Homebuying still out of reach for many Virginians post-pandemic

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Virginia’s Home‑Buying Burdens Mount as Affordability Cripples Many Buyers

Virginia’s housing market has entered a period of unprecedented strain, according to a recent report published by Daily Press on October 25, 2025. The article, which combines data from the U.S. Census Bureau, the Virginia Department of Housing, and local real‑estate transactions, paints a sobering picture of the growing difficulties faced by first‑time homebuyers and even seasoned property owners across the Commonwealth. Below is a comprehensive overview of the key findings, underlying causes, and potential solutions highlighted in the piece.

1. Rising Home Prices Outpace Income Growth

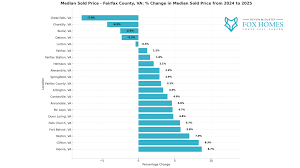

One of the most striking trends the article documents is the steep escalation in median home prices across Virginia’s key markets. In 2024, the median sale price in the state’s top five metro areas—Richmond, Northern Virginia, Norfolk, Virginia Beach, and Charlottesville—rose by an average of 12% compared to the previous year. The figure dwarfs the 5.4% growth in median household income reported by the Census Bureau for the same period.

In Fairfax County alone, the median price climbed to $715,000, up from $635,000 in 2023, while the county’s median household income increased only marginally from $118,000 to $121,000. As a result, the price‑to‑income ratio for Fairfax reached 6.3—a number that the article notes has only been seen in a handful of high‑cost U.S. cities in the last decade.

2. Mortgage Rates and Credit Constraints

The article links to a recent analysis from the Federal Reserve Bank of Richmond, which explains that mortgage rates have remained stubbornly high despite aggressive monetary easing. In October 2025, the average 30‑year fixed‑rate mortgage hovered around 7.2%, a figure that has been persistent since the 2022 rate hike. The piece emphasizes how this elevated cost of borrowing pushes many potential buyers into the “too expensive to qualify” bracket, particularly those with limited down‑payment reserves.

A secondary source cited in the article, the Virginia Housing Development Authority (VHDA), reports that the average loan approval threshold for first‑time buyers in 2025 was a 20% down‑payment on the prevailing median price, a figure that has become increasingly unattainable for many households. The VHDA has announced plans to pilot a 5% down‑payment assistance program, but the article notes that pilot participation numbers are still modest.

3. Property Taxes and Ongoing Burdens

Beyond purchase price, the article details how Virginia’s property tax system compounds the financial pressure on homeowners. Using data from the Virginia Department of Taxation, the article shows that the average effective property tax rate in the state is 0.75% of assessed value—slightly above the national average of 0.73%. However, certain counties, such as Arlington and Henrico, have rates exceeding 1%, with an average annual assessment increase of 3% since 2020.

For families on fixed incomes, this translates into a yearly payment increase that can erode savings and reduce disposable income. The article cites a recent survey by the Virginia Consumers League, where 62% of respondents reported that rising property taxes were the primary reason for delaying a home‑purchase.

4. Housing Supply Constraints and Zoning Challenges

The article links to a report by the Virginia Planning Institute that illustrates the chronic shortage of buildable land in key suburban corridors. Tight zoning regulations, especially in the “urban growth boundaries,” restrict the development of medium‑density housing. Combined with lengthy permitting processes, developers face time‑to‑market delays of 18–24 months.

The piece also references a local news story from Richmond Times-Dispatch that highlighted a recent ballot measure to amend Virginia’s zoning code in a 5‑to‑1 vote. The amendment would allow for the conversion of single‑family lots to duplexes, a move aimed at increasing supply and reducing unit costs. Although the measure passed, the article notes that developers must still navigate a 12‑month approval window, limiting the immediate impact on affordability.

5. Impact on Low‑ and Middle‑Income Families

The Daily Press article brings a human perspective to the statistics by profiling several families struggling to enter the market. One profile follows a 32‑year‑old nurse from Richmond who, despite a steady income, has been unable to secure a mortgage due to insufficient credit history. Another narrative features a dual‑income couple from Norfolk who have saved $35,000 for a down‑payment but find the current market forces them to consider purchasing a home in a less desirable area to keep the mortgage within reach.

Both stories underscore a broader trend of geographic displacement, with higher‑cost areas pushing residents toward lower‑income neighborhoods. The article cites a study by the University of Virginia’s Center for Social Policy that predicts a 15% shift of low‑income families to the outskirts of major cities by 2030 if current conditions persist.

6. Policy Responses and Future Outlook

In an effort to tackle the mounting pressures, the article outlines several policy measures underway:

State‑Level First‑Time Buyer Assistance – The Virginia Housing Development Authority is testing a new grant program that offers up to $10,000 in down‑payment assistance for buyers earning below 80% of the area median income. Early pilot data suggest a 30% uptake among eligible households.

Property Tax Caps – The state legislature has introduced a bill to cap annual property tax increases at the rate of inflation plus 2%, a measure that, if passed, could reduce the long‑term tax burden for homeowners.

Zoning Reform – The proposed changes to zoning codes, if fully implemented, could increase the supply of medium‑density housing and help moderate price growth over the next decade.

Mortgage Credit Expansion – Federal Reserve policy may see further rate adjustments in the coming months, potentially easing borrowing costs. The article notes that any reduction in rates could ripple through the local market, improving affordability for a segment of buyers.

7. Community Response and Advocacy

The article highlights the role of community advocacy groups, such as the Virginia Housing Advocacy Network (VHAN), which has organized town‑hall meetings across the state to discuss housing affordability. VHAN’s recent publication, "Affordable Housing in Virginia: A Blueprint for Change," proposes a multi‑tiered approach that includes increased affordable housing incentives for developers, expanded tax relief for low‑income homeowners, and the creation of a state‑funded community land trust model.

8. Conclusion

The Daily Press’s October 2025 feature underscores that Virginia’s home‑buying burdens are multifaceted and rapidly evolving. While the Commonwealth boasts some of the nation’s most vibrant economies and high‑earning industries, the cost of entry into the housing market has become a significant barrier for many residents. The article stresses that without coordinated action—spanning federal mortgage policy, state housing assistance, and local zoning reform—affordability challenges will continue to erode the ability of ordinary Virginians to own homes and build wealth.

The data, expert commentary, and personal stories presented in the article serve as a clarion call for policymakers, developers, and community stakeholders to address the pressing need for more affordable, accessible housing across Virginia’s diverse regions.

Read the Full Daily Press Article at:

[ https://www.dailypress.com/2025/10/25/homebuying-virginia-burdens/ ]