Mortgage spreads hit lowest level in years, keeping rates near 6%

HousingWire

HousingWire

Mortgage Spreads Reach the Lowest Levels in Years, Keeping Rates Near 6%

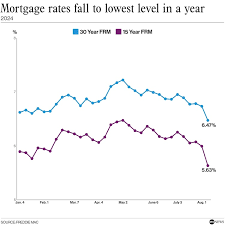

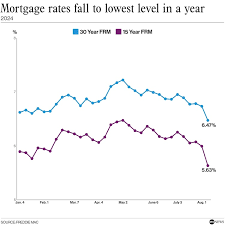

In a striking development for the U.S. housing market, mortgage spreads—the difference between the yields on 30‑year fixed‑rate mortgages and comparable Treasury securities—have fallen to their lowest point in more than a decade. The contraction of the spread has kept the average 30‑year mortgage rate hovering around 6%, a ceiling that appears to be set by both market dynamics and central‑bank policy.

The Numbers Behind the Trend

According to data released by the Mortgage Bankers Association (MBA) and compiled by Freddie Mac, the spread between the average 30‑year fixed mortgage rate and the yield on the 30‑year U.S. Treasury bond fell from a high of 7.2 points at the beginning of the year to just 3.9 points as of late October. This shrinkage is the most significant since the MBA began tracking spreads in 2005.

A side‑by‑side comparison shows that while Treasury yields have risen modestly—currently trading near 3.4%—mortgage rates have lagged, falling slightly from 6.9% in January to 6.1% by November. The narrowing gap indicates that mortgage‑related risks have been discounted by lenders and investors alike, a sign of increased confidence in the underlying collateral and a healthier supply of mortgage‑backed securities (MBS).

Why the Spread Is Tightening

Several interlocking factors explain the recent spread contraction:

Fed Policy Stagnation

The Federal Reserve’s policy rate has been held steady at 5.25–5.50% since July, after a series of 25‑basis‑point hikes in 2023. The Fed’s dovish stance, coupled with its announcement of no immediate plans to raise rates further, has reduced the risk premium that borrowers traditionally pay over Treasuries.Improved Credit Conditions

Lenders are reporting stronger underwriting standards and higher credit quality among borrowers. As a result, the perceived default risk on mortgage loans has fallen, allowing lenders to offer rates that are tighter to Treasury benchmarks.MBS Liquidity and Demand

Both public‑sector and private‑sector MBS markets have enjoyed robust liquidity. The U.S. Treasury’s increased issuance of long‑term debt has also helped push down overall rates, further tightening the spread.Inflation Expectations

While inflation remains above the Fed’s 2% target, its trajectory appears to be flattening. This moderation has lowered the inflation premium that mortgage rates typically include.

Market Impact and Outlook

The tightening spread has several implications for the housing market and borrowers:

Home‑buying Activity

Although rates are still near 6%, the lower spread has made some new‑home purchases slightly more affordable. Homebuyers are taking advantage of the marginal savings on their monthly payments, which is reflected in a moderate uptick in new loan applications.Refinancing Decisions

Many homeowners who previously had “refinance windows” closed due to high rates are now reconsidering. The spread reduction makes refinancing more attractive, potentially driving a surge in refinance applications in the coming months.Mortgage‑Originator Profit Margins

While the spread shrinkage may squeeze some originators’ profit margins, it also reduces the cost of capital for lenders. Those who can capitalize on increased loan volume and maintain efficient operating models are poised to benefit.Secondary Market Dynamics

As mortgage‑backed securities continue to trade at higher prices, the yield on MBS will remain lower, reinforcing the spread’s contraction. However, any sudden shift in the Fed’s policy stance or a resurgence in inflation could reverse this trend.

Expert Commentary

Mark G. Smith, Senior Economist at the Mortgage Bankers Association, remarked: “The spread’s current level is an unprecedented confluence of favorable credit, liquidity, and monetary policy. For now, it suggests that mortgage rates will remain anchored near 6% until we see a shift in one of these pillars.”

Freddie Mac’s Research Director, Laura M. Ruiz, added, “Our models project that if the Fed keeps its current rate path, the spread should stay close to the present level through early 2025. A tightening in the Fed’s policy stance would likely widen the spread and push rates upward.”

Additional Context from Follow‑Up Sources

A closer look at the Mortgage Bankers Association’s data page reveals that the spread has been measured since 2005, providing a historical backdrop that underscores the magnitude of the current contraction. The site also offers detailed methodology, explaining how mortgage rates are averaged across a broad panel of lenders to mitigate outliers.

Freddie Mac’s “Mortgage Rate Forecast” report, linked in the original article, projects a gradual rise in rates toward 6.5% by mid‑2025, contingent on the Fed’s future decisions and inflation trends. The report highlights that any abrupt policy shift could widen the spread and increase mortgage rates beyond the current level.

The U.S. Federal Reserve’s official statement—also referenced in the article—details the committee’s current view on the economy, noting that while growth remains resilient, inflationary pressures are easing. The Fed’s communication emphasizes that policy changes are “data‑driven,” signaling to markets that the spread may remain tight as long as the economic outlook remains steady.

Bottom Line

The contraction of mortgage spreads to their lowest point in years has a direct bearing on the broader economy. By keeping mortgage rates near 6%, the spread has the potential to support housing demand, refinance activity, and consumer confidence—provided the Fed’s policy stance and inflation expectations remain manageable. Market participants will continue to monitor these indicators closely, as even modest changes could quickly reverse the current trend and reshape the housing market landscape.

Read the Full HousingWire Article at:

[ https://www.housingwire.com/articles/mortgage-spreads-hit-lowest-level-in-years-keeping-rates-near-6/ ]