What is the typical down payment on a house?

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Average Down Payment on New Home Purchases: What Buyers Should Know

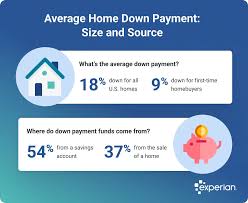

In the U.S., the size of a first‑time homebuyer’s down payment has steadily risen over the past decade, reflecting tighter financial conditions and a shift in buyer expectations. According to a recent analysis that pulls together data from the U.S. Department of Housing and Urban Development (HUD), Freddie Mac, and real‑estate experts, the average down payment for a newly purchased home in 2023 was around 15 % of the purchase price. This represents a significant jump from the roughly 10 % that prevailed during the 2010s and signals that buyers are taking on more of the purchase cost up front.

Why the Jump?

The article explains that several forces have contributed to the larger down payments. First, mortgage‑interest rates have climbed from the near‑zero levels that characterized the post‑great‑recession era. Higher rates mean that buyers are more motivated to reduce their loan amount to keep monthly payments manageable. Second, stricter underwriting standards after the 2008 crisis mean that lenders are now more cautious about approving high‑leverage loans, especially for non‑prime borrowers. Third, the housing inventory continues to be tight, pushing up prices and making buyers feel the need to put more money down to close the deal quickly and avoid bidding wars.

Different Down‑Payment Tiers

The article breaks down average down payments by loan type:

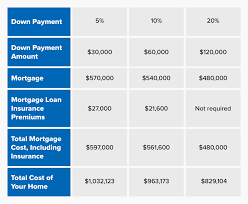

- Conventional loans – 16 % average down. Conventional lenders typically require 20 % for a loan without private mortgage insurance (PMI), but many borrowers opt for 10‑15 % and pay PMI instead.

- FHA loans – 8.5 % average down. The Federal Housing Administration guarantees these loans and caps the required down payment at 3.5 % for qualified buyers. However, the article notes that many FHA borrowers choose to put down more than the minimum to reduce their monthly payment and avoid paying for PMI (which in the FHA context is called mortgage insurance premium, MIP).

- USDA and VA loans – 0 % average down. These government‑backed programs offer zero‑down options for eligible rural buyers and veterans, though the article points out that some borrowers still pay for a “certificate fee” and mortgage insurance.

Trends Over Time

Historical charts in the article illustrate a clear upward trend in down‑payment percentages over the last fifteen years. In 2008, the average down payment was only 10 %, but by 2016 it had reached 12 %. The COVID‑19 pandemic temporarily slowed the rise, as many buyers took advantage of historically low rates and opted for minimal down payments. Since 2021, the rate has accelerated again, with the average down payment hovering around 14‑15 % as of mid‑2023.

What This Means for Buyers

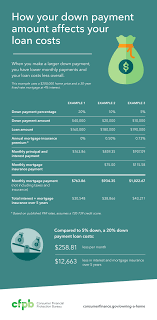

- Affordability – A higher down payment reduces the loan balance and, therefore, monthly payments. This can be especially important for buyers who want to maintain a comfortable debt‑to‑income ratio.

- Mortgage insurance – Paying more upfront can help buyers avoid or shorten the duration of PMI or MIP, saving thousands of dollars over the life of the loan.

- Cash reserves – The article warns that a larger down payment can strain a buyer’s emergency savings. Experts recommend keeping at least three to six months’ worth of living expenses in an accessible account even after putting down a sizable down payment.

- Investment strategy – For some buyers, investing the money that would otherwise go toward a larger down payment can yield higher returns, especially if interest rates remain low. A financial advisor can help evaluate the trade‑off between loan balance and investment gains.

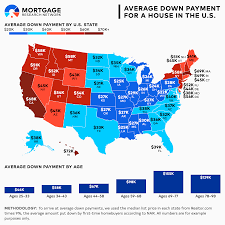

Regional Variations

The article also highlights significant regional differences. In high‑cost markets such as San Francisco, Seattle, and New York City, the average down payment exceeds 18 %, as buyers contend with sky‑high home prices. Conversely, in more affordable areas like the Midwest or South, average down payments hover closer to 12‑13 %. This pattern reflects the interplay between home‑price levels, local economic conditions, and the prevalence of cash‑buyers in each market.

Links to Further Data

The piece pulls its primary data set from Freddie Mac’s “Home Price Index” and “First‑Time Homebuyer Data” releases. The Freddie Mac website offers downloadable spreadsheets that break down down‑payment percentages by loan type, region, and time period. These data sets are freely accessible at https://www.freddiemac.com/research/. For those interested in the regulatory framework, HUD’s website (https://www.hud.gov/) provides guidance on mortgage insurance requirements and lender underwriting guidelines. Finally, the article references the “U.S. Census Bureau’s American Housing Survey,” which can be accessed at https://www.census.gov/programs-surveys/ahs for deeper demographic insights on homeownership patterns across the country.

Bottom Line

The average down payment for new home purchases in 2023 is now closer to 15 % of the purchase price, a notable increase from the 10 % levels seen a decade ago. While higher down payments can reduce long‑term debt and mortgage insurance costs, they also demand careful financial planning to preserve cash reserves and ensure long‑term affordability. Buyers who weigh these factors thoughtfully and tap into the wealth of publicly available data can navigate today’s housing market with greater confidence.

Read the Full Local 12 WKRC Cincinnati Article at:

[ https://local12.com/money/mortgages/average-down-payment ]