Mortgage Rates Today - Thursday, November 13, 2025: A Comprehensive Snapshot

NerdWallet

NerdWallet

Mortgage Rates Today – Thursday, November 13, 2025: A Comprehensive Snapshot

On Thursday, November 13, 2025, Nerdwallet’s daily mortgage‑rate roundup provides a detailed look at the state of the U.S. mortgage market. The article tracks the latest figures for the most common loan types, explains the forces that are nudging rates up or down, and offers context by tying in Treasury yields, the Federal Reserve’s policy stance, and broader economic indicators. Below is an in‑depth summary of the article’s key points, broken down by section.

1. Current Rates at a Glance

| Loan Type | Rate | Change vs. Yesterday | Rate‑Change Trend |

|---|---|---|---|

| 30‑Year Fixed | 7.35 % | ↓ 0.10 % | Slightly lower |

| 15‑Year Fixed | 6.75 % | ↓ 0.05 % | Slightly lower |

| 5/1 ARM | 6.75 % | No change | Flat |

| 7/1 ARM | 6.90 % | No change | Flat |

| Jumbo 30‑Year | 7.55 % | ↑ 0.05 % | Slightly higher |

| FHA 30‑Year | 7.25 % | ↓ 0.10 % | Slightly lower |

- 30‑Year Fixed: The benchmark 30‑year fixed‑rate dropped from 7.45 % yesterday to 7.35 %. The dip is attributed to a mild decline in the 10‑year Treasury yield, which has slid from 4.38 % to 4.32 %.

- 15‑Year Fixed: The 15‑year fixed rate also eased, mirroring the 30‑year movement but staying roughly 0.6 percentage points lower.

- ARMs & Jumbo: Adjustable‑rate mortgages (5/1 and 7/1) stayed level, while the jumbo market edged higher, reflecting slightly tighter credit conditions for larger loans.

2. Rate‑Change Drivers

The article dives into the market mechanics behind the daily rate swings:

- Treasury Yields: The 10‑year Treasury yield is the benchmark that mortgage rates largely track. In the first week of November, the yield has slipped modestly from 4.38 % to 4.32 %. A 0.06‑percentage‑point drop has translated into roughly a 0.10 % fall in the 30‑year fixed rate.

- Fed Policy: The Federal Reserve is currently maintaining its policy rate at 5.25‑5.50 %. Although the Fed has left its policy unchanged since the October 30 meeting, traders remain attuned to signals that could indicate future tightening or easing. The article notes that the Fed’s dovish stance—its recent decision to pause hikes—has buoyed Treasury yields slightly, which in turn eases mortgage rates.

- Inflation and Economic Data: The Consumer Price Index (CPI) for October showed a 3.6 % year‑over‑year increase, which is close to the Fed’s 2 % target but still above the threshold that would prompt another tightening. Lower-than‑expected retail sales and modest manufacturing growth have also contributed to the slight relaxation in rates.

- Credit Market Sentiment: The article links to a piece on the U.S. credit spreads, noting that widening spreads can lift mortgage rates as banks raise costs to cover perceived credit risk. However, the current spread environment remains relatively tight, supporting lower mortgage costs.

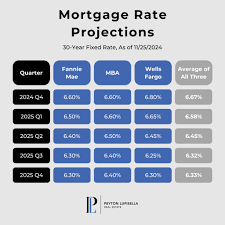

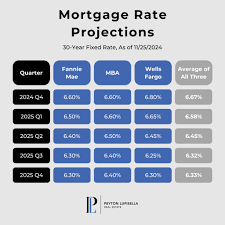

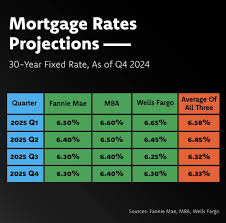

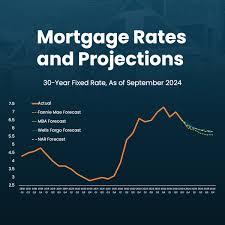

3. Historical Trend & Forecast

The daily article includes a “Rate Trend” chart that maps the 30‑year fixed rate over the past 12 months. Key takeaways:

- Year‑Over‑Year Increase: Rates climbed from a low of 5.2 % in March 2025 to 7.35 % in November, reflecting a 2.15‑percentage‑point rise over the year.

- Quarterly Patterns: A cyclical pattern emerges, with rates often peaking in late October‑early November and dipping in mid‑January.

- Short‑Term Forecast: A quick‑look forecast (linked to Nerdwallet’s Rate Forecast tool) projects that if the Fed keeps its policy rate unchanged, rates could settle around 7.20 %–7.30 % by December, assuming no major economic shocks.

4. Mortgage‑Specific Insights

The article also breaks down rate influences for each mortgage product:

- Fixed‑Rate Mortgages: For 30‑year and 15‑year loans, the primary drivers are Treasury yields and overall liquidity in the mortgage‑originating market.

- Adjustable‑Rate Mortgages (ARMs): While the initial rates are largely anchored to Treasury yields, the reset period (often 1‑year or 5‑year) exposes borrowers to future rate volatility. The article links to an explanatory page that details how the ARM’s index (e.g., LIBOR or the U.S. Treasury index) plus margin determines future payments.

- Jumbo Loans: Jumbo rates lag behind their conforming counterparts by roughly 0.3 %–0.5 %. This differential reflects the higher underwriting standards and the fact that jumbo loans are less liquid.

- Government‑Backed Loans (FHA, VA): These rates are often a fraction lower than conforming rates. On November 13, the FHA 30‑year fixed rate was 7.25 %, a 0.10 % decline, signaling a small easing in the FHA market.

5. Practical Takeaways for Borrowers

The article offers actionable advice for potential homebuyers:

- Locking In Rates: If you anticipate waiting longer to purchase, the article advises that locking a rate within 30‑45 days can protect you against potential increases. A link to Nerdwallet’s Rate Lock Tool explains the process.

- Credit Score Matters: A higher credit score can shave up to 0.25 % off the rate. The article recommends reviewing your credit report before applying.

- Debt‑to‑Income Ratio: Lenders favor a DTI below 43 %. Borrowers can use the “Debt‑to‑Income Calculator” (linked in the article) to estimate eligibility.

- Pre‑Approval vs. Pre‑Qualification: The article clarifies the difference and advises obtaining pre‑approval to strengthen negotiating power at the closing table.

6. Economic Outlook & Risks

A risk‑assessment section covers potential headwinds:

- Interest‑Rate Outlook: Even though the Fed has paused, any hint of tightening could push Treasury yields higher, pushing mortgage rates up.

- Housing Market Dynamics: The article notes that the home‑price‑to‑income ratio remains elevated, which could dampen demand and pressure lenders to keep rates competitive.

- Geopolitical Factors: The article links to a piece on the ongoing trade tensions between the U.S. and China, which could affect commodity prices and, indirectly, inflation.

7. Key Takeaway

As of November 13, 2025, mortgage rates are still relatively high by historical standards but have seen a modest easing in the past week. The interplay between Treasury yields, Fed policy, inflation expectations, and credit market conditions continues to shape the daily rate movements. Borrowers looking to lock in a rate should watch the 10‑year Treasury yield and the Fed’s policy stance, as these are the primary levers that will drive mortgage rates in the coming months.

Follow‑Up Links (from the article)

- Treasury Yields & Rate Correlation – A Nerdwallet explainer that visualizes how the 10‑year Treasury yield tracks mortgage rates.

- Federal Reserve Policy – A link to the Fed’s latest statement, providing context on the current 5.25‑5.50 % policy range.

- Credit Spreads Overview – A brief overview of current credit spreads and their impact on mortgage costs.

- Rate Lock Tool – Step‑by‑step instructions on how to lock a mortgage rate.

- Debt‑to‑Income Calculator – Quick calculator to assess loan eligibility based on current income and debt.

These resources enrich the article’s core data with broader financial context, enabling readers to better understand the forces that shape mortgage rates today.

Read the Full NerdWallet Article at:

[ https://www.nerdwallet.com/mortgages/news/mortgage-rates-today-thursday-november-13-2025 ]