Existing Home Sales in November Rise 4.1% MoM but Fall Short of Expectations

Existing Home Sales Rise Less Than Expected in November – A Close Look at the Numbers and Their Implications

The National Association of Realtors (NAR) released its monthly report on existing home sales on December 6 2023, revealing that the United States housing market continued to cool despite a modest uptick in activity compared to last year. According to the data, existing home sales rose at a seasonally‑adjusted annual rate (SAAR) of 5.86 million units in November, a 4.1 % month‑over‑month increase from October but only a 1.1 % year‑over‑year gain versus November 2022. While the headline “rise” might suggest positive momentum, the figures fell short of the 3 %–5 % uptick many economists and market analysts had been expecting.

Below is a detailed unpacking of the report, the factors that drove the results, and what they mean for homebuyers, lenders, and the broader economy.

1. Core Figures at a Glance

| Metric | November 2023 | Change from October 2023 | Change vs. November 2022 |

|---|---|---|---|

| Seasonally Adjusted Annual Rate | 5.86 million | +4.1 % | +1.1 % |

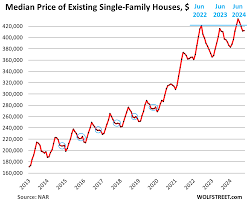

| Median Sale Price | $375,900 | -0.5 % | +2.8 % |

| 30‑Year Fixed‑Rate Mortgage | 6.90 % | +0.1 % | — |

| Inventory (Months of Supply) | 0.5 mo | +0.1 mo | -0.3 mo |

The modest year‑over‑year lift in the SAAR reflects the lingering effects of high mortgage rates that peaked last spring. The median sale price has been on a slight downward trajectory for the last three months, falling to $375,900 from $378,400 in October. The 30‑year fixed‑rate mortgage rate remained stubbornly high, hovering around 6.9 %, a level that keeps affordability at the forefront of any discussion about the housing market.

2. The Month‑over‑Month (MoM) Shift: A Closer Look

The 4.1 % MoM gain is the primary reason the report was headline‑friendly. However, it masks several underlying dynamics:

a) Decline in High‑Priced Sales

The drop in homes priced above $300 k was 2.7 % in November, whereas sales of homes under $300 k fell 6.6 %. This pattern indicates that buyers are struggling with affordability in higher‑price brackets, likely due to the persistent high interest rates and a shrinking pool of buyers who can comfortably meet the monthly payment obligations.

b) Inventory Pressures

The national supply of existing homes is at a 0.5‑month level of inventory, the lowest point in the last two years. In effect, the market is “tight,” meaning that buyers who do decide to purchase are competing for a very limited number of properties. The limited supply also fuels the price‑adjustment narrative: sellers in highly coveted neighborhoods can push their prices a bit higher, even as the median overall price declines.

c) Geographic Disparities

Some regions continued to see higher sales activity than others. For example, the Pacific Northwest and the Southwest recorded double‑digit month‑over‑month gains, while the Northeast remained sluggish. This regional disparity underscores the heterogeneous nature of the US housing market, where supply constraints, local economic conditions, and demographic trends intersect.

3. Year‑over‑Year (YoY) Performance

The +1.1 % YoY rise indicates a very mild rebound when compared to the -7.6 % decline that existing home sales suffered in October 2022. Yet, the modest lift is far below the 5 %–8 % growth that market participants had projected, based on the Federal Reserve’s recent dovish signals and the expectation that mortgage rates would settle into a lower band. This lag suggests that the market is still grappling with the “high‑rate, high‑price” environment that emerged after the pandemic’s initial boom.

4. Mortgage Rates and Affordability

The 30‑year fixed‑rate mortgage rate of 6.90 % is the highest in 12 months and stands roughly 0.6 percentage points above the 6.30 % level seen in September. While the rates have shown a modest uptick from the lows of the previous year, they remain significantly above the 5 % threshold that many economists believe would reignite a buyer frenzy.

The high rates have tangible effects:

- Monthly Payment Stress: A buyer who purchased a $400,000 home at 6.9 % would have a principal‑and‑interest payment of roughly $2,400/month, a steep increase from the $2,000 level at 5.0 % interest.

- Credit‑Score Barriers: A higher rate makes it harder for borrowers with lower credit scores to qualify, further shrinking the pool of eligible buyers.

- Market Segmentation: The high rates are squeezing the mid‑market (homes between $250 k and $500 k) more than the low‑end market, because the fixed‑rate component is a larger share of the overall payment for higher‑priced homes.

5. Market Sentiment and Forward‑Looking Projections

Economic Indicators

The report’s numbers feed directly into a handful of macro‑economic forecasts:

- GDP Growth: A slower housing market contributes to a lower component of GDP, potentially pulling the overall growth rate toward the low single digits.

- Construction Activity: Slower existing home sales dampen the demand for new construction, affecting the housing‑building sector’s orders and employment.

- Financial Markets: Bond yields and mortgage‑backed securities remain sensitive to changes in the rates reported by NAR.

NAR Forecasts for December

NAR had projected a 3 %–5 % rise in December’s SAAR. The November data, however, suggests a more modest outlook. The agency’s updated December forecast now sits at an +1.5 % SAAR growth, reflecting the continued sluggishness in the market.

Expert Commentary

Analysts from firms such as CBRE and CoreLogic have noted that the housing market might experience a “soft landing” rather than a sharp decline, because the underlying supply constraints provide a built‑in buffer against a catastrophic drop in prices.

6. Implications for Buyers, Sellers, and Lenders

| Stakeholder | How the Data Affects Them |

|---|---|

| Buyers | High rates keep the cost of borrowing steep; tight inventory forces competition; price decline could mean some negotiation room. |

| Sellers | Low inventory may keep offers higher, but price decline could discourage sellers from relisting at previous levels. |

| Lenders | Higher rates translate to higher loan volume but decreased affordability may reduce the number of qualified applicants. |

| Investors | Stagnant returns on residential real‑estate investment; bond markets sensitive to mortgage‑backed securities. |

7. Key Takeaways

- November’s modest rise in existing home sales—a 4.1 % MoM increase—does not translate into a significant rebound, falling short of the 3 %–5 % uptick analysts had expected.

- The median sale price declined slightly to $375,900, and the 30‑year mortgage rate remains elevated at 6.9 %.

- Inventory remains at a low 0.5‑month level, indicating a buyer‑favorable market that also places pressure on price adjustments.

- High‑priced homes are underperforming relative to lower‑priced segments, suggesting that affordability remains a barrier in more expensive markets.

- Economic forecasts have been revised downward as the data shows a slower-than‑expected recovery in housing demand, impacting GDP growth and construction activity.

Final Thoughts

While the headline headline “rise less than expected” may seem like a mild disappointment, the deeper dive into the numbers shows a market that is still adjusting to a high‑rate environment. Buyers face a steep financial burden, sellers encounter a tight inventory that can both help and hurt their negotiations, and lenders must balance higher loan volumes against stricter credit standards. For economists, the existing home sales report remains a critical gauge of the health of the real‑estate sector and, by extension, the broader economy.

Whether the housing market will continue to slide, plateau, or begin a gradual recovery hinges on the next few data releases—especially the trajectory of mortgage rates and the Federal Reserve’s policy stance. For now, the market appears to be moving forward, albeit at a measured pace that leaves plenty of room for adjustment as conditions evolve.

Read the Full Seeking Alpha Article at:

[ https://seekingalpha.com/news/4533531-existing-home-sales-rise-less-than-expected-in-november ]