Housing Market Stalls: Listings Plummet to 2-Year Low

Newsweek

NewsweekLocales: N/A, Texas, California, Florida, UNITED STATES

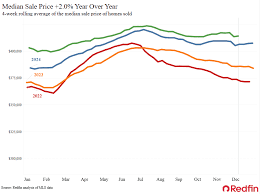

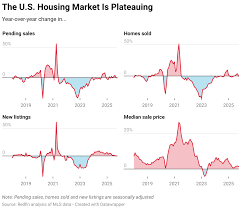

Washington D.C. - February 20th, 2026 - The US housing market is experiencing a surprising stall, with new data revealing the largest drop in home listings in two years. A report released today by Redfin indicates a 1.7% decrease in the number of homes available for sale in the week ending February 17th, sinking inventory levels to their lowest point since February 2022. This sudden constriction of supply is throwing previously held predictions of a market cooling period into question and sparking concerns about sustained high prices.

The decline isn't a simple matter of seasonal slowdown. While winter typically sees fewer homes listed, the current dip is significantly more pronounced than historical averages. Experts point to a complex interplay of economic factors creating a "lock-in" effect for homeowners - and a frustrating scenario for potential buyers.

At the heart of the issue lies the persistent high mortgage rates. Many current homeowners secured historically low rates in the years leading up to the recent Federal Reserve rate hikes. Selling now would mean exchanging that favorable rate for something considerably higher, creating a powerful disincentive. As Redfin Chief Economist Daryl Fairweather explained to Newsweek, "We're seeing a bit of a standstill in the housing market, with homeowners hesitant to sell because they're sitting on super low mortgage rates." This isn't merely reluctance; it's a significant financial calculation for many families.

Beyond the mortgage rate lock-in, the practicalities and costs of moving are also weighing heavily on homeowners' minds. Transaction costs - including realtor fees, closing costs, and moving expenses - can easily amount to several percentage points of the home's value. Coupled with the difficulty of finding a suitable and affordable replacement property in the current limited inventory environment, the risks associated with selling are outweighing the potential rewards for many.

The limited overall inventory is itself a self-reinforcing problem. Years of underbuilding, particularly following the 2008 financial crisis, created a housing shortage that hasn't been adequately addressed. This chronic undersupply means that even a modest decrease in listings has a disproportionate impact on the market. The situation is exacerbated by demographic trends; a growing population coupled with shrinking household sizes is further increasing demand for housing.

This lack of supply is having a direct impact on buyers. Limited options lead to increased competition for available properties, driving up bidding wars and, consequently, prices. While some analysts had predicted a cooling trend driven by affordability concerns and economic uncertainty, the shrinking inventory is providing a strong counterforce. "Buyers are still struggling to find homes, and that's keeping prices elevated," Fairweather stated. "It's possible that the housing market won't cool down as much as previously expected."

Looking ahead, the situation appears unlikely to resolve itself quickly. Construction of new homes, while increasing, is still not keeping pace with demand. Supply chain issues, labor shortages, and zoning regulations continue to hamper building efforts. Furthermore, the potential for further interest rate cuts later in the year could incentivize more buyers to enter the market, further tightening supply.

Some experts suggest that a shift in homeowner psychology will be necessary to unlock the market. A growing sense that prices have plateaued or that interest rates will remain stable could encourage more sellers to list their homes. However, this is by no means guaranteed. The market is also being watched for the impact of potential government interventions, such as tax incentives for downsizing or programs to increase housing supply.

For potential buyers, the current environment requires patience, flexibility, and a willingness to compromise. For sellers, it remains a favorable market, but a careful consideration of their own financial situation and long-term housing needs is essential. The "freeze" in the housing market isn't a complete standstill, but rather a delicate balancing act between limited supply, persistent demand, and the financial realities facing both buyers and sellers. The next few months will be critical in determining whether the market will ultimately cool down or continue to defy expectations.

Read the Full Newsweek Article at:

[ https://www.newsweek.com/us-house-listings-see-biggest-drop-2-years-11259613 ]