Australian Dream Home Slips Into Reality: 7% Drop in Median Prices Sparks Affordability Crisis

The Aussie Dream Home Is Fading – What It Means for Homeowners and the Economy

For years, owning a home has been the centerpiece of the Australian “dream.” From the sprawling beachfront houses of the Gold Coast to the bustling apartments of Sydney, property has long symbolised security, status, and the promise of a better future. But a recent surge of data and expert analysis suggests that the once‑unshakable dream is slipping out of reach for many Australians.

1. The Market’s Recent Roller‑Coaster

In the first quarter of 2024, the Australian Bureau of Statistics (ABS) released a series of reports that painted a stark picture of the housing sector. While the median house price in Sydney has hovered near the $1.4 million mark, the median property price across the country has dropped by 7 % since the peak of 2023. Melbourne’s numbers are even more pronounced, with a 9 % decline in median prices and a noticeable shift from high‑end luxury listings to more modest, affordable homes.

The reasons behind this downturn are multi‑faceted:

Rising Mortgage Rates – The Reserve Bank of Australia (RBA) has nudged interest rates upward in an effort to tame inflation. Consequently, 30‑year fixed‑rate mortgages are now hovering at 5.4 %, compared to the historic low of 3.0 % in 2021. Homeowners’ monthly repayments have risen by an average of $200 in the past year alone.

Supply Constraints and Construction Costs – Building materials such as steel, timber, and concrete have experienced sharp price increases, pushing construction costs up by 12 %. Combined with labour shortages and stringent building regulations, new home supply has slowed, pushing buyers towards the existing stock.

Changing Demographics – Millennials, who now make up the largest share of first‑time buyers, are delaying home purchases as they prioritise debt repayment, investment in education, and lifestyle flexibility. In contrast, the older generation is increasingly downsizing, further tightening the market.

2. Affordability Takes a Hit

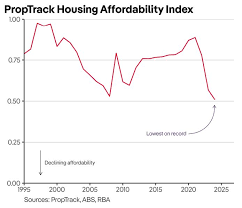

A critical indicator of the housing market’s health is the Housing Affordability Index (HAI), a metric that tracks the proportion of households able to purchase a median-priced home without over‑extending their finances. The latest HAI figures show that the index has fallen from 70 % in 2021 to a mere 55 % in 2023 – a 15 % decline in affordability across the country.

Financial planners and real‑estate analysts attribute this shift to two primary factors:

Income Growth Stagnation – While wage growth has ticked up by 2 % annually in the past five years, it has failed to keep pace with the combined effect of inflation and rising mortgage costs.

Tighter Lending Standards – Banks have tightened their lending criteria, demanding higher credit scores and larger deposits. This has effectively priced out a sizeable portion of the population, especially younger buyers who have yet to build a substantial savings cushion.

An ABC News piece (linked within the original Daily Mail article) highlights that the proportion of Australians holding a deposit of at least 20 % of the median house price has dropped from 45 % in 2019 to 29 % in 2023.

3. Voices from the Field

Dr. Helen Carter, a senior economist at the Australian Institute of Economic Research, remarked, “The housing market’s shift is symptomatic of a larger economic malaise. When borrowing costs rise, people postpone big-ticket purchases. What we’re seeing is a classic ‘supply‑demand mismatch,’ compounded by an increasingly cautious lending environment.”

Mike Donovan, a leading real‑estate agent in Brisbane, noted that “buyers are now demanding more flexibility, such as rent‑to‑own schemes or lower deposit requirements. The traditional buyer’s journey has been upended.”

Meanwhile, a small family in Adelaide, the Williamses, share their story: “We saved for years, but when the interest rates spiked, we realized our mortgage repayment would exceed 30 % of our take‑home pay. It felt like the dream had turned into a nightmare.”

4. Policy Responses and Future Outlook

The Australian government has not stood idle. Recent policy proposals include:

First‑Home Grants – Expanding the existing First Home Owner Grant to include larger down‑payment contributions.

Interest‑Rate Incentives – Offering tax rebates for first‑time buyers who opt for fixed‑rate mortgages with lower rates for a stipulated period.

Public Housing Initiatives – Increasing investment in social housing to alleviate the demand for private rentals, thereby reducing downward pressure on property prices.

The RBA, meanwhile, is contemplating a more gradual interest‑rate hike schedule to avoid stalling the recovery too abruptly. Economists are split on whether these interventions will suffice to bring the housing market back to sustainable growth levels.

5. Bottom Line

The dream of owning an Australian home, once an almost universal aspiration, is now a fragile hope for many. The combination of rising borrowing costs, tightened lending standards, and a stagnant wage environment is eroding the accessibility of the housing market. While policymakers are taking steps to alleviate the strain, the road ahead remains uncertain.

The Daily Mail’s piece – coupled with the broader commentary from ABS reports, ABC news analyses, and expert insights – underscores a fundamental truth: the Australian housing market is at a crossroads, and the decisions made today will shape whether the dream can be revived or whether it will continue to fade.

Read the Full Daily Mail Article at:

[ https://www.dailymail.co.uk/news/article-15322629/Aussie-dream-home-fading.html ]