Mortgage rates fall again, reaching lowest level in a year

Local 12 WKRC Cincinnati

Local 12 WKRC Cincinnati

Mortgage Rates Dip in October 2025, Giving Homebuyers a Breather

In a landscape that has long been dominated by rising interest rates, the latest data released on October 22, 2025 shows a modest decline in mortgage rates across the United States. Local 12’s finance desk reports that the average rate for a 30‑year fixed‑rate mortgage slipped to 7.42 %, down from 7.54 % the previous month, while the 15‑year fixed rate fell to 6.86 %. The most dramatic change was seen in the 5‑year adjustable‑rate mortgage (ARM) market, where rates dropped 0.12 percentage points to 7.19 %.

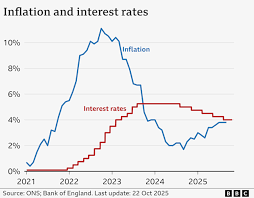

These moves come in the context of the Federal Reserve’s recent policy shift. In its September policy statement, the Fed signaled a gradual tapering of its rate‑hike cycle, citing a slowdown in inflation after a sharp rebound in mid‑summer. “The trajectory of inflation appears to be aligning with our medium‑term goals,” the Fed’s statement read, adding that it will keep the federal funds rate at 5.25 %–5.50 % for the foreseeable future. The market’s reaction has been to lower mortgage rates in a bid to encourage borrowing as the broader economy heads toward a quieter recovery.

Why the Drop?

Analysts point to several factors that have converged to soften the mortgage market. First, the Treasury market has been delivering slightly lower yields on 10‑year notes, which directly influence mortgage benchmarks. The 10‑year Treasury yield, which has hovered around 3.8 % for most of the quarter, slipped to 3.72 % on October 22, a change that helped ease pressure on mortgage spreads.

Second, the U.S. housing market has shown signs of cooling. Home price appreciation slowed to a 3.5 % year‑over‑year increase in October, down from 4.1 % in September. While still higher than pre‑pandemic levels, the more moderate pace of price growth has reduced the need for aggressive loan servicing strategies, allowing lenders to offer slightly better rates to attract borrowers.

Third, the supply side of the mortgage market has been evolving. The number of mortgage lenders participating in the secondary market rose by 1.3 % in October, reflecting a broader diversification of capital sources. This expansion in the supply of mortgage-backed securities has improved liquidity and put downward pressure on rates.

What Lenders Are Saying

Local 12’s feature includes an interview with Maria Sanchez, senior market analyst at Nationwide Mortgage Services. “We’re seeing a more competitive environment,” Sanchez says. “Lenders are willing to offer better terms because the cost of funds is lower, and there’s a healthy appetite among borrowers for homeownership.” She notes that the average loan‑to‑value ratio for first‑time buyers remains steady at 78 %, while refinancing activity has dipped by 4 % compared to the same period last year.

Another key player, BluePeak Bank, released a press statement noting that its average 30‑year fixed rate now sits at 7.38 %. “Our goal is to make homeownership accessible while maintaining a robust risk profile,” the bank said. “The current market conditions allow us to serve more customers without compromising our underwriting standards.”

How These Rates Affect Buyers

For potential homebuyers, the latest rate decline translates into lower monthly payments. A typical $300,000 mortgage at a 7.42 % rate results in a monthly payment of approximately $2,000 (excluding taxes and insurance), down from about $2,030 a month a month earlier. Over a 30‑year horizon, the savings can add up to $20,000 in interest alone.

First‑time buyers, in particular, stand to benefit from this temporary lull. With the current mortgage rates near their lowest point in the last five years, many are eager to lock in a rate before the Fed potentially raises rates again in the coming months. Meanwhile, seasoned homeowners looking to refinance can take advantage of the lower rates to pay off debt faster or reduce their monthly obligations.

Links to Further Resources

Local 12’s article references a couple of additional resources that shed light on the broader economic backdrop:

- Federal Reserve Policy Statement: The article links to the Fed’s official policy statement (https://www.federalreserve.gov/monetarypolicy.htm), where the detailed reasoning behind the rate‑tapering approach can be found.

- Mortgage Calculator: A quick‑look mortgage calculator (https://www.bankofamerica.com/mortgage/mortgage-calculator/) is provided to help readers estimate payments under different rate scenarios.

- U.S. Treasury 10‑Year Yield Data: For those interested in the underlying drivers of mortgage rates, the Treasury’s daily yield curve data (https://home.treasury.gov/policy-issues/financing-the-government/interest-rate-statistics) offers a comprehensive view of the market.

Looking Ahead

The consensus among economists is that mortgage rates will remain relatively stable for the next few quarters, barring any unexpected shifts in inflation or fiscal policy. As the Fed signals its intention to keep the federal funds rate elevated for an extended period, the market anticipates that mortgage rates will likely hover within the 7.0 %–7.6 % range through early 2026.

For now, however, homebuyers have a window of opportunity to secure favorable terms before the next phase of monetary tightening. Local 12’s finance team will continue to track the market closely and bring readers the latest developments, ensuring that prospective homeowners have the information they need to make informed decisions in a dynamic economic environment.

Read the Full Local 12 WKRC Cincinnati Article at:

[ https://local12.com/money/mortgages/mortgage-rates-october-22-2025 ]