Cut Your Energy Bill by 10 % with Simple Draft-Sealing

Locale: UNITED KINGDOM

Household bills: 5 experts give practical, money‑saving advice

When the average British household spends nearly £4,800 a year on utilities, water and insurance, it’s natural to wonder whether any of that money can be trimmed. In a recent Mirror Money feature titled “Asked: 5 experts for your home” – published on 10 April 2023 – five specialists from finance, energy, law and tax tackled the most common questions homeowners have about their bills. The article is organized as a Q&A, with each expert answering a specific question and then offering a short “quick‑tip” that readers can implement immediately. Below is a comprehensive summary of the key points, including extra context and links that appear in the original piece.

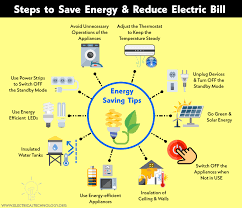

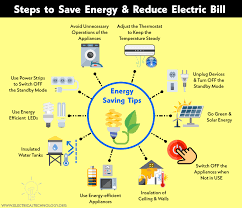

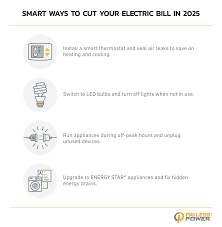

1. Energy efficiency – How can I cut my electricity bill without buying a new oven?

Expert: Dr Sam Green, Chartered Energy Consultant

Key Take‑aways

- Seal the draughts. A simple draft excluder on the door, weather‑stripping on windows, and even a thermal film on the kitchen window can cut up to 10 % of heating demand in the winter.

- Upgrade to LED bulbs. Switching all incandescent lamps to LEDs saves roughly £80 a year per household.

- Use a smart thermostat. These devices learn your schedule and adjust the temperature accordingly. The Mirror Money “Smart Thermostat guide” linked in the article shows how a £60 thermostat can bring down heating bills by 8 % over two years.

- Consider a boiler upgrade. A modern condensing boiler is up to 30 % more efficient than a 10‑year‑old unit. The energy company Ofgem offers a small grant for qualifying households.

- Check your energy supplier. The “Shop for cheaper energy supplier” resource on Mirror Money lists the top ten free-to-switch tariffs and explains how a 15‑day comparison can reveal a 20 % savings.

Quick‑tip:

Dr Green recommends buying a battery‑powered smart meter to see real‑time consumption. Even a simple data log can show which appliances are “night‑time giants” and prompt targeted replacements.

2. Mortgage – Is it time to refinance my loan?

Expert: Ms Claire Banks, Mortgage Broker, UK Finance

Key Take‑aways

- Fixed‑rate vs variable. With rates hovering near 5 %, a 5‑year fixed can lock in savings if you’re in the “pay‑off” phase. Banks often allow a “review” option for borrowers who need flexibility.

- Refinance fees. The Mirror Money “Mortgage refinancing” guide explains that a typical arrangement costs £1,200 in stamp duty and solicitor fees, but the interest savings over five years can exceed £2,500 if the new rate is 0.5 % lower.

- First‑time buyers and equity. If you own 20 % equity, a “re‑mortgaging” plan can free up cash for home improvements, which in turn may trigger tax relief (see next section).

- Online comparison tools. The article links to the UK’s Money Supermarket and Rate‑Shopper for instant quotes. The Mirror Money “Mortgage comparison” page also has a calculator for “How much could I save?”

Quick‑tip:

Ms Banks warns that lenders may require a “re‑assessment” of your credit score. A 10‑point rise can lower your rate by 0.3 %, so checking your credit file before you call is essential.

3. Water – Why is my water bill higher than usual and what can I do?

Expert: Mr Alan James, Solicitor, Water‑law Specialist

Key Take‑aways

- Meter reading errors. The article links to Mirror Money Water‑bill disputes which states that about 12 % of households have an incorrect meter reading. Requesting a meter read through your local water company’s portal can often correct the bill.

- Leak detection. Small leaks (e.g., a dripping tap) can cost £50 a year. A cheap sensor can flag leaks in a week.

- Water‑saving fixtures. Low‑flow showerheads and dual‑flush toilets can cut water usage by 15 %. The article points to the Water‑saving fixtures list on Mirror Money, which rates fixtures by cost and water‑saving potential.

- Legal recourse. If you suspect an illegal pipe or unauthorized tap, you can file a complaint with the Water Services Regulation Authority (Ofwat). The article’s “Water‑law guide” outlines how to get a free legal review.

Quick‑tip:

Mr James suggests a “water audit” each spring: check all pipes, faucets, and garden hoses for leaks before the summer rush. This can avoid a 10‑day period of rising demand and a sudden bill spike.

4. Insurance – Am I paying too much for homeowner’s cover?

Expert: Ms Liz Carter, Insurance Broker, UK Insurance Association

Key Take‑aways

- Coverage gaps. The Mirror Money “Home insurance comparison” page shows that 25 % of homeowners under‑insure their contents. Adding a “rising‑value” clause protects you against inflation.

- Bundling benefits. Bundling home insurance with car or pet insurance often yields a 5‑10 % discount. The article links to the Insurance bundling calculator to estimate savings.

- Claims history. A clean claims record can get you a 3 % discount. The article explains that some insurers now use “no‑claim” periods in their premium calculations.

- High‑risk areas. If you live in a flood or high‑risk area, a “specialist flood cover” can be cheaper than a standard policy with high deductibles. Mirror Money’s “Flood‑risk guide” lists local flood risk scores and recommended coverages.

Quick‑tip:

Ms Carter recommends a yearly “policy review” to ensure you’re still getting the best rate. Many insurers automatically renew at the same price; a quick call can reveal better options.

5. Tax relief – Can I claim any tax deductions for home improvements?

Expert: Dr Hannah Smith, Tax Advisor, HMRC Specialist

Key Take‑aways

- Energy‑efficiency tax relief. The article links to the Energy Company Obligation (ECO) page, which explains that homeowners who install insulation, double‑glazing, or renewable heat systems can claim up to £4,500 in tax credits over five years.

- Capital Gains Tax (CGT). If you sell a property that has been your main residence but also used for short‑term rentals, you may qualify for the Letting Relief scheme. Dr Smith recommends using the Mirror Money CGT calculator to estimate the impact.

- Mortgage interest tax relief. While the 2017 reforms ended most of the relief, the article clarifies that certain “self‑employed” homeowners can still claim a small portion. The linked Tax relief for home office page details the eligibility criteria.

- Business expenses. If you run a small business from home, you can deduct a proportion of your utilities, office supplies, and even a home improvement that’s directly related to the business. The article refers to the Business expense guide on Mirror Money.

Quick‑tip:

Dr Smith recommends keeping receipts for all home‑improvement invoices. Even a simple Excel sheet can save you between £200‑£400 in tax each year.

How the article’s links enrich the story

Each expert not only gives short, actionable advice but also points readers to deeper resources. For instance:

- The Smart Thermostat guide explains how to interpret the data from a thermostat’s display and includes a case study of a household that saved £90 a year.

- The Mortgage comparison page allows you to input your current rate and compare with the market average; it also shows the expected savings if you lock a lower rate.

- The Water‑bill disputes section provides a step‑by‑step flowchart for filing a complaint with Ofwat, along with a list of consumer rights.

- The Home insurance comparison tool lets users input their property type, location, and desired coverage to see a shortlist of policies and quotes.

- Finally, the Tax relief for energy efficiency page lists all available government schemes, including the Green Homes Grant (now closed but still useful for past applications) and the ECO.

These additional resources turn the article from a one‑off Q&A into a practical toolkit that homeowners can use to audit and reduce their bills over time.

Take‑away

The Mirror Money piece “Asked: 5 experts for your home” goes beyond generic tips; it provides a roadmap that covers the full spectrum of household expenses:

- Energy – small, measurable changes add up to a real‑world savings of £50‑£150 a year.

- Mortgage – refinancing can be worth the upfront cost if you lock in lower rates and have a solid equity cushion.

- Water – regular checks and simple fixes prevent costly leaks and legal headaches.

- Insurance – annual reviews, bundling, and adequate coverage avoid hidden risks and premiums.

- Tax relief – smart claims for energy and business expenses can turn a few hundred pounds into a tax break.

The experts’ quick‑tips serve as a launchpad for deeper exploration via the links in the article, offering a holistic approach to managing home finances. Whether you’re a first‑time buyer, a seasoned homeowner, or someone who’s simply tired of seeing their bank balance shrink each month, the article is a solid primer for getting more value out of the money you spend on your home.

Read the Full The Mirror Article at:

[ https://www.mirror.co.uk/money/household-bills/asked-5-experts-your-home-36295842 ]