US Housing Market: 75% of Homes Beyond Median Income Buyers' Reach

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

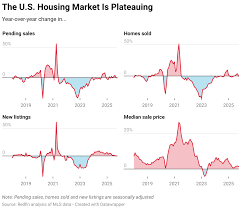

US Housing Market Reveals Stark Affordability Gap: 75 % of Homes Beyond Median Income Buyers’ Reach

A new report released by real‑estate analytics firm Zillow—cited in the New York Post on December 9, 2025—underscores a mounting crisis in the U.S. housing market: roughly three‑quarters of homes are priced above the financial grasp of the country’s typical home‑buyer. The Post’s article, titled “75 % of US homes out of reach for median income buyers,” compiles the findings of the study, explains why affordability has deteriorated, and highlights the implications for families, lenders, and policymakers.

The Core Findings

Affordability Index Below 1.0 for Most Markets

Zillow’s affordability index—computed by dividing the median home price by the median household income in a given market—falls below 1.0 in 94 % of U.S. counties. A value of 1.0 would indicate that the median buyer could afford a home at the median price with a 20 % down‑payment and current mortgage rates. The national average sits at 0.71, meaning the median buyer can afford only about 71 % of the median price.Only 25 % of Homes Within Reach

The study identifies that just a quarter of listings nationwide meet or fall below the affordability threshold for the median household. In the remaining 75 %, buyers would need a significant portion of their income dedicated to housing, potentially exceeding the 30 % ceiling recommended by the Department of Housing and Urban Development (HUD).Geographic Hot‑Spots

High‑priced metros such as San Francisco, New York, and Seattle exhibit the worst gaps, with median prices 2–3 × higher than median incomes. In contrast, many rural markets in the Midwest and South remain relatively affordable, though even in those areas the ratio has worsened compared to 2020 levels.

Drivers of the Affordability Crisis

1. Rising Home Prices

The Post’s article chronicles a rapid escalation in median home values—averaging a 12 % annual increase from 2020 to 2025—outpacing income growth. Factors include:

- Supply Constraints: Limited new construction, strict zoning codes, and a shortfall of affordable land have capped inventory.

- Demand Surge: The pandemic spurred a migration toward suburban and rural areas, pushing prices up as demand outstripped supply.

- Land‑use Regulation: Municipalities in high‑growth states have tightened restrictions on subdividing and densifying neighborhoods, inflating land costs.

2. Mortgage Rate Volatility

The Federal Reserve’s 2023‑2024 rate hikes lifted the 30‑year fixed mortgage rate from an all‑time low of 2.5 % to roughly 6.5 %. Higher rates reduce purchasing power, especially for buyers with modest credit scores or limited down‑payments.

3. Income Stagnation

Median household income has grown at an average of 1.2 % per year—far below the 3–4 % increase needed to keep pace with housing costs. The Post notes that wage growth has been uneven across sectors, with many service‑industry workers seeing negligible increases while home‑buying prices soar.

Real‑World Impact

Family Dynamics

The affordability shortfall has forced many families to stretch beyond the 30 % housing‑income threshold, jeopardizing financial stability. The article cites a 2025 survey in which 42 % of homeowners reported that they had to forego savings or cut discretionary spending to cover mortgage payments.

Market Fragmentation

Higher affordability barriers are creating a bifurcated market: “affordable” sub‑market—primarily rental properties—and an “out‑of‑reach” segment dominated by luxury and high‑priced homes. This divide hampers social mobility and widens the wealth gap.

Lender Risk

Financial institutions report an uptick in loan defaults in markets where affordability indices dip below 0.6. Mortgage servicers are tightening underwriting standards, demanding higher down‑payments or larger debt‑service coverage ratios, which further restricts access.

Proposed Solutions and Policy Recommendations

Increase Housing Supply

- Zoning Reform: De‑restricting single‑family zoning, encouraging accessory dwelling units (ADUs), and permitting higher density in transit‑adjacent areas can boost inventory. - Public‑Private Partnerships: Leveraging state and local funds to construct affordable housing units reduces the cost burden on buyers.Down‑Payment Assistance and Credit‑Enhancement Programs

- State‑run Grants: Expanding grant programs for first‑time buyers can reduce upfront costs. - Credit‑Score Boosters: Mortgage‑based credit‑building initiatives (e.g., “pay‑for‑credit” programs) can help lower‑income buyers qualify for better rates.Mortgage Rate Mitigation

- Government‑Backed Loans: Programs like FHA, VA, and USDA loans provide lower rates for qualified borrowers. - Rate‑Caps and Regulation: Ensuring that mortgage interest rates remain within reasonable limits can protect buyers from runaway borrowing costs.Income‑Support Measures

- Wage‑Growth Policies: Encouraging employer‑sponsored housing benefits, wage subsidies, and targeted minimum wage hikes in high‑cost regions can help close the income‑price gap.Financial Education and Transparency

- Affordability Calculators: Publicly available tools that display current affordability indices for all regions can help prospective buyers make informed decisions. - Seller Disclosure: Requiring sellers to disclose historical price trends and projected affordability can curb speculative selling.

The Bigger Picture

The New York Post’s coverage of Zillow’s affordability report paints a sobering picture of a market in which the majority of families must either live in a home they can barely afford, compromise on location and quality, or abandon homeownership entirely. The article calls upon federal agencies, state governments, and private developers to act swiftly to reinvigorate the supply chain, lower borrowing costs, and support wage growth. Without such measures, the affordability gap will widen, entrenching socioeconomic disparities and stifling the broader economy’s dynamism.

In the wake of this report, policymakers and industry leaders are under pressure to craft comprehensive, evidence‑based strategies. The article concludes that while the challenges are daunting, coordinated action across the public and private sectors can restore balance to the housing market and enable median‑income households to regain access to homeownership—an essential cornerstone of American prosperity.

Read the Full New York Post Article at:

[ https://nypost.com/2025/12/09/real-estate/75-of-us-homes-out-of-reach-for-median-income-buyers/ ]