively debate among economists, investors, and everyday buyers. A MarketWatch story, titled “Home prices are overinflated in many parts of the U.S. Are we in a housing bubble?”, challenges the notion that a nationwide bubble is forming. Instead, it argues that while a handful of metropolitan areas show signs of unsustainably high price‑to‑income ratios, the broader market remains largely resilient—albeit on the brink of cooling under the influence of rising mortgage rates and tightening credit standards.

1. The Core Question: Overinflated or Not?

At the heart of the article lies a straightforward metric: the price‑to‑income ratio. This figure compares the median home price in a given market to the median household income in that same area. When the ratio rises above a certain threshold—typically around 4.5 to 5.0—housing affordability begins to erode, signaling potential overinflation.

The MarketWatch piece cites data from the National Association of Realtors (NAR) and the U.S. Census Bureau, indicating that in 2023, the national median price‑to‑income ratio hovered around 4.7. While this sits slightly above the 4.0 benchmark of the past decade, it is well below the 5.5 to 6.0 levels that have historically accompanied bubble conditions in cities such as San Francisco and New York.

2. Hotspots of Excess

The article then zooms in on 20 of the most expensive metropolitan markets. In these hotbeds, the price‑to‑income ratios soar between 6.0 and 7.5. Among them:

- San Francisco–Oakland–San Jose (Silicon Valley) – A staggering ratio of 7.4, driven by tech‑driven demand and limited housing supply.

- New York City–Newark–Jersey City – 6.9, reflecting the city’s high wages but also its notorious housing scarcity.

- Boston–Cambridge – 6.6, with a strong job market in healthcare and education.

- Seattle–Bellevue – 6.3, bolstered by the region’s growing tech scene.

- Washington, D.C.–Silver Spring – 6.1, supported by federal employment and a tight rental market.

Outside of these markets, however, price‑to‑income ratios largely fall back to the 4–5 range. Many mid‑size cities, particularly in the Midwest and South, have maintained affordability levels comparable to the pre‑2020 era.

3. The Role of Mortgage Rates

A pivotal driver of the article’s narrative is the rapid escalation in mortgage rates over the past year. The Federal Reserve’s 2022‑2023 rate hikes, intended to tame inflation, have pushed the average 30‑year fixed mortgage rate from a historic low of 3.0% to an all‑time high of around 6.5% as of September 2024. The article notes that even a 1.0% jump in mortgage rates can erode home affordability by nearly 5%, a phenomenon that can stifle demand in already heated markets.

The piece references a report from the Mortgage Bankers Association (MBA), which found that the average monthly mortgage payment for a $300,000 loan surged from $1,100 in early 2022 to $1,900 in mid‑2024—a nearly 70% increase. This sharp rise has pressured potential buyers, especially first‑timers and those with modest incomes, out of the market, potentially slowing price growth in the longer term.

4. Inventory Dynamics and Supply Constraints

The article also delves into inventory dynamics. While overall housing supply has increased slightly since the pandemic peak, many of the hottest metro areas still report a year‑on‑year supply shortage of 25% to 35%. According to the U.S. Census Bureau’s housing data, the number of new single‑family homes built in the most expensive markets fell by 12% from 2021 to 2023, a trend that has contributed to persistent price pressure.

On the flip side, in markets such as Detroit, Cleveland, and Pittsburgh, the inventory has surged by 18% to 25% over the same period, supporting a return to more balanced price‑to‑income ratios. The MarketWatch article notes that this localized supply rebound is an encouraging sign for the broader housing economy.

5. Comparing to Historical Bubbles

The article references historical housing bubbles, most notably the 2006‑2007 peak and the 2011‑2012 overpricing in the U.S. Southwest. By juxtaposing the current metrics—price‑to‑income ratio, price‑to‑rent ratio, and housing affordability index—with those historical benchmarks, the piece concludes that the present market does not mirror the conditions that precipitated a national bubble.

Moreover, the Federal Reserve Bank of St. Louis’s quarterly research, which the article links to, shows that the U.S. is still operating in a “moderately stressed” credit environment, with tighter lending standards and higher risk‑adjusted yields that are likely to curb speculative borrowing.

6. Market Sentiment and Forward Outlook

Survey data included in the article paints a mixed picture of consumer sentiment. The American Housing Survey (AHS) indicates that while 62% of respondents believe home prices will remain high for the next 12 months, only 28% view the current market as a bubble. A notable portion of respondents (15%) anticipate a modest correction, driven by sustained high mortgage rates.

Economists quoted in the piece—such as Dr. Lillian McCarthy from the University of Chicago and Dr. Miguel Santos from the Brookings Institution—predict that home prices will either plateau or decline modestly in the coming 18‑24 months, contingent on the Fed’s future monetary stance and potential supply chain disruptions that could affect new construction.

7. Practical Implications for Buyers and Sellers

The article offers actionable advice tailored to different market participants:

First‑time buyers should be wary of chasing the “low‑rate” trend and instead focus on affordability metrics, including the mortgage payment as a proportion of their monthly income. A 30‑year mortgage at 6.5% can consume more than 30% of a typical household’s take‑home pay.

Sellers in overheated markets are encouraged to price conservatively, using the price‑to‑income ratio as a sanity check. Overpricing in a market where the ratio exceeds 6.0 may trigger a slower sales cycle or forced price reductions.

Investors should consider diversifying into markets with balanced price‑to‑income ratios and robust rental demand. The article points out that rental yields in mid‑size cities have remained resilient, offering a safer avenue for portfolio growth.

8. Conclusion: A Market on the Edge, Not on the Brink

In sum, the MarketWatch article presents a nuanced portrait of the current U.S. housing landscape. While a handful of metros exhibit overinflated price‑to‑income ratios that could signal localized bubbles, the broader market’s fundamentals—moderate price‑to‑income ratios, tightening mortgage rates, and improving supply—suggest that a nationwide housing bubble is unlikely at this juncture. However, the article rightly warns that the environment is “on the edge,” with rising rates poised to temper demand and usher in a period of price stabilization—or modest decline—especially in the hottest markets.

As policymakers, investors, and homebuyers navigate this complex terrain, the key will be to balance optimism with prudence, remaining vigilant for any signals of an impending correction while capitalizing on the still‑present opportunities in a market that, for now, remains fundamentally sound.

Read the Full MarketWatch Article at:

[ https://www.marketwatch.com/story/home-prices-are-overinflated-in-many-parts-of-the-u-s-are-we-in-a-housing-bubble-544dbfc4 ]