U.S. Household Debt Hits New Record of $15.1 Trillion in Q1 2024, NY Fed Announces

U.S. Household Debt Reaches a New High, According to the New York Fed

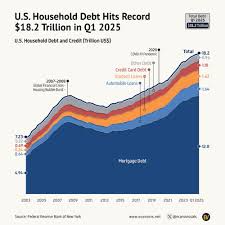

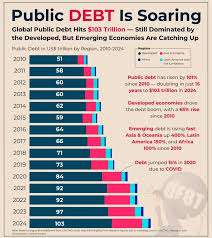

The latest data from the New York Federal Reserve’s quarterly Survey of Consumer Finances shows that total U.S. household debt surged to an all‑time high of $15.1 trillion in the first quarter of 2024, eclipsing the previous record of $14.8 trillion set in late 2023. The increase is the biggest jump in more than a decade and underscores how households are borrowing to keep pace with rising living costs, inflation, and a housing market that remains strong despite higher mortgage rates.

What’s Behind the Jump?

The rise in debt is largely driven by three core components:

| Debt Category | Q1 2024 Balance | Change YoY | % of Total |

|---|---|---|---|

| Mortgage debt | $10.3 trillion | +12 % | 68 % |

| Credit‑card debt | $1.9 trillion | +6 % | 13 % |

| Auto‑loan debt | $1.4 trillion | +4 % | 10 % |

| Other unsecured debt | $1.5 trillion | +3 % | 12 % |

Mortgage debt continues to be the dominant share of household borrowing. While mortgage rates have climbed from the record lows seen in 2021‑2022, many homeowners have still taken advantage of relatively favorable terms to refinance or purchase new properties. Credit‑card balances have risen in tandem with consumer spending and higher grocery and healthcare costs, whereas auto‑loan debt grew modestly as vehicle prices rebounded after the supply‑chain disruptions of the previous year.

The New York Fed notes that the debt‑to‑income ratio has held steady at 2.8 (i.e., the average household carries debt equal to 2.8 times its annual income). This figure is roughly unchanged from the prior quarter, suggesting that households are not simply borrowing more relative to their earnings, but rather that wages have lagged behind the cost of living.

What the New Data Means for the Economy

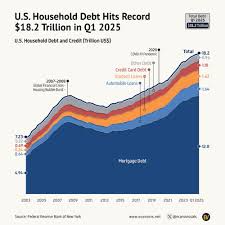

The Federal Reserve has repeatedly highlighted consumer debt as a key lever for economic growth. Higher borrowing levels can fuel spending on durable goods and services, which in turn supports employment and GDP. However, the Fed also cautions that an overreliance on debt can amplify vulnerabilities, especially if interest rates rise sharply.

In a note accompanying the quarterly release, the New York Fed’s Research Director Dr. Laura Miller remarked, “While the surge in household debt reflects robust consumer confidence, it also signals that many households are taking on more risk to maintain their standard of living. The Fed will continue to monitor the debt‑to‑income ratio as an indicator of financial stability.”

This perspective dovetails with the Fed’s broader policy stance. In a recent Federal Reserve Board meeting (link: https://www.federalreserve.gov/monetarypolicy.htm), officials reiterated that they will keep rates on a gradual‑increase path, targeting a 2 % inflation rate over the medium term. The higher debt levels raise concerns that a tighter monetary stance could squeeze household budgets and dampen discretionary spending.

Sources of the Data

The NY Fed’s quarterly data derive from its Survey of Consumer Finances (SCF), a triennial survey that collects detailed information on household financial profiles, including assets, liabilities, income, and expenditures. The SCF is widely used by economists, policymakers, and researchers to assess financial well‑being and risk exposure across the U.S. population.

Additional context can be found in the NY Fed’s research portal (link: https://www.newyorkfed.org/research/consumer-debt), which offers in‑depth reports on debt dynamics, borrower demographics, and the impact of macroeconomic variables on household borrowing behavior.

Links to Related Coverage

- “Fed’s Inflation Outlook” – A Fox Business feature that explains how the Fed’s policy decisions are influenced by consumer spending patterns and debt levels (link: https://www.foxbusiness.com/economy/fed-inflation-outlook).

- “Household Debt Growth and Savings Rates” – An analysis article that contrasts debt growth with household savings trends (link: https://www.foxbusiness.com/economy/household-debt-savings).

- “Mortgage Rates and Homeownership” – A piece examining how changing mortgage rates affect home buying and refinancing activity (link: https://www.foxbusiness.com/economy/mortgage-rates-homeownership).

The Bigger Picture

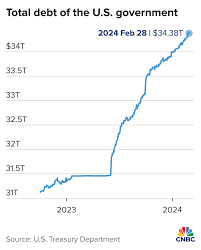

The U.S. economy continues to navigate a mix of challenges: persistent inflationary pressures, a labor market that remains tight, and a consumer that is still eager to spend despite higher borrowing costs. The new household debt record illustrates that consumers are willing to shoulder increased debt to sustain their lifestyle, but it also highlights the potential risk of a future tightening cycle.

Financial experts suggest that households should pay attention to their debt‑to‑income ratios, diversify savings, and avoid overleveraging in a volatile interest‑rate environment. Policymakers, meanwhile, must balance the need to keep inflation under control with the imperative to maintain consumer confidence and credit availability.

In sum, the New York Fed’s latest data paints a nuanced picture: while U.S. households are at a record borrowing level, the debt‑to‑income ratio remains stable, and consumption is still robust. How the economy reacts to this backdrop will depend on how quickly the Federal Reserve can bring inflation down without stifling the credit-fueled engine that drives growth.

Read the Full Fox Business Article at:

[ https://www.foxbusiness.com/economy/us-household-debt-hits-new-record-ny-fed-finds ]