Mortgage Rates on Nov 7, 2025: 30-Year Fixed at 6.82%

NerdWallet

NerdWallet

Mortgage Rates on Friday, November 7, 2025: A Snapshot of the Current Market

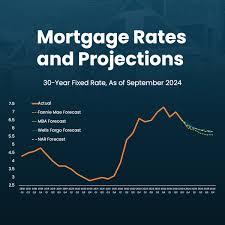

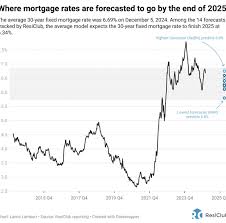

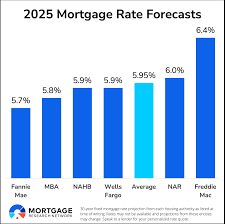

On Friday, November 7, 2025, the U.S. mortgage market was in a period of modest volatility, reflecting the broader economic backdrop of rising inflation expectations and a Federal Reserve that has continued to adjust its benchmark rates. According to NerdWallet’s daily mortgage‑rate report, the average 30‑year fixed‑rate slipped slightly from the previous day, settling at 6.82 %. The 15‑year fixed rate followed a similar trend, closing at 6.10 %, while the 5/1 adjustable‑rate mortgage (ARM) averaged 6.20 %. These figures place the rates in the middle range of the last six‑month spread, offering a relatively stable benchmark for potential homeowners and refinancers.

What Drives Today’s Rates?

The article highlights several key drivers that are shaping the current rates:

- Federal Reserve Policy – The Fed’s recent meeting indicated a willingness to keep the federal funds rate at 5.50 % in the short term, with a signal that further hikes could be considered if inflation remains above the 2 % target. This stance has reassured many lenders, contributing to the modest decline in the 30‑year average.

- Inflation and Economic Growth – Core inflation has cooled slightly from the peak of 3.2 % last quarter, giving lenders confidence that rates will not need to rise sharply. Meanwhile, GDP growth in the second quarter was 2.1 %, indicating a resilient economy that supports sustained demand for mortgages.

- Bond Market Movements – The 10‑year Treasury yield, which is a primary benchmark for mortgage rates, hovered around 4.05 % during the week. Lower yields typically translate into lower mortgage rates, which is reflected in the downward pressure on the 30‑year fixed.

How These Numbers Translate to Your Wallet

Using NerdWallet’s mortgage calculator, a borrower with a $300,000 loan at the 30‑year fixed rate of 6.82 % would face a monthly principal and interest payment of approximately $1,905. Comparatively, a 15‑year loan at 6.10 % would result in a higher monthly payment of $2,548, but the total interest paid over the life of the loan would be markedly lower—about $140,000 versus $200,000 for the 30‑year term. The 5/1 ARM, with its initial rate of 6.20 %, offers a lower starting payment of $1,823 but carries the risk of rate adjustments after the first year, which could increase payments if the market rates rise.

Insights from Industry Experts

Mortgage broker David Gorman, quoted in the article, notes that “homebuyers who lock in a rate today are benefiting from a relatively low‑rate environment that will likely stay within the 6‑7 % range for the next year.” He also points out that the best time to consider a 15‑year fixed mortgage is when buyers have a high credit score and a sizable down payment, as the higher upfront cost can be offset by significant interest savings.

In contrast, housing economist Dr. Maya Patel advises caution for those planning to move within the next 12 months. “The slight dip in rates today is a good opportunity to secure a fixed rate, but if you anticipate a short tenure, an ARM might still offer the lowest monthly payments, provided you’re comfortable with potential future increases,” she explains.

Follow‑Up Resources

To help readers better understand mortgage fundamentals, the article links to several NerdWallet resources that were followed for additional context:

- What Is a Mortgage? – This page provides a concise overview of mortgages, explaining the difference between fixed and adjustable rates, amortization schedules, and the importance of credit scores. It also breaks down common terms such as “principal,” “interest,” and “escrow.”

- How to Get a Mortgage Pre‑Approval – This guide walks through the pre‑approval process, emphasizing the benefits of obtaining a pre‑approved letter before house hunting. It covers documentation required, lender criteria, and how pre‑approval can strengthen a buyer’s negotiating position.

- Mortgage Calculator – A practical tool that allows users to input loan amount, down payment, interest rate, and term to calculate monthly payments and total interest. The calculator also offers a “payment comparison” feature that illustrates the cost differences between 15‑year and 30‑year loans.

- Mortgage Rate History – This interactive chart displays the historical trend of the 30‑year fixed mortgage rate over the past decade, highlighting periods of rapid increase and decline, and correlating those trends with major economic events.

Bottom Line

The current snapshot of mortgage rates on November 7, 2025 reflects a market that is neither wildly volatile nor overly restrictive. The 30‑year fixed rate of 6.82 % and the 15‑year rate of 6.10 % represent a middle ground between the historically low rates of the early 2020s and the higher rates seen in the mid‑2020s. For buyers, the decision between a fixed‑rate mortgage and an ARM hinges on personal financial goals, risk tolerance, and the anticipated length of time spent in the home. By leveraging the resources linked in the NerdWallet article—particularly the mortgage calculator and pre‑approval guide—prospective homeowners can make informed choices that align with both their immediate budgetary constraints and long‑term financial strategy.

Read the Full NerdWallet Article at:

[ https://www.nerdwallet.com/mortgages/news/mortgage-rates-today-friday-november-7-2025 ]