Housing Market: 2026 Could Be a Buyer's Opportunity

Investopedia

InvestopediaLocale: UNITED STATES

Recapping the Recent Market Turbulence

Looking back to 2023 and 2024, the housing market was largely defined by a difficult equation: elevated mortgage rates coupled with persistent, high home prices. This combination severely impacted affordability, effectively sidelining many potential buyers. While inventory has slowly begun to recover from historically low levels seen during the pandemic boom, it remains below pre-pandemic norms.

Why the Focus on 2026? A Shifting Tide

The renewed interest in 2026 as a potential purchase year isn't based on wishful thinking. Instead, it's fueled by observable trends and expert projections:

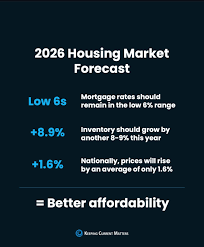

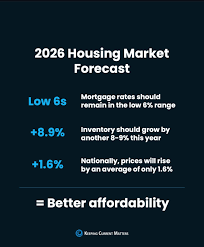

- Mortgage Rate Projections: The most significant factor contributing to the hope for 2026 is the anticipated decline in mortgage rates. While a return to the record-low rates of the early 2020s seems unlikely, the general consensus among financial analysts is that rates will moderate. A rate around 6% is viewed as a realistic target, a substantial difference that would significantly improve affordability for prospective buyers and increase purchasing power. This expectation is tied to broader economic forecasts regarding inflation and the Federal Reserve's monetary policy.

- Price Stabilization and Potential Moderation: The era of runaway home price appreciation, a defining characteristic of the pandemic years, appears to be over. The intense bidding wars and rapid price spikes that were commonplace are unlikely to return. While widespread price drops are not predicted - and are, in many areas, improbable - the rate of price increases is expected to slow considerably, potentially leading to stabilization or even localized price corrections. Increased housing construction is directly contributing to a gradual increase in supply, helping to curb price surges.

- Inventory Gains: The limited selection that frustrated buyers for years is slowly starting to ease. More homeowners are listing their properties, driven by a combination of factors including a desire to downsize, relocate, or capitalize on accumulated equity. This increase in inventory provides buyers with more choices and increased negotiating power.

Critical Considerations Beyond the Numbers

While the trends offer reasons for optimism, several caveats and potential pitfalls warrant careful consideration:

- Economic Health Remains Paramount: The housing market isn't an isolated entity. It's inextricably linked to the broader economy. Significant shifts in inflation, unemployment rates, or consumer confidence can swiftly alter the trajectory of the housing market, potentially impacting interest rates and demand.

- Hyper-Local Realities: National trends often obscure critical regional variations. The housing market in a booming tech hub like Austin, Texas, will behave differently than in a Rust Belt city experiencing population decline. Potential buyers must focus on the specific conditions within their desired geographic area.

- Personal Financial Readiness is Key: The most favorable market conditions in the world are irrelevant if you're not financially prepared. Thoroughly assess your income, debt levels, credit score, and savings for a down payment and closing costs. Rushing into a home purchase based solely on market forecasts is a recipe for financial strain.

Looking Ahead: 2026 and Beyond

As of mid-January 2026, the outlook for the housing market appears cautiously optimistic. 2026 represents a window of opportunity for those who have been waiting on the sidelines. However, it is crucial to approach the market with realistic expectations and a well-informed perspective. Continuous monitoring of local market dynamics, national economic indicators, and, most importantly, personal financial circumstances, are essential for making sound real estate decisions. Consulting with qualified professionals, including a seasoned real estate agent and a financial advisor, can provide invaluable guidance in navigating this evolving landscape. While 2026 may present a more favorable environment, informed preparation remains the cornerstone of successful homeownership.

Read the Full Investopedia Article at:

[ https://www.investopedia.com/is-2026-the-right-year-to-buy-a-house-key-market-trends-you-need-to-know-11889312 ]