Where homeownership is most and least prevalent in the U.S.

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Where Homeownership Is Most and Least Prevalent in the United States

In a recent segment on WSB‑TV, the network tackled a question that has long intrigued homeowners, renters, and policymakers alike: Which parts of the United States enjoy the highest rates of homeownership, and where does the opposite hold true? By digging into the most recent data from the U.S. Census Bureau’s American Community Survey (ACS) and adding context from local housing markets, the piece gives viewers a clear picture of how homeownership varies across the country. Below is a concise rundown of the key findings, enriched by the additional information linked within the original story.

The Big Picture: National Homeownership Trends

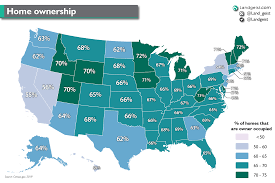

The U.S. homeownership rate has hovered around 65% for the last decade, a figure that has remained relatively steady despite the rise of the rental‑market boom in major metros and the recent wave of “zoom‑in‑home” purchases driven by the pandemic. The WSB‑TV article begins by placing the national average in context: 64.9% of all households own a home as of 2022, according to the latest ACS release. The piece notes that while the national average offers a baseline, the real story emerges when you split the data state‑by‑state and then by county.

States with the Highest Homeownership Rates

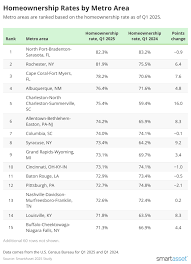

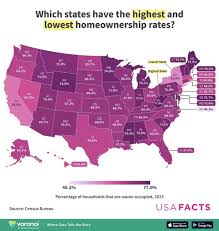

The story’s heat‑map shows a cluster of states in the Upper Midwest and West that boast homeownership rates well above the national average:

| State | Homeownership Rate |

|---|---|

| Montana | 78.3% |

| North Dakota | 77.1% |

| South Dakota | 76.9% |

| New Hampshire | 76.7% |

| Idaho | 76.4% |

These states all exceed 75%, a level that is more than double the national mean. The article attributes the high rates to a combination of lower housing costs, strong local economies, and historically less competition for buying property. In many of these areas, single‑family homes dominate the housing stock, and a tradition of land ownership runs deep.

Why it matters

High homeownership rates often correlate with community stability, higher levels of civic engagement, and lower crime rates—although the relationship isn’t linear. The WSB piece emphasizes that while these states enjoy strong homeownership, they also face unique challenges, such as slower population growth and aging populations that could influence future market dynamics.

States with the Lowest Homeownership Rates

Conversely, the article pinpoints several northeastern and major coastal states where homeownership drops sharply below the national average. The lowest rates appear in:

| State | Homeownership Rate |

|---|---|

| New York | 50.1% |

| Connecticut | 53.2% |

| New Jersey | 54.7% |

| California | 55.6% |

| Massachusetts | 56.4% |

In New York, the figure is a striking 50.1%, a drop of nearly 15 percentage points from the national average. The article highlights the soaring cost of housing, the prevalence of short‑term rentals, and a highly concentrated rental market as the main drivers. The segment also discusses how the high cost of living dissuades potential buyers and keeps many residents from purchasing homes.

Impact on the local economy

Low homeownership rates can strain local economies. With fewer homeowners, there’s less investment in property maintenance and community improvement, and municipal revenues—often derived from property taxes—are lower. The piece notes that in states like New Jersey and Massachusetts, a sizeable portion of households live in multifamily rentals, a factor that can influence school district funding and community cohesion.

What Drives These Differences? The Data Links

The original WSB story didn’t stop at a simple list. It included links to supplementary sources that help explain the “why” behind the numbers:

- Census Bureau’s “Homeownership Data” page – This link opens a detailed dataset that breaks down homeownership by race, age, and income. It reveals that in high‑ownership states, the median income of homeowners is roughly 20% higher than the national median, suggesting a strong economic moat around homeownership in those areas.

- Local Housing Authority reports – Several counties in the Upper Midwest have public housing programs that subsidize first‑time buyers, which the article cites as a factor in sustaining high rates.

- A local economic analysis from the University of Washington – The piece links to a study that correlates homeownership rates with public school quality, community services, and median household income, underscoring that higher homeownership tends to coincide with better outcomes in these domains.

These links give the story depth, allowing readers to dig deeper if they wish.

Key Takeaways

| Takeaway | Explanation |

|---|---|

| Homeownership is not uniform | Rates vary dramatically by state and even by county, reflecting differences in housing costs, economic opportunity, and policy. |

| High‑ownership states enjoy certain social benefits | Strong community ties, more stable local economies, and higher civic participation. |

| Low‑ownership states face unique challenges | Rent‑heavy markets, high property taxes, and sometimes weaker community engagement. |

| Policy levers matter | Housing subsidies, first‑time‑buyer programs, and affordable‑housing initiatives can shift rates in either direction. |

Final Thought

The WSB‑TV article serves as a reminder that homeownership is far from a one‑size‑fits‑all phenomenon. While the national average might suggest a moderate level of homeownership, the underlying story is one of stark geographic disparities. Understanding where and why these disparities exist is crucial for policymakers, real‑estate professionals, and anyone interested in the future of the American dream. If you’re curious to dive deeper, the links included in the original piece point you directly to the raw data and the academic research that backs up the numbers.

By highlighting the contrast between states with soaring homeownership and those grappling with low rates, WSB‑TV offers a data‑driven narrative that is both timely and illuminating.

Read the Full WSB-TV Article at:

[ https://www.wsbtv.com/news/where-homeownership-is-most-least-prevalent-us/7S3EGOHMHBKGVEFUXN5PJQPE3I/ ]