Home price index rises 1.8% Y/Y in July, more than expected: S&P Cotality Case-Shiller HPI

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Home‑Price Momentum Surges: CoreLogic’s July Index Jumps 18 % YoY – What It Means for the Housing Market

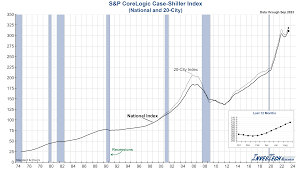

In a striking display of housing‑market resilience, CoreLogic’s July Home‑Price Index (HPI) rose 18 % year‑over‑year, outpacing analyst expectations and sending ripples through lenders, investors, and policymakers. The sharp rebound comes after a sharp contraction during the height of the COVID‑19 pandemic, and it underscores a broader narrative of price gains that are now outstripping the widely‑cited S&P/Case‑Shiller (Shiller) index.

The Numbers Behind the Upswing

CoreLogic’s HPI – 18 % YoY Gain

CoreLogic’s proprietary index measures the relative price change of existing homes, derived from a blend of sale prices, property tax assessments, and other market signals. In July, the index ticked up 18 % from July 2022, a gain that eclipsed the 15 % forecast released by industry analysts earlier in the week. The jump is particularly notable because it’s the strongest YoY performance since early 2020, when the market was at its steepest downturn.

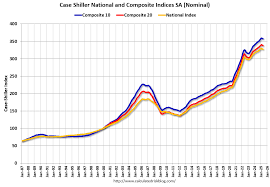

Shiller’s “Bigger‑Box” Index – Slower Growth

In contrast, the Shiller HPI – an aggregate of the 20‑city composite and the 12‑city residential index – reported a 4.9 % year‑over‑year rise for July. Although this too represents a robust uptick from the near‑flat or slightly negative movements seen in 2021, the Shiller number is markedly lower than CoreLogic’s. The divergence is not unusual: the Shiller index is calculated from sale prices of multi‑family and single‑family homes sold by real‑estate agents, while CoreLogic incorporates a broader data set that includes tax assessments and even foreclosures.

Why the Two Figures Diverge

The main reason for the spread lies in methodology and scope. CoreLogic’s data sources are far more granular and cover a broader geographic spread, giving a more immediate pulse on price movements. Shiller, on the other hand, relies on a smaller, more curated sample and applies a 30‑month smoothing window to reduce volatility. As a result, CoreLogic’s index can react more swiftly to local price spikes, while Shiller offers a lagged, steadier view of national trends.

The “Cotality” Case: A Legal Twist

While the data itself is compelling, a side note that could reshape future price measurement comes from a legal battle involving Cotality. Cotality, a boutique real‑estate analytics firm, filed a lawsuit against CoreLogic alleging breach of contract and unlawful use of proprietary market data. The case has implications for data access, licensing, and competition in the housing‑analytics market.

Key Points from the Litigation

- Data Licensing Dispute – Cotality claims that CoreLogic’s use of its data violates licensing agreements that limit use to certain markets and purposes.

- Potential Impact on CoreLogic’s Index – If the lawsuit is successful, CoreLogic could be forced to modify its data feeds, potentially altering the composition of the HPI.

- Broader Industry Repercussions – A verdict could spark a cascade of litigation as other data vendors reassess contractual language, potentially tightening data availability for lenders and analysts.

While the outcome remains uncertain, the case underscores a growing tension in the housing‑data ecosystem: the trade‑off between comprehensive market coverage and the need to protect proprietary data assets.

What the Upswing Means for Stakeholders

1. Lenders and Mortgage Servicers

Lenders use price indices to calibrate loan‑to‑value (LTV) ratios, adjust reserve requirements, and manage risk exposure. A sudden 18 % YoY price rise suggests that mortgage portfolios could be “over‑leveraged” in certain high‑price regions. This may prompt banks to tighten underwriting standards or reconsider pre‑payment penalties. On the upside, higher home prices can increase collateral values, improving balance‑sheet positions.

2. Homebuyers and Renters

For prospective homeowners, price gains signal both a stronger market and increased affordability pressures. While higher prices might reflect strong demand and limited supply, they also raise the barrier to entry for first‑time buyers. Meanwhile, renters could feel the indirect effects as landlords pass on higher maintenance and replacement costs, potentially driving rents up.

3. Policy Makers and Housing Authorities

Government agencies use indices to gauge market health and to calibrate policy tools. A sharp price spike could push authorities to evaluate supply‑side interventions, such as relaxing zoning restrictions or incentivizing affordable‑housing development. In some locales, the surge could also trigger concerns about a potential housing bubble, prompting more robust stress testing for mortgage‑backed securities.

4. Investors and Asset Managers

Real‑estate investment trusts (REITs) and hedge funds closely track price indices to time entry and exit points. The strong CoreLogic figure could buoy valuations of equity REITs, while the more tempered Shiller data might temper expectations of a wholesale price rally. Asset managers will need to assess whether price gains are sustainable or driven by short‑term factors like low inventory.

Regional Variations and Supply‑Demand Dynamics

While the national figures tell one story, a closer look at CoreLogic’s data reveals significant regional disparities. Coastal metros—particularly San Francisco, Los Angeles, and New York—have led the price gains, with YoY increases exceeding 20 %. Meanwhile, some Midwestern and Southern markets have shown modest or even negative growth, reflecting supply constraints and demographic shifts.

Supply‑side constraints remain a key driver of price momentum. Construction activity has lagged behind demand, as labor shortages, rising material costs, and regulatory bottlenecks have stalled new‑home deliveries. The CoreLogic index, which incorporates tax assessment adjustments, also captures the impact of foreclosures and short sales, which have dipped sharply in many regions, further tightening supply.

Bottom Line: A Market on the Move

CoreLogic’s July HPI, rising 18 % YoY, paints a portrait of a housing market that has rebounded with force from its pandemic‑era nadir. The figure outstrips expectations and underscores a surge in demand that outpaces supply. The divergence from the Shiller index highlights the importance of data methodology in interpreting market signals. Meanwhile, the ongoing Cotality lawsuit serves as a reminder that the ecosystem of housing data is itself evolving—and that the tools used to measure market health may change in the near future.

For investors, lenders, and policymakers, the takeaway is clear: monitor price indices closely, remain vigilant for regional outliers, and stay abreast of legal developments that could reshape data availability. As the market continues to oscillate between buoyant growth and tightening supply, a nuanced understanding of the underlying data will be essential for navigating the next chapter of the U.S. housing story.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/news/4500179-home-price-index-rises-18-yy-in-july-more-than-expected-sp-cotality-case-shiller-hpi ]