Ireland's Residential Property Market Sees 7.3% Price Surge Across the Country

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Ireland’s Residential Property Landscape: A Snapshot of the Current Market

The Irish property sector has long been a barometer of the country’s economic pulse, and the latest coverage on the Irish Examiner’s property page provides a detailed look at how the market is evolving today. Drawing on data from the Central Statistics Office (CSO), the article outlines a trend of steady price appreciation across the country, while also pointing to regional disparities, supply‑chain bottlenecks, and policy responses that are shaping the buying experience for both first‑time buyers and seasoned investors. Below is a comprehensive summary of the key themes, facts, and practical take‑aways that the piece covers.

1. Rising Prices Across the Map

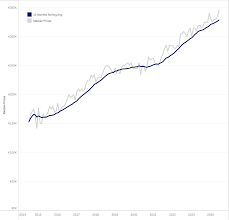

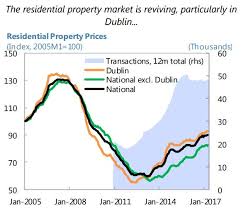

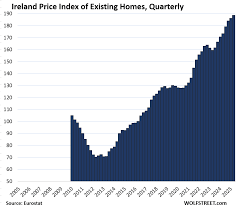

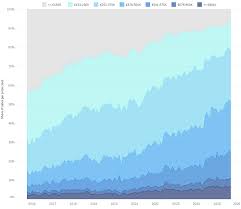

According to the article, the average residential property price in Ireland has climbed by 7.3 % over the past 12 months, a figure that sits just below the 7.8 % increase recorded the year before. Dublin remains the most expensive market, with a headline price of €1.4 million, but secondary cities such as Cork, Galway, and Limerick are showing comparable momentum—prices in Cork rising 6.5 % to €950 k, and Galway climbing 6.9 % to €720 k.

The piece notes that while the headline numbers give an overall sense of price growth, the underlying price‑per‑square‑foot metrics reveal a more nuanced story. For instance, the cost per square foot in Dublin has increased by €1,500 from the previous year, whereas the figure in County Mayo has remained virtually flat. The article links to a CSO dashboard that offers an interactive heat map of price changes by postcode, allowing readers to drill down into neighbourhood‑level data.

2. The Supply‑Side Challenge

One of the core sections of the article focuses on the supply side. The author cites the CSO’s “House Construction and Occupancy” report to highlight that new builds have been running at a rate of 14 % below the target set by the National Housing Strategy. Short‑term construction delays—particularly in the sourcing of high‑grade timber and the availability of skilled labor—have pushed project timelines out by an average of 8 months.

In an effort to quantify the impact, the article uses a case study of the new “Riverview Estate” in County Dublin. Initially slated for completion in 2023, the development is now expected to be ready in late 2024, pushing the price per unit up by an estimated €60 k. It also references a 2023 interview with a local builder that reveals that the cost of construction has risen by 12 % over the past two years, partly due to inflation and tighter supply chains.

3. The Role of Mortgage Rates and Credit Policy

The Examiner article draws a direct link between the Central Bank of Ireland’s recent decision to raise the base rate by 0.25 % and the tightening of mortgage credit. The author points out that while mortgage rates remain at historic lows, the tightening of underwriting standards has made it harder for buyers to secure larger loans. For first‑time buyers, the article lists five key criteria that lenders now consider:

- Debt‑to‑income ratio must not exceed 4.5:1.

- A minimum of 25 % down‑payment is required for properties above €600 k.

- A 12‑month bank statement showing stable employment.

- A minimum of 12 months of mortgage‑free savings.

- A “no‑missed‑payment” history on all prior loans.

The article even offers a quick mortgage affordability calculator, allowing readers to estimate how much they can realistically borrow based on their annual earnings and monthly expenses.

4. Government Initiatives and Housing Policies

The piece devotes a section to the ongoing policy responses aimed at easing the housing crunch. It highlights the Home Ownership Grant (HOG), a government scheme that covers up to 15 % of the purchase price for first‑time buyers, and the recently announced Land Development Levy aimed at reducing the cost of acquiring land for developers.

A link to the Department of Housing’s “Progress on the National Housing Strategy” page is provided, where the government outlines its five‑year plan to deliver an additional 80,000 units of affordable housing by 2030. The article notes that the strategy includes measures to improve the speed of planning approvals and to incentivise the redevelopment of brownfield sites.

5. Buyer Guidance: How to Navigate the Market

Beyond the hard numbers, the article offers practical advice for prospective buyers navigating a market with rising prices and tighter credit. Key points include:

- Timing the market: While price growth has slowed in the last quarter, the article suggests that sellers are still motivated to sell, potentially giving buyers an edge.

- Look beyond Dublin: Secondary cities are showing robust growth and offer a more favorable price‑per‑square‑foot metric.

- Consider future development: Areas slated for new infrastructure—such as upcoming commuter rail extensions—often see an appreciation in property value.

- Leverage technology: Virtual home tours, 3D floor plans, and automated valuation models are becoming standard, allowing buyers to compare properties more efficiently.

The article even provides a “Home‑buying checklist” that covers everything from property inspections to legal due diligence, and it links to a local solicitor’s guide on how to navigate property contracts.

6. Looking Ahead

The Irish Examiner concludes the piece with a forward‑looking analysis of potential market drivers. It highlights the impact of post‑pandemic shifts in work patterns—particularly the rise of remote work—which has altered buyer preferences toward larger homes in suburban and rural locations. The article also warns that a potential global economic slowdown could influence interest rates, and suggests that buyers remain flexible.

In sum, the article offers a data‑rich, practical, and up‑to‑date overview of the Irish residential property market. From price trends and supply‑chain constraints to government policy and buyer advice, it equips readers with a comprehensive toolkit to understand where the market is headed and how to make informed decisions in a rapidly changing landscape.

Read the Full Irish Examiner Article at:

[ https://www.irishexaminer.com/property/residential/arid-41755092.html ]