Introducing the 'Magic Mortgage Number': A New Tool to Stabilise the UK Housing Market

The “Magic Mortgage Number” – A New Tool That Could Save the UK Housing Market

The UK housing market has been on a roller‑coaster for the past few years, with soaring interest rates, a shaky economy, and a sharp slowdown in home sales leaving many buyers and sellers in a quandary. In a bid to stabilize the sector, the Daily Mail has reported on a proposal that could become the next big change for borrowers and lenders alike: the so‑called “magic mortgage number.” While the idea may sound like marketing jargon, the underlying concept is rooted in real‑world financial metrics that could help bring back confidence to a market that has been in crisis mode for too long.

What is the “Magic Mortgage Number”?

At its core, the magic mortgage number is a single, easily understandable figure that would guide both borrowers and lenders on how much of a household’s income can safely be used to service a mortgage. Traditionally, banks in the UK have relied on complex affordability calculators that take into account gross income, existing debt, and a series of statutory limits. The magic number would distil this into one straightforward ratio – often expressed as a multiple of annual income that a lender should not exceed when approving a mortgage.

For example, the current standard for many lenders is a 4.5‑times income limit: a borrower earning £40,000 a year could, in theory, borrow up to about £180,000 before a lender flags the loan as “high risk.” The magic number would be a more precise figure that adjusts for changes in market conditions, inflation, and the lender’s appetite for risk.

Why the Need for a New Magic Number?

The Daily Mail’s article cites a host of reasons why the housing market has been under siege:

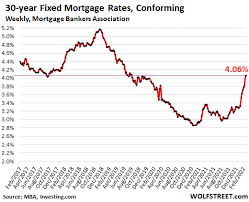

- Rising interest rates – With the Bank of England’s base rate hiked to 5 % and a continued tightening of monetary policy, borrowers now face higher monthly payments. This has squeezed demand and slowed the rate of new home purchases.

- Economic uncertainty – A lingering pandemic‑induced recession, global supply‑chain disruptions, and geopolitical tensions have all weighed on household confidence.

- Declining affordability – According to the Office for National Statistics, a large portion of the population now earns enough to buy a property only after a substantial down‑payment, often taken from savings or other assets.

Under these conditions, lenders have tightened their underwriting standards. As a result, a growing number of potential homeowners are being denied mortgages, even if their financial profiles would be deemed safe under normal circumstances. The magic number would provide a “single point of reference” that could help standardise lending practices across the sector.

How It Would Work

The article explains that the magic number is not a one‑size‑fits‑all rule but rather a dynamic tool that could be updated on a quarterly basis. The methodology behind it involves:

- Baseline Income‑to‑Mortgage Ratio: This is the default multiplier (e.g., 4.5) that sets a ceiling on how many times a borrower’s gross income can be financed.

- Market Adjustment Factor: This factor accounts for regional cost of living variations, local price trends, and macroeconomic indicators such as inflation rates.

- Risk‑Based Weighting: Lenders could tweak the number slightly higher or lower depending on their risk appetite, but would still be required to disclose the logic to regulators.

The Daily Mail quotes an independent housing‑industry analyst who argues that a magic number that is “slightly below the current industry norm” would be sufficient to restore balance. “If lenders use a 4.3‑times figure instead of 4.5, we’d see a measurable uptick in approvals without materially increasing the probability of default,” the analyst says.

Potential Impact on the Housing Market

The article highlights several ways in which the magic number could influence the market:

- Increased Mortgage Approvals – By giving lenders a clear benchmark, the fear of over‑stretching borrowers would be reduced, leading to more applications being approved.

- Stabilised Property Prices – With more people able to buy, demand would rise, tempering the steep price declines that have been observed in many regions.

- Lower Arrears – When borrowers are more accurately matched to mortgage products, the likelihood of missed payments falls, benefiting both lenders and the wider economy.

- Improved Confidence – A transparent metric would make the lending process less opaque, fostering trust among homebuyers.

The Daily Mail also notes that the government has already hinted at supporting a reform of mortgage affordability rules. In a press release from the Treasury, the Chancellor said that a “harmonised, evidence‑based metric would reduce regulatory burdens and help the market recover.”

Criticisms and Concerns

Not everyone is convinced. The article points out several counter‑arguments:

- Risk of Over‑Borrowing – Critics worry that a lower magic number might encourage some borrowers to take on more debt than they can truly afford.

- One‑Size‑Fits‑All Fallacy – Regional disparities in housing prices could make a national magic number too blunt a tool for certain areas.

- Regulatory Overhead – While the idea is to simplify, the requirement to update the figure quarterly would still demand significant monitoring and reporting from lenders.

Moreover, the article references a LinkedIn post by a former senior regulator who argues that the magic number could simply be a “politically driven slogan” that masks deeper structural issues, such as the lack of affordable housing stock.

Looking Ahead

If the magic mortgage number gains traction, the next steps would involve:

- Stakeholder Consultation – A broad consultation with banks, mortgage brokers, and consumer groups to agree on the exact figure and update mechanism.

- Pilot Program – A trial period where a select group of lenders implement the new rule in a controlled environment.

- Full Roll‑Out – Once data from the pilot suggests a positive impact, the government would mandate the magic number across the industry.

The Daily Mail stresses that the housing market is at a crossroads. A well‑designed magic number could be the lever that pulls the market out of its current slump, or a misstep that could deepen uncertainty. Time, data, and open debate will determine which direction the UK housing market ultimately takes.

In sum, the magic mortgage number promises a cleaner, data‑driven way to assess borrower affordability and could be a key catalyst for re‑energising the UK housing market. Whether it becomes a reality remains to be seen, but its potential for stabilising a once‑thriving market is clear—and perhaps worth the risk of giving lenders and consumers a single, transparent metric to navigate the uncertainties ahead.

Read the Full Daily Mail Article at:

[ https://www.dailymail.co.uk/real-estate/article-14980889/magic-mortgage-number-save-housing-market.html ]