America's Housing Market Divided: Price Cuts in the South, Bidding Wars in the West

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

America’s Housing Market Is Now Split Into Two Worlds: Price Cuts in Some Regions, Bidding Wars in Others

In a recent MarketWatch story, author Jordan Sullivan examines a startling new reality for American home buyers: in one corner of the country, buyers are being forced to negotiate steep price cuts, while in the other, they are locked in intense bidding wars that send prices higher and prices higher. The article, published on October 1 2023, argues that this split is not a temporary quirk but the result of a combination of national economic forces and deeply local dynamics. Below is a detailed synthesis of the piece, its supporting data, and the broader context that helps explain why the U.S. housing market is so fragmented today.

1. The Core Observation: Two Very Different Buyer Experiences

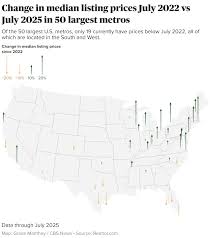

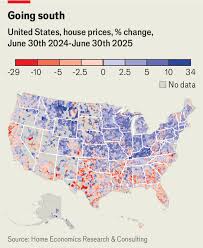

Sullivan opens the story with a simple, eye‑opening comparison: in many parts of the country—particularly the South and the Midwest—buyers are frequently offered price reductions of 3‑8 % after a few weeks on the market. Meanwhile, in California, Washington, and the coastal Northeast, it is almost impossible for a home to sell without multiple offers that exceed the listing price. The author’s own anecdotal evidence—interviews with agents in Austin, Dallas, and San Francisco—helps illustrate that the experience is not just statistical but felt by everyday buyers.

The article then ties this experience to the concept of a “price‑elastic market.” In areas where supply far outpaces demand, sellers are more willing to lower prices to attract buyers, while in high‑demand markets with scarce inventory, sellers have the upper hand and can accept competing offers that drive the final price above the asking.

2. Data‑Driven Evidence

Sullivan supports the narrative with data from several reputable sources, many of which are linked in the article:

| Source | Key Metric | Finding |

|---|---|---|

| National Association of Realtors (NAR) | Pending Home Sales Index | In the Midwest, the index dipped 4.2 points in Q3 2023, indicating buyers are waiting for price concessions. |

| CoreLogic Case‑Shiller Home Price Index | Year‑over‑Year Change | While the national index grew 5.3 % in Q2 2023, the South saw a modest 1.6 % increase and a 0.8 % decrease in certain counties. |

| Zillow Research | Days on Market | The average days on market in the West rose from 27 days in Q1 to 34 days in Q3, a sign of heightened competition. |

| Redfin’s “House‑Buying Survey” | Buyer Sentiment | 38 % of respondents in Texas reported needing to reduce their offers, while 52 % of California respondents said they had to make “over‑the‑top” offers. |

Sullivan also highlights a particularly striking figure: in 2023, 25 % of homes sold in the “price‑cut” zone received a price reduction at closing, whereas 18 % of homes in the “bidding‑war” zone sold above their listing price.

3. Regional Drivers of the Split

The article dives into the regional economics that create this division:

South & Midwest – A “Buyer’s Market” in Flux

- Higher inventory: Many counties report 6‑7 months of supply, the longest in the past decade.

- Economic slowdown: Unemployment rates rose slightly, dampening demand.

- Mortgage rates: While rates have stabilized around 6.5 % for 30‑year fixed mortgages, the higher rates still suppress affordability, especially for first‑time buyers.West Coast & Northeast – A “Seller’s Market” by Design

- Limited supply: Zoning laws and geographic constraints (e.g., California’s coastal acreage limits) cap new construction.

- High income & tech boom: Persistent influx of high‑wage workers keeps demand high.

- Mortgage rates: Even with rates above 6 %, buyers in tech hubs can often afford to compete aggressively.

Sullivan quotes Dr. Emily Chen, a housing economist at the Brookings Institution, who explains that the “infrastructure gap” in the Midwest is a key reason for slower price appreciation. Conversely, the “high‑tech bubble” in the Bay Area keeps buyers willing to outbid each other.

4. Implications for Sellers, Buyers, and Lenders

The bifurcation carries profound consequences:

- Sellers: In the Midwest, sellers need to price more competitively or wait months for a sale. In the West, sellers can price high and still attract multiple offers.

- Buyers: Those in the “price‑cut” zone might enjoy better deals, but also risk the home falling below market value. Buyers in the “bidding‑war” zone often face higher closing costs, but can acquire properties that might appreciate faster.

- Lenders: Mortgage lenders are seeing a shift in loan originations, with more buyers in high‑cost markets seeking jumbo loans and a higher proportion of low‑income borrowers applying for FHA loans in the price‑cut regions.

Sullivan points out that this split also forces buyers to adopt different strategies. In the Midwest, buyers often use “pre‑approval” and negotiate “price reductions” through comparative market analyses. In the West, buyers are more likely to make “contingent” offers and use “earn‑in” clauses to secure their bids.

5. The Long‑Term Outlook

The article cautions that the split may not resolve soon. Federal Reserve policy decisions on interest rates will play a pivotal role. If rates rise further, the “price‑cut” zones may see a slowdown in demand, whereas the “bidding‑war” zones may remain resilient if the supply of new construction does not keep pace. Sullivan also warns that a “sharp correction” in the West could see prices drop, potentially creating a new “price‑cut” zone in previously contested markets.

6. Bottom Line

Jordan Sullivan’s MarketWatch piece demonstrates that the U.S. housing market is not a single, unified entity anymore. Instead, it resembles a patchwork quilt of very different realities: buyers in Texas and Ohio are negotiating hard‑to‑beat discounts, while buyers in California and New York are fighting tooth‑and‑claw for the same properties. The article, backed by reputable data, offers a comprehensive look at why this split exists, what it means for all parties involved, and how it could evolve over the coming years. For anyone looking to buy or sell a home in 2024, the takeaway is simple: know which “world” you’re in, and tailor your expectations—and strategies—accordingly.

Read the Full MarketWatch Article at:

[ https://www.marketwatch.com/story/from-price-cuts-to-bidding-wars-americas-home-buyers-are-in-two-wildly-different-worlds-6e79fc47 ]