Calgary Housing Market Ends 2024 with Sales Decline

Locale: Alberta, CANADA

Calgary Housing Market Ends 2024 on a Downbeat: Sales Plummet and Inventory Remains Elevated

Calgary's housing market concluded 2024 with a significant downturn, marking the end of an extended period of robust growth fueled by Alberta’s economic boom. The Calgary Real Estate Board (CREB) reported a 14% decrease in home sales for December compared to the same month last year, capping off a full year where market activity cooled considerably from its peak in 2022 and early 2023. This decline signals a shift in dynamics, with buyers exhibiting more caution despite relatively stable prices.

The core of the issue lies in a combination of factors including rising interest rates, affordability concerns, and a persistent inventory surplus that has eroded seller leverage. While Calgary's economic outlook remains positive – driven by energy sector investment and population growth – these positives haven’t translated into the same level of housing demand seen previously.

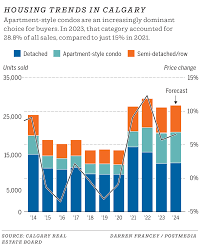

Sales Decline Across Segments: The December sales decrease wasn't limited to one particular housing type. All segments experienced declines, although detached homes saw a steeper drop (18%) compared to condos (-9%) and townhouses (-12%). This suggests a broader shift in buyer preferences or purchasing power rather than simply a segment-specific issue. The overall year-end sales figures reflect this trend; 2024’s total sales were down approximately 13% compared to 2023, a stark contrast to the rapid growth experienced in prior years when buyers aggressively pursued properties amid limited supply.

Inventory Remains High: A key contributor to the slowdown is the elevated inventory levels. December saw 6,784 active listings, a 25% increase year-over-year. This abundance of choice has given buyers more negotiating power and reduced competition among potential purchasers. The increased inventory isn't solely due to fewer sales; it also reflects a hesitancy from some homeowners to list their properties, fearing they won’t achieve the prices they received during the peak market conditions. This reluctance is understandable given that while Calgary home prices have remained relatively stable, they are still significantly higher than pre-boom levels.

Price Stability Masks Underlying Weakness: While average sale prices haven't plummeted dramatically, they remain a point of concern. The December average price for all housing types was $536,900, only marginally lower (around 1%) than the same period last year. However, this stability is largely due to the composition of sales – higher-priced homes are still being sold, propping up the average. The median price, which is less susceptible to outliers, has shown a more noticeable decline, suggesting that buyers are increasingly opting for lower-priced options or negotiating significant discounts on existing listings. CREB notes that while prices haven’t crashed, they are demonstrating "price sensitivity" and are likely to be influenced by ongoing economic factors.

Interest Rates as the Primary Driver: The Bank of Canada's interest rate decisions have played a pivotal role in shaping the Calgary housing market’s trajectory. Higher rates significantly impact mortgage affordability, making it more difficult for potential buyers to qualify for loans. While there’s hope that rates will begin to decrease in 2025, the uncertainty surrounding these cuts continues to dampen buyer enthusiasm. As reported by CBC News (linked within The Star article), any rate reductions would likely provide a much-needed boost to the market, but until those cuts materialize, buyers are expected to remain on the sidelines or be more discerning.

Population Growth & Economic Outlook: Despite the current slowdown, Calgary’s long-term prospects remain positive. Alberta continues to attract interprovincial migrants and international newcomers, driven by job opportunities in sectors like energy, technology, and healthcare. This population growth creates underlying demand for housing that will eventually reassert itself. However, the immediate impact of this demographic shift is being tempered by affordability challenges and economic uncertainty. The ongoing investment in Alberta’s energy sector – particularly related to carbon capture and hydrogen production – provides a degree of stability, but its full effect on the housing market remains to be seen.

Looking Ahead: CREB anticipates that 2025 will likely see continued price stabilization or even modest declines as inventory levels remain elevated and interest rates continue to impact affordability. The pace of recovery will heavily depend on when the Bank of Canada begins cutting interest rates, and how quickly buyers respond to those changes. A return to the frenzied buying activity of 2022 seems unlikely in the near future; instead, a more balanced market with greater negotiating power for buyers is expected to prevail. The key takeaway is that while Calgary’s housing market has experienced a significant adjustment, its fundamental economic strengths suggest it's well-positioned for eventual recovery – though the timing and magnitude of that rebound remain uncertain.

I hope this summary accurately reflects the information presented in the article and provides sufficient context for understanding the current state of Calgary's housing market.

Read the Full Toronto Star Article at:

[ https://www.thestar.com/news/canada/alberta/calgary-housing-market-closed-out-2025-with-14-fewer-home-sales-in-december-board/article_8c3c9d8d-6cd3-57cb-a2f0-c55072f33853.html ]