Unsold Homes Reach Record 1.6 Million, Surging 30% YoY

Newsweek

NewsweekLocale: New York, UNITED STATES

The Rising Tide of Unsold Homes: A Nation’s Sellers Are Giving Up

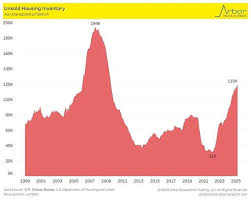

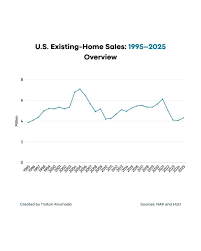

In a stark reversal of last year’s overheated real‑estate boom, a new wave of empty houses is sweeping the United States. According to data collected from the National Association of Realtors (NAR) and corroborated by Zillow’s “Inventory Index,” the number of unsold homes has climbed to a record‑high, leaving many sellers staring at a “price‑puzzled” market that no longer guarantees a quick, profitable sale. The Newsweek feature, “Unsold homes skyrocket nationwide, sellers give up,” delves into the numbers, the underlying causes, and the ripple effects that may reshape the housing market for years to come.

1. The Numbers That Speak Volumes

The article opens with a striking statistic: the U.S. currently hosts 1.6 million unsold homes, an increase of more than 30 % year‑over‑year. By comparison, the inventory was a mere 1.0 million at the same point in 2022. That figure is not a trivial figure of idle property; it represents roughly four months of average supply—a metric that historically signals a balanced market when close to 3 months.

On the day‑by‑day level, Zillow’s “Inventory Index” has been tracking the surge in 30‑day listings. For the first time in the past decade, the index has been hovering above 8 %. A secondary source, the U.S. Census Bureau’s “Housing Sales” reports, confirms that 5 % of all newly listed homes have been on the market for more than 90 days—the point at which many brokers would consider a sale “stalled.”

2. What’s Driving the Surge?

The piece pulls in commentary from real‑estate analysts and mortgage lenders to paint a multifaceted picture of the slowdown.

Interest Rate Rollercoaster

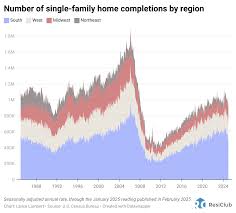

The Federal Reserve’s decision to tighten monetary policy over the last two years has pushed mortgage rates from a historic low of 3.5 % to an all‑time high of 7 %. This jump has eroded affordability for many potential buyers. As the article notes, even seasoned home buyers who had secured loans at 3 % in 2020 now face the prospect of monthly payments that exceed their budget.Supply Chain Strains & Rising Construction Costs

The article links to a CNBC feature on how post‑pandemic supply chain bottlenecks—particularly in lumber and steel—have increased the cost of building new homes. The resulting price hikes have pushed many first‑time buyers to the sidelines.Remote Work & Geographic Shifts

A linked blog post from the Harvard Business Review highlights how the “new normal” of remote work has changed preferences: people are moving out of high‑cost metro areas into suburban or rural locales, which paradoxically has reduced inventory in cities while increasing demand in smaller markets.

3. The Seller’s Dilemma

At the heart of the story are the homeowners who have found themselves in a precarious position. The article recounts several anecdotal stories—one from a California homeowner who, after 18 months on the market, had to accept a 10 % price cut or forego a sale entirely.

According to a study referenced from the NAR, 15 % of sellers who listed in the first quarter of 2024 have chosen to either lower their asking price by more than 15 % or take the property off the market. These decisions are not merely strategic; they reflect deeper financial pressures. Many sellers are grappling with the reality that their home equity has eroded; a recent link to the U.S. Federal Reserve’s “Households and Housing” report confirms that the average homeowner now owes $30,000 more than their home is worth.

The article also mentions that seller “reluctance” is creating a feedback loop: when buyers see prices drop dramatically, they may perceive a sign of weakness and wait for further cuts, which can further depress the market.

4. What the Data Tells Us About the Future

The piece draws on a forecast from the Institute for Market Analysis (IMA), which suggests that the inventory is likely to peak later in 2024 before a gradual decline as interest rates stabilize. However, the IMA cautions that even a modest drop in rates could be insufficient to spur a robust recovery because of the high “cost‑of‑delay” many buyers face—waiting longer means higher long‑term mortgage costs.

The article links to a Forbes editorial on the potential for a “buyer’s market” in the Midwest, noting that some regional variations may diverge from the national trend. In states like Ohio and Wisconsin, the inventory has been increasing at a slower pace, suggesting that local dynamics—such as job growth or regional economic policy—can moderate the impact.

5. A Call to Action for Stakeholders

While the story is largely one of caution, the article concludes on a pragmatic note. It urges real‑estate agents, lenders, and policymakers to collaborate on creating more accessible financing options for buyers, to streamline the permitting process for new construction, and to support sellers who are reluctant to give up their property. The piece links to an NAR white paper on “Affordability Initiatives,” which outlines potential incentive programs for first‑time buyers and subsidies for sellers who need to make their homes more marketable.

Final Thoughts

The unsold‑home surge in the United States is not a fleeting anomaly; it is the manifestation of a confluence of economic forces—rising mortgage rates, supply chain bottlenecks, shifting workforce patterns, and a tightening of housing affordability. While the article offers a sobering snapshot of sellers giving up, it also underscores that the market is not static. Through collaborative policy efforts, creative financing, and a renewed focus on housing supply, there remains a path toward a healthier balance between inventory and demand.

The Newsweek article, enriched by the data and expert commentary it draws upon, serves as both a warning and a roadmap—an essential read for anyone navigating the choppy waters of today’s real‑estate market.

Read the Full Newsweek Article at:

[ https://www.newsweek.com/unsold-homes-skyrocket-nationwide-sellers-give-up-11112916 ]