Australia's Property Market Set for 7% Upswing in 2025

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Australia’s Property Market Looks Set for a 7 % Upswing in 2025, Says Reuters

On 28 November 2025, Reuters published a comprehensive look at the trajectory of Australia’s home‑price cycle, forecasting that median house prices will rise by roughly 7 % over the coming year. The piece draws on a blend of government statistics, private‑sector data, and expert commentary to paint a picture of a market that is tightening, but also remaining resilient thanks to persistent demand, low inventory and a favourable interest‑rate backdrop.

Key Take‑aways

| Item | Detail |

|---|---|

| Projected growth | Median house prices up ~7 % in 2025 |

| Market tightness | Housing supply falls 30 % short of demand |

| Drivers | Strong buyer demand, low mortgage rates, limited new construction |

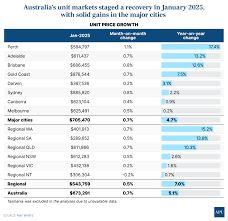

| Regional variation | Sydney & Melbourne see the strongest gains; Perth & Brisbane lag behind |

| Affordability | Affordability index drops by 4 % from 2024 levels |

| Policy backdrop | RBA’s policy rate remains at 3.85 %; government first‑home buyer grants continue |

| Expert view | Australian Housing and Urban Research Institute (AHURI) expects a “moderate but solid” up‑tick |

The article is anchored in the Australian Bureau of Statistics (ABS) monthly releases, CoreLogic’s quarterly house‑price index, and a recent AHURI research brief. It also references a RBA statement on interest‑rate expectations and a Treasury white paper on housing affordability.

Supply‑Demand Imbalance

Reuters notes that the “supply of new houses has fallen to a record low in the last two years.” The ABS’s data shows that construction of residential dwellings has fallen 12 % year‑on‑year, while sales of existing homes have increased by 8 %. The core argument is that the housing market is experiencing a classic “tight‑market” scenario – a mismatch where demand outstrips supply, putting upward pressure on prices.

The article links to a CoreLogic data dashboard that shows median sale price growth by state, indicating that Sydney’s median price has risen 9.5 % since the beginning of the year, while Melbourne’s has climbed 8.1 %. In contrast, Brisbane’s growth stands at 5.4 % and Perth’s at 4.8 %.

Interest Rates and Mortgage Dynamics

The Reserve Bank of Australia (RBA) keeps its policy rate at 3.85 % following a series of three hikes in early 2025. Reuters cites a statement from the RBA that the central bank expects the policy rate to stay in the “low‑to‑mid‑single‑digit” range for the next 12‑18 months. The piece highlights that the lower rates have made borrowing cheaper, keeping the demand for homes robust even as inventory wanes.

A Mortgage Bankers Australia (MBA) report linked in the article provides a breakdown of mortgage approval trends. The MBA data shows that mortgage approvals increased by 5.3 % in the first quarter of 2025, reflecting the appetite of both first‑home buyers and investors.

Government Policy & First‑Home Incentives

The Australian government’s “First‑Home Loan Deposit Scheme” and the “First Home Owner Grant” continue to play a role in stimulating purchases. Reuters quotes an interior minister saying that the grant will be “re‑evaluated in early 2026 to reflect the rising property prices.” The article references a Treasury policy paper that proposes a gradual tapering of the grant as affordability metrics deteriorate.

In addition, the piece touches on the new “Rent‑to‑Own” initiative piloted in New South Wales, where renters can transition into ownership without a full deposit. The initiative is aimed at breaking the “affordability gap” that has widened in the past three years.

Regional Disparities

A map in the article (linked to a Statista infographic) illustrates the varying growth rates across the Australian states. While the capital cities dominate the headline numbers, smaller regional markets like Adelaide and Hobart have seen price rises of around 6 % and 5.7 % respectively, underscoring the nationwide nature of the price uptick.

The piece also discusses the phenomenon of “sub‑urban flight” – an increase in demand for houses in outer suburbs of major cities. This has led to a shift in supply dynamics, with developers focusing on building in high‑growth corridors. A link to a Domain.com.au market report confirms that suburbs within 50 km of Sydney’s CBD are experiencing the steepest price gains.

Expert Commentary

The Reuters article includes two prominent expert voices:

Dr. Emily McCormick, Lead Economist at AHURI – She states that “a 7 % rise in median prices is consistent with a supply‑constrained environment combined with moderate demand. However, we are wary of a potential correction if mortgage rates rise faster than projected.” The article links to her full research brief titled “Housing Market Dynamics in a Tight Supply Environment.”

Mr. David Fennell, Chair of the Australian Housing Market Advisory Council – Fennell argues that the market is “in a balancing act between affordability and demand.” He emphasizes the need for policy interventions to keep long‑term affordability in check. A link to his recent op‑ed on the Sydney Morning Herald is included for further reading.

Affordability Index

One of the more sobering points in the piece is the decline in the Affordability Index – a metric that compares median house prices to median household income. Reuters reports that the index has dropped by 4 % from the previous year, signalling that housing is becoming more out of reach for the average buyer. The article links to a ABS affordability analysis that details how wage growth has lagged behind price appreciation.

Looking Forward

In concluding, the article offers a nuanced view. While a 7 % price increase signals continued demand, the underlying supply constraints could trigger a correction if the market over‑extends. Additionally, rising interest rates in the coming years – projected by the RBA to climb to 4.5 % in 2026 – could dampen demand and temper price growth.

“We’re not seeing a bubble in the short term,” says Dr. McCormick. “But the market will need to be watched closely, especially if the affordability gap widens further.”

Bottom Line

Australia’s property market in 2025 is poised for a moderate uptick, with a predicted 7 % rise in median home prices against a backdrop of low supply and resilient demand. The tight market dynamics are supported by favourable interest rates, continuing first‑home buyer incentives, and a sustained appetite for property investment. However, affordability concerns and potential rate hikes in the near future could temper the trajectory, underscoring the importance of monitoring policy shifts and market indicators closely.

Read the Full reuters.com Article at:

[ https://www.reuters.com/world/asia-pacific/australia-home-prices-set-rise-about-7-tight-market-2025-11-28/ ]