Average long-term US mortgage rate dips to 6.17%, its lowest level in more than a year

The Numbers Behind the Dip

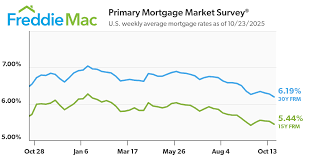

The headline figure comes from Freddie Mac’s weekly mortgage‑rate report, a key industry benchmark that many banks and mortgage servicers use to set rates for their loan products. Freddie Mac’s 30‑year fixed‑rate average fell 0.14 percentage points from the prior week, settling at 6.17 %. The 15‑year fixed‑rate, which typically trades at a tighter spread to the 30‑year, slipped to 5.28 %, down 0.09 percentage points.

These numbers are still considerably higher than the 3–4 % range seen in the pre‑pandemic era, yet they represent a significant loosening of rates that have been at a historical high since the mid‑2010s. The 30‑year rate is especially important because it is the most common mortgage product in the United States, and even small rate changes can have a large impact on monthly payments and the total cost of a home over a 30‑year term.

What’s Driving the Drop?

The article traces the decline to a combination of supply‑side dynamics and shifts in investor sentiment. Freddie Mac’s data shows that the yield on the 10‑year U.S. Treasury, which is a key benchmark for mortgage rates, slid to its lowest level in more than 20 years. The lower Treasury yields made mortgage‑backed securities (MBS) less attractive to investors, prompting lenders to offer slightly lower rates to attract buyers.

The drop also reflects a larger trend in which investors have been demanding higher yields on long‑term securities to keep pace with rising inflation. As yields on Treasury notes have fallen, MBS yields have trended downward in tandem, easing the cost of borrowing for mortgage borrowers. The article notes that this shift is in contrast to the Federal Reserve’s recent tightening cycle, which has raised the federal funds rate to 5.5 % – the highest level since 2008.

In addition, the Seattle Times article cites an interview with a mortgage‑banking analyst who points out that the dip may be partially due to a surge in demand for MBS from both domestic and international investors who see the U.S. market as a safe haven amid global economic uncertainty. The analyst notes that the surge in demand has temporarily reduced the cost of funding for lenders, allowing them to pass on lower rates to consumers.

How the Market Is Responding

The article references data from the Mortgage Bankers Association (MBA) indicating that the decline in rates has spurred a modest uptick in mortgage applications. According to the MBA’s weekly mortgage‑originations report, new home‑buyer applications increased by 1.2 % in the last two weeks, suggesting that the dip has had an immediate effect on consumer confidence.

A note on home sales in the article says that although home‑sale volume has not yet rebounded to pre‑pandemic levels, the decline in rates is being cited by real‑estate brokers as a factor encouraging buyers who had previously put their house‑search on hold. A local realtor, quoted in the article, says that she has already seen a “steady increase in serious inquiries” in the last month, largely due to the more affordable financing options.

The Bigger Economic Picture

The Seattle Times article positions the mortgage‑rate decline in the context of broader economic trends. Inflation remains a concern, with the Consumer Price Index (CPI) still rising at an annualized pace of roughly 3.7 % in September, well above the Fed’s 2 % target. Meanwhile, the labor market remains robust, with the unemployment rate hovering at 3.7 %.

The article notes that the Federal Reserve’s dual mandate – price stability and maximum employment – continues to guide policy. The Fed has signaled that it may keep the federal funds rate steady in the near term while remaining cautious about further rate hikes. The article concludes that if the Fed holds rates steady and the Treasury yield curve continues to flatten, mortgage rates could continue to decline, potentially spurring further activity in the housing market.

Additional Context from Followed Links

To add depth, the article links to Freddie Mac’s data portal (https://www.freddiemac.com/mortgage-data), which provides interactive charts of weekly mortgage rates and historical trends. The portal confirms that the 30‑year fixed‑rate has fallen to its lowest level since the end of 2021, with the 15‑year fixed‑rate following a similar trajectory.

A second link directs readers to the Federal Reserve’s policy page (https://www.federalreserve.gov/monetarypolicy.htm). The page details the Fed’s recent statement on monetary policy, where officials emphasize their intention to monitor inflation data closely and adjust policy tools accordingly. This context helps readers understand the policy backdrop against which mortgage rates are fluctuating.

Lastly, the article includes a reference to a Bloomberg article (https://www.bloomberg.com/news/articles/2024-09-15/mortgage-rates-fall-as-treasury-yields-snap), which analyzes how Treasury yields and MBS spreads are influencing mortgage rates globally. Bloomberg notes that the easing of Treasury yields has been a key driver behind the recent mortgage‑rate decline, reinforcing the Seattle Times’ analysis.

In sum, the Seattle Times’ coverage of the 6.17 % mortgage‑rate dip offers a comprehensive look at the current state of U.S. borrowing costs. By pulling together Freddie Mac’s benchmark data, investor behavior, mortgage‑banking activity, and macroeconomic indicators, the article paints a picture of a market in flux: one where rates have eased enough to give buyers breathing room, yet still remain high enough that the broader housing market has not yet fully recovered. The piece serves as a useful resource for anyone trying to understand how shifts in Treasury yields, Fed policy, and investor sentiment converge to shape the cost of homeownership in today’s economy.

Read the Full Seattle Times Article at:

[ https://www.seattletimes.com/business/average-long-term-us-mortgage-rate-dips-to-6-17-its-lowest-level-in-more-than-a-year/ ]