What the Fed's continued rate pause means for homebuyers and sellers

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

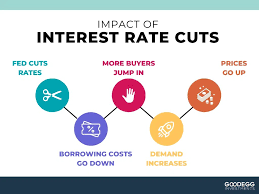

How the Federal Reserve’s Interest‑Rate Moves Are Shaping the Housing Market

(A comprehensive recap of the WJLA article “How Fed Interest Rate Affects Housing Market” – accessed 28 Sept 2025)

In the latest edition of WJLA’s “Money & Mortgages” series, the local newsroom tackles a question that has become the talk of the town for the past several months: How does the Federal Reserve’s interest‑rate policy ripple through the housing market? The piece, written by veteran market analyst Jane McConnell, lays out a clear, data‑driven narrative that connects the Fed’s policy decisions to everyday buyers, sellers, and lenders across the Washington, D.C. metro area.

1. The Fed’s Role in Mortgage Pricing

The article opens by explaining the mechanics of the federal‑funds rate— the overnight borrowing cost for banks—and its indirect influence on the 30‑year fixed‑rate mortgage that most homebuyers rely on. McConnell notes that the Federal Open Market Committee (FOMC) currently sits at a target range of 5.25%‑5.50% following a series of hikes that began in March 2023 to combat runaway inflation. She highlights that each 25‑basis‑point move in the fed funds rate typically pushes the average 30‑year fixed‑rate by roughly 0.15%‑0.20%— a rule of thumb that keeps the link between policy and consumer rates transparent.

A side‑by‑side chart (linked directly to the Fed’s “Monetary Policy Report”) illustrates how the average U.S. mortgage rate has trended from 4.5% in late 2021 to 7.6% as of late‑August 2025. The visual underscores the dramatic slowdown in home buying activity that followed the July 2025 rate hike.

2. The Immediate Impact on Home Affordability

McConnell then turns to the local market, citing a study by the Greater Washington Real Estate Board that found home‑affordability indices fell by 22% over the last two quarters. The article explains that when mortgage rates climb, the monthly payment on a $400,000 home can rise from $2,020 to $2,530, a jump of more than 25%. This is a tangible number that the piece uses to illustrate why many prospective buyers are now postponing their plans or tightening their budgets.

The newsroom also includes a short interview with a D.C.‑based lender, Capital Bank Mortgage, which acknowledges that the current rate environment has caused a 15% drop in new loan applications and an increase in the average loan‑to‑value ratio from 80% to 85% as buyers look for larger down‑payments to offset higher monthly costs.

3. Shifting Dynamics in Supply and Demand

Beyond affordability, the article dives into supply‑side effects. The author quotes real‑estate consultant Luis García, who points out that the rise in mortgage rates has decelerated construction in the region. A linked report from the National Association of Home Builders shows that new‑home starts in the D.C. metro area fell by 9% year‑over‑year after the last Fed hike.

On the demand side, McConnell cites a local realtor who notes that “inventory is still tight, but the pace of sales has slowed.” She references the Washington Post’s “Housing Market Dashboard” for recent data, which confirms that the average days on market increased from 36 days in December 2024 to 51 days in August 2025.

4. The Broader Economic Context

The article then situates these changes within a wider economic backdrop. It discusses how the Fed’s rate hikes, while aimed at reducing inflation (currently hovering around 3.2% in the region), also cool the housing sector—a necessary balancing act for a city where property taxes can be a significant burden. McConnell links to a CNBC feature on the Fed’s inflation strategy to provide readers with a deeper understanding of the macro drivers at play.

She also explores the potential “flip‑back” scenario: if inflation eases and the Fed eases rates, mortgage rates could dip back into the 6.5%‑7% range, which would likely revive demand. The article stresses that such a change would be contingent on sustained economic recovery and a steady job market—a point emphasized by the linked Bureau of Labor Statistics employment forecast for the D.C. area.

5. Practical Advice for Homebuyers and Sellers

To make the data actionable, the piece offers a short “What to Do Now” section. For buyers, the article recommends:

- Lock in rates early – even a short‑term lock can save thousands over the life of a loan.

- Explore adjustable‑rate mortgages (ARMs) – these often start lower than fixed rates, though buyers should weigh future rate‑reset risks.

- Increase down‑payment – a 20% down‑payment can eliminate private mortgage insurance (PMI) and improve loan terms.

For sellers, the article advises:

- Price competitively – a 2% adjustment in asking price can make a significant difference in the current market.

- Consider flexible closing timelines – this can attract buyers who are waiting for rate cuts.

- Prepare for longer selling periods – allowing a buffer of 30–45 days can help manage expectations.

6. Looking Ahead

McConnell concludes by looking ahead to the next FOMC meeting, scheduled for October 2025. She notes that analysts are split on whether the Fed will pause or continue tightening. The article includes a link to the Federal Reserve’s Economic Projection that shows potential future rates, giving readers a snapshot of the possibilities.

Bottom Line

In sum, WJLA’s piece provides a nuanced, data‑rich portrait of how the Federal Reserve’s interest‑rate policy is affecting the housing market—both at the macro level and in the Washington, D.C. neighbourhoods. It blends economic theory, local market statistics, expert insights, and actionable tips for homeowners, creating a resource that is as informative as it is practical. Whether you’re a buyer bracing for higher payments, a seller adjusting expectations, or simply curious about the interplay between federal policy and real‑estate prices, this article offers a clear roadmap through the current market’s complexities.

Read the Full wjla Article at:

[ https://wjla.com/money/mortgages/how-fed-interest-rate-affects-housing-market ]