U.S. Household Debt Soars to Record $185 Trillion in Q3 2023

WSB Radio

WSB Radio

US Household Debt Hits an All‑Time High of $185 Trillion, Study Finds

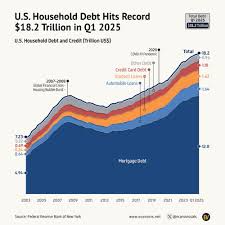

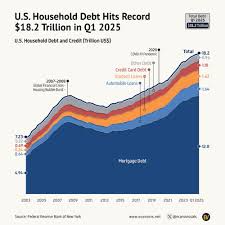

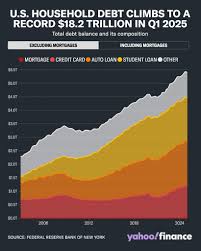

A recent study released by a leading research organization has shown that U.S. household debt has surged to an unprecedented $185 trillion as of the third quarter of 2023, topping the 2020 peak of $180 trillion. The data, compiled from the Federal Reserve’s “Consumer Credit” series and the U.S. Treasury’s “Household Debt” reports, reveal a continued upward trajectory in borrowing that is reshaping the economic landscape.

The Numbers Behind the Record

- Total Debt – The study cites $185 trillion in total household debt, a rise of roughly 6 % from the same quarter last year.

- Mortgage Debt – The largest component, mortgage balances climbed by $18 trillion, reflecting sustained demand for homeownership even after a brief dip in 2020. Residential mortgage debt now accounts for about 51 % of total household debt.

- Auto Loans – Auto financing grew by $4 trillion, driven by a rebound in vehicle sales and a gradual easing of pandemic‑era credit restrictions.

- Credit Card Debt – Credit card balances increased by $2.5 trillion, continuing a trend of rising consumer borrowing at higher interest rates.

- Student Loans – Student debt reached $1.6 trillion, a modest uptick from the 2020 plateau but still significant given its long‑term repayment horizon.

- Other Loans – Remaining categories such as personal loans, medical debt, and lines of credit added roughly $5 trillion.

Drivers of Debt Growth

Housing Market Resilience – Despite interest‑rate hikes in 2023, mortgage rates have remained attractive to many buyers, leading to higher loan balances. The continued affordability of suburban and rural homes, coupled with strong buyer sentiment, has maintained the momentum.

Post‑COVID Recovery – The economic rebound after the pandemic saw a surge in consumer confidence and spending. Many households increased credit card usage and took advantage of low‑interest auto loans to offset the lingering effects of lockdowns.

Policy and Regulatory Environment – The Federal Reserve’s monetary policy, characterized by steady rate hikes and a focus on controlling inflation, has influenced borrowing costs. Simultaneously, the Department of Education’s adjustments to student loan repayment plans have provided some relief, slightly easing the pressure on borrowers.

Inflationary Pressures – Rising prices have pushed households to seek additional credit for maintaining living standards, especially in food, housing, and healthcare.

Implications for the Economy

The surge in household debt carries several risks and opportunities:

- Consumer Spending – With more income funneled toward debt service, discretionary spending may slow, potentially dampening economic growth.

- Financial Stability – Elevated debt levels heighten vulnerability to interest‑rate shocks. A rapid rate hike could squeeze household budgets, increasing default risk across mortgage, auto, and credit card portfolios.

- Credit Markets – Banks and other lenders may tighten underwriting standards, which could make credit harder to obtain for new borrowers.

- Policy Response – Policymakers are closely monitoring debt dynamics to gauge the need for fiscal or monetary adjustments. The Treasury’s upcoming budget proposals may address the long‑term burden of student loan debt, while the Federal Reserve could weigh further rate hikes.

Related Resources

Federal Reserve Bank of New York – “Household Debt Outlook”

A comprehensive report outlining trends in consumer credit, available at the Fed’s research portal. The document includes projections for 2024 and 2025, noting potential shifts in borrowing patterns.U.S. Treasury – “Consumer Credit” Series

The Treasury’s monthly data releases provide granular breakdowns of debt categories, including mortgages, auto loans, credit cards, and student loans. The series is updated on a bi‑weekly basis and is essential for analysts tracking debt evolution.NYTimes – “The High‑Cost Price of Debt in a Post‑COVID Economy”

An investigative piece that examines how rising household debt is affecting household incomes and long‑term financial health. The article includes case studies of families navigating high credit card balances and student loan repayments.S&P Global – “US Household Debt and Economic Forecast”

A market‑focused analysis detailing the potential impact of debt on GDP growth, employment, and consumer confidence. The report highlights risk scenarios under different interest‑rate trajectories.

Looking Ahead

While the current debt levels are undeniably high, the trajectory over the next few years will depend on a confluence of factors: Federal Reserve policy, inflation trends, consumer confidence, and the health of the labor market. Analysts suggest that moderate interest‑rate hikes and continued economic recovery could stabilize debt growth, but a sudden reversal in growth dynamics could expose vulnerabilities across the financial system.

The study underscores the importance of transparent, timely data and proactive policy measures to manage the risks associated with household borrowing. As the U.S. navigates the post‑pandemic era, understanding the nuances of debt accumulation will remain central to fostering sustainable economic growth.

Read the Full WSB Radio Article at:

[ https://www.wsbradio.com/news/local/us-household-debt-reaches-record-185-trillion-study-finds/GHV6QZTQWJCPBB6NMKY4APUCRI/ ]