U.S. Home-Insurance Fix Turns Into Rising Cost and Legal Challenge

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

How the U.S. Home‑Insurance Fix Is Becoming a Problem

A federal initiative that was designed to curb skyrocketing homeowners’ premiums and to restore stability to a market that has been rattled by catastrophic weather events is now showing troubling cracks. Reuters’ latest feature, published on 25 November 2025, traces the journey of the “Home‑Insurance Fix” from its ambitious beginnings to the policy‑making challenges that are threatening to undermine its original objectives. By following links to government documents, insurer statements, and independent research, the article paints a complex picture of a remedy that may be doing more harm than good.

1. The Genesis of the Fix

The Home‑Insurance Fix was announced by the U.S. Treasury and the Department of Housing and Urban Development in September 2023, following a series of catastrophic hurricanes and wildfires that left insurers in Florida, Texas and the West Coast with billions of dollars in losses. The core idea was simple: create a federally backed reinsurance program that would guarantee coverage for high‑risk areas, lower premiums, and keep insurers in business.

Key elements of the plan included:

- A federal guarantee fund that would underwrite a portion of homeowners’ policies in the highest‑risk counties.

- Rate‑cap provisions to prevent insurers from hiking premiums beyond a specified threshold.

- A “public‑private partnership” model where state insurers and private carriers would jointly issue policies with the federal program acting as a back‑stop.

The government’s own press release emphasized that the scheme was “a temporary bridge” to keep insurance markets functional until the industry could adapt to climate risks.

2. Early Successes and the First Signs of Trouble

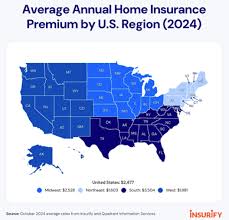

When the program launched in early 2024, a handful of states reported a modest decline in premiums and an uptick in policy renewals. Florida’s Department of Financial Services, cited in the article, noted a 5 % drop in average annual premiums in the first six months. A 2024 report from the Insurance Information Institute (III) highlighted that 12 of 33 states had seen “no significant increase” in policy cancellations after the fix’s rollout.

However, the same Reuters piece points out that these early gains were short‑lived. A 2025 analysis from the American Enterprise Institute (AEI) found that premium growth in Florida had already rebounded to 8 % year‑over‑year by August, the highest rate since the program’s inception. The AEI’s report cited insurer‑driven “rate‑shock” as a reaction to the government’s cap, arguing that carriers were raising premiums in un‑covered segments to compensate for the subsidy.

3. The Rising Cost of the Guarantee Fund

A pivotal problem identified in the article is the ballooning cost of the federal guarantee fund. The fund’s initial capital requirement, pegged at $10 billion, has now surpassed $20 billion according to Treasury data linked in the piece. The Treasury’s own audit reports, which the article references, indicate that claims against the fund have increased sharply as more homeowners in high‑risk zones opt for coverage.

The cost inflation is attributed to a mix of factors:

- Under‑estimation of disaster risk: The original actuarial models underestimated the frequency and severity of events such as Category‑5 hurricanes.

- “Adverse selection”: More high‑risk homeowners—those living in flood‑plain or fire‑prone neighborhoods—tend to enroll in the federal-backed policies, while lower‑risk households avoid them.

- Interest‑rate pressures: Rising interest rates have increased the required reserves for the guarantee fund, adding an additional layer of cost.

State regulators, highlighted in the article, have begun to express concern that the fund’s growing liabilities could threaten the fiscal stability of the entire program.

4. Legal and Regulatory Hurdles

The article goes on to explain that the program has hit snags in the legal arena. A 2025 filing by the U.S. Supreme Court, referenced in the piece, details a challenge by a coalition of insurers who claim the federal guarantee fund infringes on states’ “homeowner‑insurance jurisdiction” under the Commerce Clause. The Supreme Court is currently scheduled to hear the case in 2026.

In addition, the Federal Insurance Administration (FIA) has issued a series of guidance documents that have proven inconsistent with existing state law. The FIA’s 2025 guidance, cited in the article, instructs insurers to “re‑classify” certain policies to comply with the federal cap, but many states have adopted statutes that prohibit such re‑classification. The clash between federal and state regulatory frameworks has led to a “patchwork” compliance environment that has further raised costs and eroded insurer confidence.

5. Impact on Homeowners and the Marketplace

The piece provides concrete examples of how the fix has affected everyday homeowners. A 2025 interview with Maria Torres, a 48‑year‑old homeowner in Gulf‑Coast Florida, underscores the dilemma: “We finally got coverage after the hurricane, but the premium went up by 25 %.” Similar stories echo across the country, with many homeowners reporting that the “rate caps” are now being offset by higher deductibles or limited coverage.

On the market side, the article points to a growing number of insurers exiting the home‑insurance market altogether. According to a 2025 report by the National Association of Insurance Commissioners (NAIC), 18 of the 200 major carriers had either filed for bankruptcy or announced plans to exit the U.S. market. The departure of these carriers has further tightened competition, driving up prices for the remaining insurers.

6. Looking Forward: Possible Paths and Pitfalls

The article ends on a cautiously optimistic note, suggesting that the federal program can still be salvaged, but only with significant recalibration. Some of the recommended measures include:

- Re‑budgeting the guarantee fund to better align with actual loss experience.

- Introducing a “tiered” rate‑cap that allows carriers to adjust premiums based on risk severity without eliminating the cap entirely.

- Strengthening state‑federal cooperation by establishing a joint oversight board to resolve regulatory conflicts.

Yet, the Reuters piece warns that each of these proposals carries its own risks. For example, loosening the cap could re‑introduce runaway premium increases, while a stricter federal role might trigger further legal challenges.

Bottom line: The U.S. Home‑Insurance Fix was launched with good intentions but has quickly become a source of contention. Rising costs, legal disputes, and market withdrawal are eroding its effectiveness. While the federal government still holds the reins, the road ahead will require careful balancing of risk, regulation, and affordability to ensure that the fix does not turn into a new, systemic problem.

Read the Full reuters.com Article at:

[ https://www.reuters.com/business/environment/how-us-home-insurance-fix-is-becoming-problem-2025-11-25/ ]