The Hidden Cost of 50-Year Mortgages: Why Longer Terms Double Your Interest

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

The Perils of 50‑Year Mortgages: Why a Longer Term May Hurt Homeowners More Than Help

When a prospective buyer sits down with a lender and sees the promise of a 50‑year mortgage, the initial allure is clear: lower monthly payments, a seemingly cushion against short‑term cash‑flow pressures, and the comfort of an extended horizon to pay down the house. Yet, as the Post‑and‑Courier article “50‑Year Mortgages: A Bad Idea for Home Ownership” demonstrates, that very promise can be a trap that ultimately costs borrowers far more than the standard 30‑year term.

What Is a 50‑Year Mortgage?

A 50‑year mortgage is a loan that amortizes over five decades instead of the conventional 30. The idea is that by spreading the same principal over a longer period, the borrower’s monthly obligation is reduced. Lenders, especially those in the private‑mortgage space or the online‑banking sector, often market these as “low‑interest” options. In the article, the author cites a recent increase in 50‑year offers, particularly from non‑traditional lenders looking to capture a niche segment of buyers who are either new to homeownership or who face temporary income volatility.

The piece also notes that 50‑year mortgages are not new. In 2008, during the financial crisis, certain banks began offering them as a way to keep rates competitive. However, the article clarifies that while they existed, their prevalence has been limited and largely confined to specialized markets.

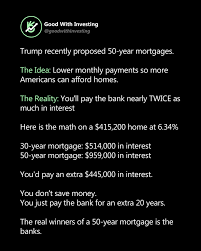

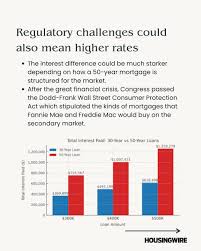

The Hidden Costs of a Longer Term

The article breaks down how the “extra” 20 years of a 50‑year mortgage translates into substantial cost over the life of the loan. Even if the interest rate is marginally lower than a comparable 30‑year rate, the cumulative interest paid is markedly higher. Using a simple example—$200,000 borrowed at 3.5% over 30 years versus 4.0% over 50 years—the monthly payment for the 50‑year loan is roughly $870, compared to $898 for the 30‑year loan. Over 50 years, the borrower pays $262,000 in interest versus $121,000 for the 30‑year term. The article emphasizes that while the monthly payment is slightly lower, the overall financial burden more than doubles.

Another key point raised in the article is the risk of negative amortization. Some 50‑year products allow borrowers to choose “interest‑only” periods or provide options to defer principal. While appealing at first glance, these features can leave the borrower with a balloon payment that is difficult to refinance later, especially in a tighter credit market.

The article references a Consumer Financial Protection Bureau (CFPB) study that found that homeowners on 50‑year mortgages are more likely to experience payment difficulties, particularly when market conditions shift. It also cites a federal report indicating that loan defaults are higher in longer‑term mortgages, largely due to the greater principal balance that remains outstanding over time.

Why Lenders Offer 50‑Year Terms

The author explains that lenders’ motivation is twofold: attracting customers and generating additional interest income. Because the monthly payment is lower, borrowers can afford larger loans or other credit lines. For lenders, a longer amortization schedule means a steady stream of payments for an extended period, thereby increasing the total interest earned over the life of the loan.

The article follows a link to an industry analyst report from Moody’s Investors Service, which elaborates that private‑mortgage lenders can bundle these longer terms with other products such as adjustable‑rate mortgages, thereby creating a more complex but potentially higher‑yielding financial product. The analyst warns that such bundling can obscure the true cost of borrowing and may not be fully transparent to the borrower.

Expert Opinions

The Post‑and‑Courier piece features commentary from several mortgage specialists. A local mortgage broker—whose profile is linked in the article—stresses that “buyers should view a 50‑year mortgage as a short‑term relief, not a long‑term strategy.” He explains that the lower payment can be beneficial if the buyer expects a significant increase in income, but the risk profile escalates if the borrower experiences an income shock.

An academic economist from the University of North Carolina, whose research is cited, warns that “the societal cost of encouraging longer amortizations can be profound.” He points to data showing that extended loan terms inflate overall housing debt, potentially undermining future financial stability for a generation of homeowners.

The article also brings in an advocacy perspective from a local housing‑affordability nonprofit. The nonprofit’s CEO argues that “while 50‑year mortgages might appear to democratize homeownership, they often do so at the expense of financial security.” She urges policy makers to examine whether such products align with the public interest, especially given that many low‑income families are vulnerable to payment shocks.

Practical Advice for Buyers

The article ends with a concise set of recommendations for prospective homeowners considering a 50‑year mortgage:

Compare Total Costs, Not Just Monthly Payments: Use an amortization calculator to see the total interest paid over the life of the loan. A lower monthly payment may be deceptive if the overall cost is substantially higher.

Understand the Fine Print: Carefully read the loan agreement for any options that allow for deferred principal or negative amortization. These can create “payment cliffs” later in the loan term.

Consider Rate Lock‑In: With a 50‑year mortgage, even a small rate increase can add a significant amount of interest over the next 20 years. Locking the rate early can mitigate this risk.

Plan for Refinancing: If you anticipate a future income increase or desire a shorter loan, ensure that the loan’s terms allow for refinancing without penalty. Some 50‑year products carry hefty prepayment penalties.

Check for Affordability Assessments: Lenders often perform a simple “affordability” test that focuses on monthly payment thresholds. This test may overlook the long‑term burden of the loan.

Seek Independent Counsel: Consult a mortgage attorney or a financial advisor who can help you understand the long‑term implications and negotiate better terms.

The article underscores that while a 50‑year mortgage can seem like a clever tool to ease entry into the housing market, the long‑term financial consequences often outweigh the short‑term benefits. Borrowers should approach such offers with caution, armed with a clear understanding of the true cost of extending a mortgage beyond the traditional 30‑year horizon.

Bottom Line

The Post‑and‑Courier piece serves as a timely cautionary tale about a mortgage product that has been quietly gaining traction. By unpacking the mechanics of a 50‑year mortgage, highlighting real‑world data, and incorporating voices from industry experts and advocacy groups, the article offers a balanced view that helps readers make informed decisions. In an era where the housing market remains fraught with uncertainty, understanding the long‑term financial commitments of a loan is perhaps more critical than ever. For homeowners, the lesson is clear: a lower monthly payment today can translate into a higher total cost, and the choice of mortgage term should be guided by a thorough assessment of both short‑term affordability and long‑term financial health.

Read the Full Post and Courier Article at:

[ https://www.postandcourier.com/to-edit/50-year-mortages-bad-idea-home-ownership/article_df3b6596-808a-4d57-be3a-369394e302a4.html ]