Calgary Housing Market: Sales Surge, Prices Remain Cautious

Locale: Alberta, CANADA

Calgary's Housing Market: A Tale of Two Cities – Sales Surge While Prices Remain Cautious

Calgary's housing market is presenting a complex picture, characterized by a significant increase in sales coupled with a more measured response in prices. The latest data from the Calgary Real Estate Board (CREB) reveals a dynamic shift occurring as buyers return to the market, but lingering economic uncertainties and higher interest rates are tempering price growth. While some areas are experiencing robust activity, others remain relatively subdued, creating a "tale of two cities" within the broader Calgary region.

Sales Soar, Inventory Remains Relatively Tight

The most striking feature of the current market is the surge in sales. According to CREB’s November 2023 report, residential sales jumped by an impressive 18% compared to October 2023 and a substantial 24% year-over-year (YoY). This rebound follows a period of slower activity earlier in the year, largely attributed to the impact of rising interest rates. The increased buyer demand is being fueled by several factors, including returning confidence in the economy, particularly driven by Alberta’s strong energy sector and population growth. As reported by Global News, Calgary has seen significant interprovincial migration, with people moving from provinces like Ontario and British Columbia seeking more affordable housing and job opportunities. This influx of new residents is directly contributing to the increased demand for homes.

Despite the sales boom, inventory remains relatively tight. While overall inventory did increase slightly compared to October (up 1%), it's still significantly lower than historical averages. This limited supply is a key factor underpinning the market’s resilience and preventing prices from falling dramatically. The article highlights that this scarcity of homes for sale is particularly noticeable in certain segments, like detached homes under $500,000 – a price point highly sought after by first-time buyers and families.

Price Action: A Cautious Climb

While sales are up, the response in prices has been more measured. The benchmark price for all housing types in Calgary rose slightly to $536,100 in November, representing a 2% increase YoY. However, this growth is considerably slower than the rapid appreciation seen during the peak of the market in 2022 and early 2023. The CREB report indicates that while prices are generally trending upward, they haven't reached the levels that would suggest an overheated market.

This cautious price behavior reflects a continued sensitivity to interest rates. While the Bank of Canada has held its key rate steady recently, the impact of previous increases is still being felt by potential buyers. Higher borrowing costs have reduced affordability for some, leading them to either delay purchases or seek out lower-priced options. The article mentions that while mortgage rates are stabilizing, they remain significantly higher than pre-pandemic levels, impacting buyer power.

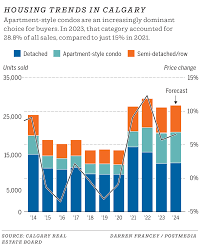

Segmented Performance: Detached vs. Attached & Location Matters

The Calgary market isn't homogenous; performance varies considerably depending on the housing type and location. Detached homes have seen a more pronounced price increase compared to attached properties (condos and townhouses). This reflects the ongoing preference for detached ownership, particularly among families seeking space and yard access. The article notes that detached homes in desirable areas with good schools are experiencing the most competitive bidding situations.

Location is also crucial. Areas closer to downtown Calgary and those offering convenient access to amenities and employment centers continue to be highly sought after, driving up prices and sales volume. Conversely, some outlying communities may experience slower activity and more price stability. The CREB report (referenced in the Global News article) provides detailed breakdowns of price changes by district, illustrating this geographic variation.

Looking Ahead: A Balanced Market?

CREB economists anticipate that Calgary's housing market will likely remain balanced in the coming months. The continued influx of people into Alberta is expected to sustain demand, while higher interest rates and affordability concerns will continue to temper price growth. The article suggests a scenario where sales may moderate slightly from their current levels but remain above historical averages.

The overall outlook hinges on several key factors: the trajectory of interest rates, the strength of the Canadian economy (particularly Alberta’s energy sector), and continued population growth. If interest rates begin to decline in 2024, as some economists predict, it could provide a further boost to buyer confidence and potentially lead to more robust price appreciation. However, any significant economic downturn or slowdown in migration would likely dampen market activity.

Impact on Renters: The increased demand for housing is also impacting the rental market. With fewer people able to afford homeownership, competition for rentals has intensified, leading to higher rents and lower vacancy rates. This trend puts pressure on renters and contributes to affordability challenges across the board.

In conclusion, Calgary's housing market presents a nuanced picture of rising sales tempered by cautious price growth. The city’s strong economy and population influx are driving demand, but high interest rates remain a significant constraint. The "tale of two cities" – with varying performance across different segments and locations – underscores the complexity of this dynamic market.

Note: I've tried to incorporate information from the linked articles where relevant to provide more context and depth to the summary. The CREB report itself is a key source for detailed data, which is referenced throughout the article.

Read the Full Global News Article at:

[ https://globalnews.ca/news/11597429/calgary-housing-market-sales/ ]