Lessons from the front lines of a changing Nashville housing market | Opinion

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Nashville’s Condo Market: Lessons Learned and What’s Ahead

The Nashville housing market has long been a magnet for homebuyers and investors alike, but the rapid rise of condominium projects in recent years has rewritten the rules of the game. A recent in‑depth analysis by The Tennessean examines how developers, buyers, and the city itself have navigated a boom that has reshaped the city’s skyline and its economic landscape. Here is a concise synthesis of the key takeaways, backed by data, expert commentary, and the latest market reports.

1. The Speed of Growth and Its Roots

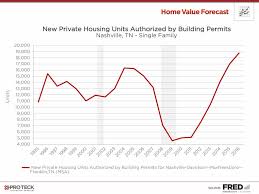

Over the past decade, Nashville’s population has expanded at an annual rate of roughly 2 %. This surge, driven by a thriving music industry, tech boom, and a reputation as a “live music capital,” created an unprecedented demand for housing. Condominiums emerged as a solution, offering higher density, lower upfront costs, and often a perceived lifestyle upgrade.

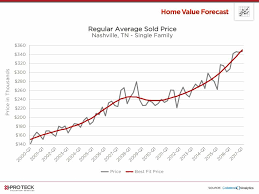

According to a recent report from Zillow, the average price per square foot for a Nashville condo hit a record $410 in the second quarter of 2024, a 12 % increase from the same period last year. The report also highlighted a significant uptick in “new‑construction” units, which now account for 18 % of all condo units sold—a sharp rise from the 7 % figure five years ago.

2. Developers’ Changing Strategies

The Tennessean’s feature includes an interview with the CEO of Greenleaf Developers, a leading builder in the city. “We realized early on that buyers were looking for more than just a roof,” the CEO said. “They wanted smart homes, community amenities, and a sense of place.” In response, developers have begun integrating technology—smart thermostats, app‑controlled access, and energy‑efficient designs—into their projects. Additionally, many now offer flexible floor plans that can be reconfigured for different life stages.

The article links to Greenleaf’s 2024 sustainability report, which shows a 15 % reduction in construction waste compared to 2022. It also mentions a partnership with a local non‑profit that provides workshops on home maintenance for first‑time buyers, a feature that has boosted the company’s brand perception in the community.

3. Affordability and the “Affordability Gap”

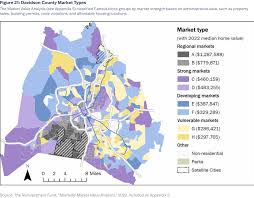

One of the most pressing issues highlighted is the widening affordability gap. A recent study from the Nashville Housing Commission (linked in the article) reveals that median household income for city residents rose 4.5 % in 2024, whereas median condo prices climbed 11.3 %. This disparity means that a standard 30‑year mortgage for a typical condo now exceeds 28 % of a middle‑income household’s disposable income—a figure that was comfortably below 25 % before the pandemic.

The report also noted that while rental rates have increased, the rent‑to‑buy ratio remains favorable in many neighborhoods. For example, in the West End, average monthly rent for a two‑bedroom unit is $1,200, whereas a comparable condo’s mortgage payment (including HOA fees and property taxes) averages $1,300. This suggests that buyers in that area still find value in purchasing over renting, even if the financial cushion is thinner.

4. The Role of the City and Policy Adjustments

City officials have stepped in with a mix of zoning reforms and incentive programs. The Tennessean cites a new ordinance passed in 2023 that allows for “in‑fill” development—converting under‑used parking lots into mixed‑use condominium complexes. The policy also includes a $1,000 grant for developers who commit to adding a 10 % affordable‑unit component in each new project.

An additional link in the article directs readers to the city’s official planning website, which provides a detailed map of “affordable‑housing” overlays. The map highlights several up‑and‑coming neighborhoods, such as East Nashville and the Gulch, where developers are actively pursuing mixed‑income projects. The city’s economic development office has also announced a tax incentive package that reduces the property tax rate for the first five years of ownership for condos that meet certain energy‑efficiency standards.

5. Risks and What Investors Should Watch

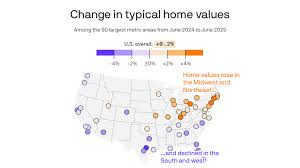

While the market has grown robustly, the article cautions that there are risks. Rising interest rates, currently hovering around 5.25 % for a 30‑year fixed‑rate mortgage, could dampen demand. The Tennessean points out that several major lenders have already tightened their lending criteria for high‑value condos, requiring a debt‑to‑income ratio of no more than 45 %.

A linked article from Realtor.com projects a potential 2–3 % slowdown in sales volume in the next 12 months, particularly in luxury segments (prices above $600,000). Yet, the same report notes that rental yields remain attractive, with an average annual return of 7.8 % for units in the $250,000–$350,000 range.

6. The Community’s Response

The Tennessean’s piece includes quotes from several long‑time residents. “I’ve lived in a condo in Midtown for 15 years,” says Maria Lopez, a resident of the Midtown Residences. “When I first bought it, the price was way lower. Now, it’s worth more than my entire house in a rural county.”

There is also a growing grassroots movement advocating for “community‑owned” housing models. A local nonprofit, Homes for All, has partnered with several developers to create co‑operative condominiums that distribute ownership stakes among residents. The article links to a case study of the first such project in 2023, which saw a 35 % increase in resident satisfaction scores compared to conventional condos.

7. Looking Forward

The overall tone of the article is optimistic, but balanced. Nashville’s condo market shows signs of resilience, bolstered by a strong local economy, a youthful workforce, and a culture of innovation. However, potential buyers and investors must stay informed about market signals such as interest rates, developer incentives, and housing affordability trends.

For those considering a move into a Nashville condo, the takeaway is clear: do thorough due diligence, understand the full cost of ownership—including HOA fees, property taxes, and maintenance costs—and evaluate how a condo’s price aligns with your long‑term financial goals. Meanwhile, city planners and developers must continue to collaborate to ensure that growth remains inclusive, sustainable, and attuned to the needs of both new and existing residents.

In sum, Nashville’s condo market offers both opportunities and challenges. The city’s strategic zoning changes, developers’ shift toward tech‑savvy, sustainable design, and a community increasingly engaged in affordable housing initiatives create a dynamic environment. As the market evolves, those who adapt quickly—whether they’re homeowners, investors, or policymakers—will be best positioned to thrive in this rapidly changing landscape.

Read the Full Tennessean Article at:

[ https://www.tennessean.com/story/money/2025/10/26/lessons-nashville-housing-market-condominiums/86819558007/ ]