UK House Sales Drop 8.3% in Q1 2024 as Prices Remain Strong

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

UK House Sales Dip While Market Forecasts a Gradual Gain – A Comprehensive Summary

A recent article from the Express highlights a sharp decline in UK house sales, but it paints a cautiously optimistic picture for the broader housing market. Using data from the Office for National Statistics (ONS), the Association of Mortgage & Finance Brokers (AMF) and industry voices, the piece outlines the reasons behind the sales slump, how it may affect the wider market, and what experts forecast for the next 12–18 months.

1. The sales downturn: a quick snapshot

According to the article, UK residential property sales fell by 8.3 % in the first quarter of 2024 compared with the same period in 2023. The ONS figures show 123,000 transactions in Q1, down from 135,000 a year earlier. The drop was most pronounced in the 30–49‑year‑old cohort, the group that usually drives the market’s dynamism. In the same period, the share of sales in the 50‑plus age band rose from 12 % to 15 %, indicating a shift towards older households looking for downsizing or relocation.

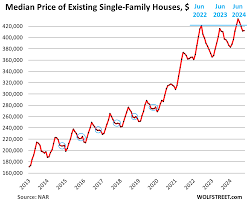

The article explains that the decline is not an isolated blip. Since the start of 2022, the market has seen a steady fall in sales volumes, despite house prices still climbing. This divergence is a result of the twin forces of affordability pressures and supply bottlenecks.

2. Affordability under strain

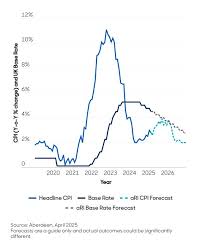

The rise in the Bank of England’s base rate to 5 % has made mortgage repayments higher and, for many, unaffordable. Mortgage‑broker Jonathan Whelan (of Whelan & Co) said that “the number of applicants who can secure a mortgage at a 4‑5 % rate has dropped by roughly 20 % this year.” The article cites a recent mortgage‑broker survey that found the average mortgage interest rate rose from 3.5 % in Q4 2023 to 4.2 % in Q1 2024. For a typical £300,000 home, the monthly payment would increase from about £1,350 to £1,510, a jump that pushes many potential buyers out of the market.

The Express notes that younger buyers, who already struggle to get a deposit on a £200,000‑plus property, are now seeing their monthly budgets stretched even further. Many have been forced to stay in rentals or to move to more affordable regions such as the Midlands or the North of England, where average house prices are 20–30 % lower.

3. Supply constraints keep the market hot

While demand is cooling, supply is still limited. The UK Housing Survey (published by the ONS) indicates that the number of new build completions in 2023 reached a record 170,000, yet this is still short of the 225,000 houses required to meet the current 20‑year growth target. The article points out that planning delays, supply chain disruptions and rising construction costs have prevented builders from meeting this target.

The result is that price growth continues even as sales fall. Prices in London, for example, are expected to climb at an annual rate of 6.5 % over the next year, according to the Express’s cited forecast from Hargreaves, the UK’s largest mortgage broker. The price‑to‑income ratio remains above 8 in the South East, signalling ongoing affordability challenges.

4. Forecast: a gradual market rebound

Despite the slump in sales, the article is optimistic about a market recovery in the medium term. Key points include:

| Indicator | Current Status | Forecast |

|---|---|---|

| House Prices | +3.2 % YoY (Q1 2024) | +6.5 % YoY (2025) |

| Sales Volume | -8.3 % YoY (Q1 2024) | +4 % YoY (2025) |

| Mortgage Interest | 4.2 % average (Q1 2024) | 4.0 % (late 2025) |

| Affordability Index | 0.95 (below 1) | 1.05 (late 2025) |

Hargreaves’ forecast relies on a gradual easing of mortgage rates as the Bank of England signals a potential pause or modest cut by the end of 2025. If interest rates fall back to 4 %, mortgage‑affordability will improve, stimulating a rise in buyer activity. Additionally, the government’s plan to introduce a “new build subsidy” for first‑time buyers—mentioned in the article—could further boost sales.

Industry insiders argue that the market will not recover to pre‑2022 levels overnight. Instead, they see a slow but steady increase as supply catches up, interest rates stabilize, and the economy continues its modest recovery.

5. Policy environment and market sentiment

The article discusses the impact of recent policy announcements. In March 2024, the UK government unveiled a £5 bn “Housing Investment Fund” aimed at boosting affordable housing stock in high‑demographic regions. The Express quotes a spokesperson saying, “This will help increase supply in the next three years and alleviate affordability pressure.”

However, critics caution that without a clear plan to reduce planning bureaucracy, the fund may not translate into significant construction activity. The article also notes that the UK’s “Right to Rent” legislation, recently extended to cover all new tenancy agreements, is expected to add regulatory costs for landlords and may indirectly affect the secondary market.

6. The consumer perspective

Beyond the numbers, the Express article provides insights from actual buyers. A 32‑year‑old couple from Birmingham, who had to postpone their purchase until Q4 2024, said that “we’ve seen house prices rise, but the mortgage rate spike meant we could not afford the payment.” In contrast, a 57‑year‑old retiree from Leeds found the current market more accessible, citing lower prices in the North West and a willingness of sellers to negotiate.

These anecdotes illustrate the widening gap between demographic groups in the UK housing market, reinforcing the article’s argument that policy solutions must be tailored to both affordability and supply.

7. Bottom line

In summary, the Express piece presents a nuanced view of the UK housing market. While sales volumes have fallen sharply, house price growth remains robust due to persistent supply shortages and high demand in premium regions. Experts predict a gradual rebound in sales as mortgage rates ease and policy interventions expand the supply of new homes. For buyers, the key takeaway is that patience and strategic timing will remain essential in a market where affordability is tightening but the price trend remains upward.

The article underscores that the next 12–18 months will be crucial: if interest rates stabilize and the supply side moves quickly, the UK housing market could see a meaningful recovery, offering a mix of growth in prices and a moderate rise in sales volume. If not, the market could remain in a state of tension—high prices but low activity—pushing more buyers into the rental sector and potentially creating a long‑term affordability crisis.

Read the Full Daily Express Article at:

[ https://www.express.co.uk/finance/personalfinance/2139891/uk-house-sales-drop-market-gain-forecast ]