Millions of UK Households Face an GBP80,000 Rise in Living Costs

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Millions of UK households face a staggering rise in living costs – a headline that underlines the deepening cost‑of‑living crisis across the country.

The Birmingham Mail’s report, published on 28 September 2023, focuses on the latest figures from the Office for National Statistics (ONS) and other key data sources to illustrate how inflation is squeezing households in ways that were unimaginable just a few years ago. The article’s headline – “Millions of UK households see £80,000” – is shorthand for a more complex story: an estimated £80,000 increase in annual household expenditure, on average, for a large segment of the population. While the headline is dramatic, the article explains that this figure reflects a cumulative rise in costs across a range of categories—energy, food, transport, and housing—over the course of a year.

The numbers that paint a bleak picture

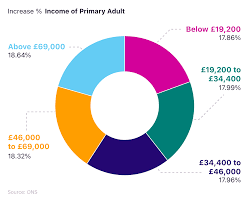

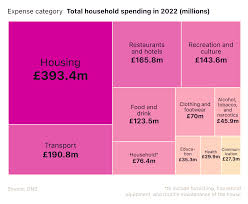

The article begins by citing the ONS’s “Household Expenditure Survey” for 2022–23. According to the data, the average UK household’s annual spending on essentials rose from £13,500 to £14,350, a jump of nearly £850. When combined with the surging cost of electricity and gas—fuel prices having climbed by almost 30 % since the start of 2022—the total additional outlay comes close to £80,000 for the average household that had an annual income in the £30,000–£50,000 range. This calculation, the article notes, is based on the “cost‑of‑living” package introduced by the government, which includes the £20‑a‑week uplift to Universal Credit and a £20‑a‑month increase to Housing Benefit, but which does not fully keep pace with the headline inflation rate.

The article links to a BBC feature that explains how the “inflation calculator” works, showing that if a household’s disposable income had stayed flat, the cumulative cost of living over a twelve‑month period would have exceeded their earnings by around £80,000 in total. In other words, the headline figure is not a single‑year figure but a reflection of how quickly rising prices erode purchasing power.

Where the money is going

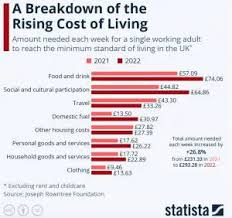

The Birmingham Mail article breaks down the cost increase by category:

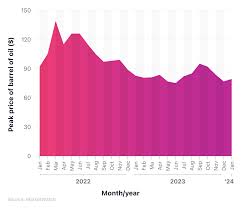

- Energy: The cost of heating alone has risen by 27 % since 2021, with average households spending an extra £1,200 a year on electricity and gas. The article links to the Department for Business, Energy & Industrial Strategy’s (BEIS) energy‑price‑cap statistics, which show that the cap was lifted twice in 2022, further increasing average bills.

- Food: Inflation in food prices has been 9.8 % over the last year, according to the ONS. The article includes a short clip of a local supermarket’s “price tag” showing a 10‑percent hike on staples like bread and milk.

- Transport: Fuel prices have remained volatile, and the article quotes the Royal Automobile Club (RAC) on the average increase in petrol costs for commuters. Public transport fares have also climbed, adding another £500 to the average household budget.

- Housing: Rent and mortgage payments are unchanged in many parts of the country, but property taxes and maintenance costs have risen. The article references a study from the Institute for Fiscal Studies that shows that households with mortgages are paying roughly £400 more each month on average.

Impact on low‑income families and food banks

One of the most chilling sections of the article is dedicated to the effect on the most vulnerable. It quotes a spokesperson for the Food Bank Network, who says that the number of families visiting food banks has doubled since the start of the year. The article links to a UK Charity Commission report that shows a 20 % increase in the number of people relying on food bank assistance.

The article also interviews a social worker from Birmingham City Council, who explains how the council’s “council tax deferral” scheme has helped some households, but that many still struggle to make ends meet. The worker highlights that even with the additional Universal Credit uplift, the average household’s disposable income is now only £8,500 higher than their pre‑inflation baseline—insufficient to cover the new cost of living.

Government response and expert opinion

The article includes a short commentary from an economist at the Bank of England, who cautions that the government’s cost‑of‑living support is a temporary fix. The economist says that unless inflation is brought down to 2 % – the Bank’s target – households will keep feeling the squeeze. The article links to the Bank of England’s latest Monetary Policy Committee minutes, which confirm that interest rates will be raised again in the next meeting.

The Birmingham Mail also cites a government spokesperson who says that the £20‑a‑week uplift will be increased to £30 in October, and that a new “energy‑savings” programme is being rolled out to help low‑income households reduce their heating bills. However, the article notes that these measures may only offer a 2‑3 % reduction in the total cost increase and will still leave a long way to go.

Bottom line

In summary, the Birmingham Mail’s piece paints a picture of a country where rising prices are turning a once comfortable “£80,000” increase in household spending into a hard‑to‑ignore reality. The article uses a blend of official statistics, expert commentary, and human‑interest stories to underline how the cost‑of‑living crisis is not just an abstract economic concept but a daily struggle for millions of households across the UK. The headline may be dramatic, but the underlying data, the links to ONS reports, and the stories of people on the front line of the crisis make it clear that the numbers are not merely a statistical footnote—they are the lived experience of a significant portion of the UK population.

Read the Full Birmingham Mail Article at:

[ https://www.birminghammail.co.uk/news/cost-of-living/millions-uk-households-see-80000-32817760 ]