UK House Prices Climb 0.6% in October, Largest Monthly Gain Since Late 2023

UK House Prices Rise 0.6% in October, Halifax Reports

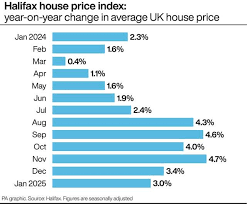

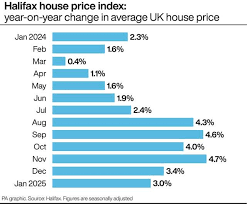

London, 7 November 2025 – Halifax, the United Kingdom’s largest mortgage lender, announced on Tuesday that house prices in the country climbed by 0.6 % in October, the biggest month‑on‑month gain recorded since late 2023. The rise lifted the year‑on‑year increase to 5.7 %, signalling a sustained upward trajectory despite the tightening monetary environment and the Bank of England’s high policy rate.

A Positive Monthly Beat

Halifax’s monthly price index, which is based on data from the UK Land Registry, showed that property values grew at the fastest pace in nearly a year. The 0.6 % uplift in October was driven largely by a surge in sales of homes priced between £250 000 and £500 000, a segment that has been the engine of recent price momentum. Sales volume in this range rose by 7.2 % compared with the previous month, a sharp increase relative to the 3.5 % growth seen in the £500 000‑£750 000 bracket.

The index covers roughly 70 % of UK property transactions, giving it a wide representation of the market. Halifax’s chief economist, Mark Sims, noted that the “positive sentiment is continuing to fuel demand, particularly in the mid‑price segment, and the price gains are translating into stronger resale values for homeowners across the country.”

Regional Dynamics

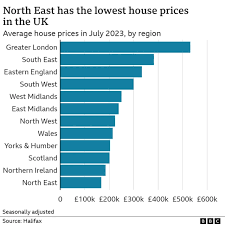

The price increase was not evenly distributed across the UK. The South‑East remained the strongest performer, with a 0.9 % rise in October. This was followed by the South‑West (0.7 %), the North‑East (0.6 %) and the Midlands (0.5 %). Meanwhile, the North‑West saw a modest 0.4 % gain, while the East of England lagged behind with a 0.3 % increase.

In all regions, the primary driver of the uptick was the rebound in sales volume. Halifax’s data shows that the number of transactions in the £250 000‑£500 000 range climbed 4.9 % in October, a 2.6‑point jump over September. The uptick in the higher price band, although present, was less pronounced.

The Macro backdrop

The Bank of England’s policy rate remains at 5.25 %, the highest level in 17 years. The central bank has signaled that it will maintain its “tight” stance until inflation falls below the 2 % target, a policy that continues to exert upward pressure on mortgage rates. Despite this, Halifax’s latest figures indicate that demand for housing remains resilient, with buyers continuing to find homes at price levels that have historically outperformed the overall economy.

Halifax’s research notes that the recent price gains are partly a response to the Bank of England’s cautious stance on future rate cuts. “Homebuyers are acting decisively now, before any potential easing of monetary policy,” said Sims. “This has contributed to the current uptrend in house prices.”

Market Outlook

Looking ahead, Halifax expects October’s momentum to carry into November, although the pace may moderate slightly. The company warns that the market remains sensitive to any changes in monetary policy. If the Bank of England were to signal a more aggressive tightening or a surprise rate hike, the property market could see a slowdown. Conversely, any indication of easing could accelerate price growth further.

Halifax’s own forward‑looking commentary suggests that the house price index could see a rise of 0.4 % to 0.5 % in November, provided that the economic fundamentals remain unchanged. The company also highlights the importance of regional dynamics, noting that the Midlands and North‑West could see stronger growth if new development projects go ahead as scheduled.

Investor and Policy Implications

The steady rise in house prices has implications for both the banking sector and policymakers. From an investor perspective, the upward trend in residential property values offers a hedge against inflation and a potential source of capital appreciation for real estate funds. For policymakers, sustained price growth could be a double‑edged sword: on one hand, it can support household wealth and confidence; on the other hand, it may exacerbate affordability challenges for first‑time buyers and put upward pressure on the broader economy.

Halifax’s latest data will be closely monitored by analysts at the Bank of England and other financial institutions. In particular, the central bank’s upcoming Monetary Policy Committee meeting will be a key event for observers, as any shift in policy stance could influence the trajectory of housing demand and, consequently, the price index.

Conclusion

Halifax’s announcement that UK house prices rose by 0.6 % in October represents a robust recovery for the property market. The price growth, driven largely by the mid‑price segment, underscores a resilient demand environment in the face of a high‑rate monetary backdrop. While the market remains sensitive to potential policy shifts, the latest figures suggest that homeowners, investors, and policymakers alike can expect continued price appreciation in the near term.

For further details, readers can consult Halifax’s official press release and the Bank of England’s policy statements, both of which provide comprehensive insights into the underlying drivers of the current market dynamics.

Read the Full reuters.com Article at:

[ https://www.reuters.com/world/uk/uk-house-prices-rose-06-october-halifax-says-2025-11-07/ ]