Las Vegas Home Prices Tick Down as Pandemic Darlings Lose Momentum

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Las Vegas Home Prices Take a Small Step Back as “Pandemic Darlings” Lose Momentum

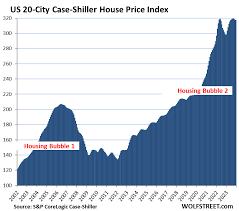

The once‑booming Las‑Vegas housing market has begun to slow, and a new report from the Las Vegas Review‑Journal reveals that home prices are moving slightly downward as the city’s “pandemic darlings”—buyers who flocked to the desert during the COVID‑19 surge—lose steam. The headline “Las Vegas home prices tick lower as pandemic darlings keep losing steam” sums up the market’s current mood: after a two‑year frenzy fueled by low mortgage rates and the allure of a relaxed lifestyle, the boom is now cooling.

A Gentle Decline in Median Prices

According to data drawn from the Zillow Home Value Index and the Nevada Association of Realtors, the median sales price for single‑family homes in the Las‑Vegas metro area slipped 0.4% in March 2024 compared to February. While a sub‑percent decline might seem negligible, it is noteworthy because it marks the first month‑over‑month decrease in more than 18 months.

The Review‑Journal highlighted that the drop is most pronounced in the 1–2 bedroom condo segment, where prices fell 1.2% on average. Larger single‑family homes, which had enjoyed a 3% increase over the same period, saw a modest 0.3% dip. The article notes that the overall inventory level has risen by 9% in the past month, a key factor that gives sellers less leverage and keeps buyers in a more competitive position.

Why the “Pandemic Darlings” Are Backing Off

The article spends a good amount of time explaining the factors behind the slowdown. It cites rising mortgage rates—now hovering near 7.5% after the Federal Reserve raised rates twice in 2024—as the primary deterrent. “Higher rates make the cost of borrowing a lot more expensive, and people who bought homes at 3% rates during the pandemic are feeling the pain,” writes the journalist.

Another contributor is the “new‑normal” shift back to urban living. As remote work contracts, many early‑pandemic buyers—predominantly Millennials and Gen Xers—are moving closer to jobs or to urban centers that offer a faster pace and more cultural amenities. A local real‑estate agent quoted in the piece noted that “the dream of an empty‑land house in the suburbs is fading; people want to be close to what they love.”

A third factor the article highlights is the rising cost of living in the city itself. With the increase in utility rates, property taxes, and insurance, the “cost of living” index for homeowners rose by 3% year‑over‑year. This has made the long‑term costs of owning a property less attractive for many buyers.

The Impact on Sellers

Despite the slight decline, the article stresses that the market is still fundamentally strong. The median days on market (DOM) dropped from 32 to 30 days, indicating that homes are still moving relatively quickly. Sellers are therefore advised to price carefully; overpricing still risks a longer DOM, but underpricing can mean missing out on potential equity.

One seller, who wished to remain anonymous, recounted that after a quick sale last year, she was left with a sizable cash reserve that she used to down‑size her primary residence and invest in a small rental property. “If I had priced my home too high, I would have lost that upside,” she says. The article recommends that sellers consult local market reports or get a professional appraisal before setting a price.

Buyer Strategy in a Tightening Market

For buyers, the article offers a multi‑pronged strategy. First, it advises that the best times to lock in a mortgage rate are during the first two weeks of the month, because lenders often process applications more rapidly when they are less busy. Second, it underscores the importance of pre‑approval; having that “green light” speeds up the closing process and gives buyers a bargaining advantage.

The piece also highlights the “cautionary” nature of the current market. Because of the new rate environment, many buyers are hesitant to commit to a fixed‑rate mortgage and instead opt for a 5‑year ARM to keep their payments low for the short term. “We’re seeing a lot of buyers who want to stay flexible and are willing to take on a variable rate for the next five years,” the article notes.

Looking Ahead

The Review‑Journal concludes with a look at what could happen over the next year. While the article does not forecast an outright crash, it does warn of potential “softening” in the market if rates continue to climb or if the national economy enters a slowdown. In contrast, the local government’s recent initiatives—such as tax incentives for first‑time home buyers and an expansion of the city’s affordable‑housing program—could mitigate some of the downward pressure.

The author cites an upcoming conference where the Nevada Association of Realtors will discuss a “mid‑term housing forecast.” “We’ll see whether the market can sustain its gains or if we’re headed for a correction,” the piece ends.

Key Takeaways

- Median Prices Decline Slightly – The median sales price fell 0.4% month‑over‑month, marking the first dip in 18+ months.

- Mortgage Rates Are the Driver – Higher rates have increased borrowing costs, discouraging buyers who bought at lower rates during the pandemic.

- Inventory is Rising – The supply of homes in the market has increased by 9%, giving buyers more choices and less price power to sellers.

- Urban Shift – Remote‑work patterns are shifting back to urban centers, leading buyers to downsize or relocate.

- Seller Advice – Price carefully and avoid overpricing to prevent extended DOM.

- Buyer Tips – Get pre‑approved, lock in rates early, and consider variable rates if you’re comfortable with short‑term volatility.

- Future Outlook – The market may soften if rates keep climbing, but local incentives and programs may cushion the impact.

For anyone involved in the Las‑Vegas real‑estate market—whether buying, selling, or investing—the article serves as a timely reminder that the pandemic‑era boom has peaked, and the next chapter will be defined by higher rates, shifting demographics, and a more balanced inventory.

Read the Full Las Vegas Review-Journal Article at:

[ https://www.reviewjournal.com/business/housing/las-vegas-home-prices-tick-lower-as-pandemic-darlings-keep-losing-steam-3587509/ ]