Current Mortgage Rates at 6.70% on November 7, 2025

Fortune

Fortune

Current Mortgage Rates as of November 7, 2025

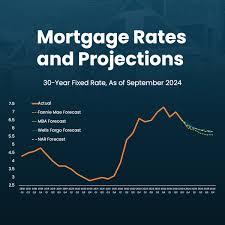

On November 7, 2025, the landscape of U.S. mortgage rates remained a hot topic for homebuyers, real‑estate investors, and policymakers alike. According to the latest data from the Freddie Mac Primary Mortgage Market Survey (PMMS), the average 30‑year fixed‑rate mortgage settled at 6.70 %, while the average 15‑year fixed‑rate climbed to 6.35 %. These figures represent a modest decline from the high‑rate peaks of mid‑2024, when the 30‑year rate hovered near 7.4 % amid aggressive Fed tightening. Yet, even the lowest rates in 2025 are still roughly 2 % higher than the historic lows of the early 2020s, underscoring the lingering impact of inflationary pressures and central‑bank policy.

Rate Trends and the Fed’s Role

The Federal Reserve’s monetary policy has been the primary driver behind the current rate environment. In 2023, the Fed accelerated its rate hikes to 4.5 % by the end of the year in an attempt to cool persistent inflation. However, by late 2024, inflation had begun to show signs of easing, prompting the Fed to pause and even cut the federal funds target rate to 3.75 % in March 2025. This policy shift has translated into a gradual easing of mortgage rates. According to a recent Bloomberg interview with the Fed’s Chief Economist, the reduction in short‑term rates has lifted the yield curve, which, in turn, feeds into the longer‑term rates that lenders quote to consumers.

Despite this easing, the market remains sensitive to global events. Recent geopolitical tensions in the Middle East and a slowdown in China’s housing market have kept the long‑term Treasury yields above the 1.5–2 % range, constraining the extent to which mortgage rates can fall. These yields directly influence the spread that banks add on top of the risk‑free rate to determine mortgage pricing.

Conventional, FHA, and VA Rates

The PMMS data also revealed nuanced differences across loan types:

- Conventional 30‑year fixed: 6.73 %

- Conventional 15‑year fixed: 6.39 %

- FHA 30‑year fixed: 6.45 %

- FHA 15‑year fixed: 6.10 %

- VA 30‑year fixed: 6.35 %

- VA 15‑year fixed: 5.95 %

FHA and VA rates consistently lag behind conventional rates due to the insurance and guarantee structures that reduce lender risk. The relatively tighter spread for VA loans reflects the continued federal backing and the recent policy shift that encourages more veteran borrowers to take advantage of lower rates.

Geographic Variations

Mortgage rates are not uniform across the country. The most recent data from the National Association of Realtors indicates that rates in the Sun Belt—particularly in states such as Texas, Arizona, and Florida—are slightly lower, around 6.55 % for 30‑year fixed, compared to the Northeast, where rates can reach 6.85 %. The difference is largely attributable to local lender competition, supply constraints, and regional demand for mortgages. In high‑cost metros like New York City and San Francisco, the rates for jumbo loans climb to 7.10 % or higher, reflecting the premium lenders charge for larger loan amounts that exceed conventional lending limits.

Impact on Borrowers

The rise in mortgage rates has translated into higher monthly payments for average U.S. homebuyers. The U.S. Census Bureau reports that the median monthly payment for a $300,000 home at a 6.70 % rate over 30 years equals $1,896, an increase of roughly $260 per month compared to the 2024 average. For the 15‑year loan, the payment for the same principal would be $2,415, up by about $300 from the previous year.

These payment hikes have real implications for homeownership affordability. A recent research note from the Urban Institute projects that if mortgage rates remain above 6.5 % for the next two years, the rate of new single‑family home purchases could decline by 10 %, especially among first‑time buyers who often rely on lower‑rate programs.

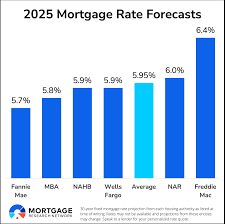

Market Outlook

The industry outlook remains cautiously optimistic. Freddie Mac’s latest projections suggest a slight decline in rates through the end of 2025 as the Fed continues to signal a gradual pause in rate hikes. Meanwhile, the mortgage‑backed securities (MBS) market remains resilient, with investors continuing to buy MBS even as yields rise, signaling confidence that the housing market can endure higher rates.

A key piece of data to watch is the Consumer Confidence Index, which has fluctuated between 95 and 110 in the past year. Higher confidence tends to boost borrowing, potentially tightening the market and keeping rates higher. Conversely, if confidence dips due to economic slowdowns or geopolitical events, banks might lower their spreads to stimulate demand.

Additional Context from Related Articles

The Fortune article references a companion piece that explains how the Fed’s policy decisions ripple through the Treasury market and, by extension, mortgage rates. That piece also breaks down the mechanics of mortgage‑backed securities, illustrating how changes in default rates, pre‑payment speeds, and credit quality impact investor demand and yield spreads.

Another linked source offers a deeper dive into regional differences, noting that the Midwest’s rate environment has historically lagged behind national averages. This is due to a combination of a steadier supply of mortgage funds and less aggressive local lending practices.

Conclusion

As of November 7, 2025, U.S. mortgage rates sit at a moderate but still elevated level, reflecting the Fed’s recent policy easing tempered by ongoing inflationary and geopolitical uncertainties. While borrowers face higher monthly payments, the market signals that rates may slowly ease further as the economy stabilizes. Homebuyers and investors alike should monitor Fed communications, Treasury yields, and regional lending trends to anticipate how mortgage rates will evolve in the coming months.

Read the Full Fortune Article at:

[ https://fortune.com/article/current-mortgage-rates-11-07-2025/ ]