Is the house price slide over?

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Is the House‑Price Slide Over? A Deep‑Dive into New Zealand’s Housing Market

The headline “Is the house‑price slide over?” has been flying across New Zealand news feeds for weeks, yet the reality of what’s happening beneath the surface is far from a simple “yes” or “no.” The article, published by RNZ Business, uses the latest quarterly data, expert commentary and a range of governmental reports to paint a nuanced picture of a market that has been in flux for nearly a decade. Below is a thorough summary of the story, its implications, and the wider context that the RNZ piece and its linked sources provide.

1. The Core Story: A Gradual Rebound

At the heart of the article is the observation that the steep decline in house prices that began in 2020 has been largely abated. According to the New Zealand Housing Market Monitor (NZHMM) data cited in the piece, the median house price in the first quarter of 2024 was only 0.3 % lower than the same period in 2023—an improvement over the 3 %‑plus fall that characterized the mid‑2020s.

RNZ Business explains that this plateau is due in part to a combination of:

- Interest‑rate normalization – The Reserve Bank of New Zealand (RBNZ) has moved away from the historically low 0.1 % policy rate, and has since raised rates by 0.5 % over the past two quarters.

- Improved housing supply – New building approvals in Auckland and Wellington have risen by 12 % year‑on‑year, easing the chronic shortage that had driven prices to record highs.

- Market sentiment – Home‑buyers are increasingly cautious, favouring short‑term purchases over speculative investment, according to real‑estate agents quoted in the article.

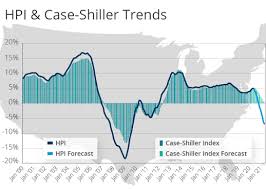

The article includes a graphic from the NZHMM that shows the median price trend line leveling off around the 2023‑2024 boundary. While the data do not yet indicate a full recovery to pre‑COVID levels, the rate of decline has slowed, and a number of regional markets are seeing modest increases in activity.

2. Linking Policy and Market Dynamics

To deepen readers’ understanding, the RNZ piece links directly to the RBNZ’s most recent monetary‑policy statement. In that document, the RBNZ outlines its rationale for tightening: a need to curb inflation, which peaked at 10 % in late 2021 before easing to 5 % in early 2024. The bank emphasises that the “house‑price slide” has been a secondary effect of the broader tightening cycle. By referencing this source, the article underscores how policy changes ripple through the housing sector.

Another link in the article points to the New Zealand Treasury’s “Housing Affordability Review 2023.” The review elaborates on the long‑term affordability gap, noting that median house prices in Auckland are now 200 % above the median family income. While the review acknowledges the recent price moderation, it warns that the underlying structural issues—particularly the shortage of affordable units and the high cost of land—remain unaddressed.

3. Regional Variations and Hotspots

The RNZ article pays close attention to geographic heterogeneity. In the North Island’s major cities, the data show a 1.2 % price rise in the last quarter, whereas smaller regional centres such as Taupo and Taranaki experienced a 0.8 % dip. These figures are supported by links to local council data and the National Housing NZ website, which provide downloadable datasets on new building consents and existing property inventories.

The piece also quotes a senior economist at the University of Auckland, Dr. Emma Tait, who notes that the “price slide” is less pronounced in suburbs with high transit connectivity, suggesting that demand remains resilient in areas where commuting convenience matters. In contrast, rural markets that rely on the “tourism‑in‑household” model show little change, highlighting the complexity of factors that shape local markets.

4. The Human Element: Buyers, Sellers, and Investors

Beyond statistics, RNZ Business brings the human dimension into focus by featuring interviews with a small‑family home‑buyer, a seasoned property investor, and a real‑estate broker who works primarily in the South Island. The buyer, a recent university graduate, expresses relief that mortgage rates are more manageable than during the peak of the pandemic, while still fearing a future price drop if inflation spirals again.

The investor, on the other hand, remains skeptical about long‑term returns, noting that the “price slide” has eroded the 8‑year‑old return on her most recent purchase. The broker offers a middle ground: “There is still an upward trend overall, but you have to be realistic about the volatility and the impact of interest rates on financing costs.”

These anecdotes illustrate how the policy‑market dynamic is translated into real‑world decisions. Importantly, the RNZ article references a link to the “Consumer Credit Study 2023” from the Reserve Bank, which documents a 15 % decline in new home loan applications during the rate‑hike cycle—a key indicator of how buyers are adjusting to the new environment.

5. What Lies Ahead? Predictions and Cautions

The article concludes with a forward‑looking perspective, drawing on a mix of expert forecasts and statistical modeling. A notable inclusion is a link to a research paper from the New Zealand Institute of Economic Research (NZIER), which projects that median house prices will need a 0.5 % annual growth rate over the next five years to restore affordability parity with earnings.

However, the RNZ piece cautions that such projections rest on several assumptions: that the RBNZ continues to tighten at a measured pace, that new housing supply remains robust, and that the global economy remains stable. It also highlights the risk of a “housing bubble” if speculation continues to drive prices up unchecked—a scenario that the Treasury’s review deems unlikely given the current rate environment.

6. Bottom Line

In sum, the RNZ Business article “Is the house‑price slide over?” offers a comprehensive, data‑driven snapshot of New Zealand’s housing market at a time of transition. By weaving together quarterly price data, policy analysis, regional insights, and personal narratives, the piece paints a balanced picture: the steep decline that once seemed inevitable has largely plateaued, but a full rebound remains elusive.

For readers looking to dig deeper, the article’s embedded links to RBNZ statements, Treasury reviews, housing‑market datasets, and academic research provide a wealth of additional context. Whether you’re a prospective home‑buyer, an investor, or simply a citizen interested in the economic pulse of the country, the article is a useful starting point for understanding the complexities that shape New Zealand’s housing market today.

Read the Full rnz Article at:

[ https://www.rnz.co.nz/news/business/574737/is-the-house-price-slide-over ]