U.S. Housing Market Sees Sixth Month of Sales Decline

Locales: Various, Florida, Texas, California, UNITED STATES

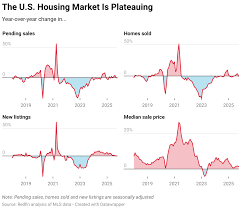

Wednesday, January 14th, 2026 - The U.S. housing market continues to adjust, with existing home sales experiencing a sixth consecutive monthly decline in December 2025. Data released this week by the National Association of Realtors (NAR) indicates a seasonally adjusted annual sales rate of 4.02 million, a 2.7% drop from the previous month. This extended downturn marks the longest stretch of declines since the 2007 financial crisis, prompting analysis and speculation about the market's trajectory into 2026.

A Six-Month Trend: What's Happening?

The persistent weakness in home sales isn't a sudden anomaly. It's the culmination of several factors creating a challenging environment for both buyers and sellers. The core issues remain stubbornly high mortgage rates--averaging around 7.5% throughout much of 2025--and a chronic lack of available homes. While inventory has seen marginal improvements, it's still far below pre-pandemic levels, further exacerbating the imbalance.

"The market is undeniably in a period of recalibration," observes Lawrence Yun, chief economist at NAR. "Buyer apprehension and seller hesitancy are both contributing to this ongoing slowdown." This sentiment is echoed throughout the industry, with analysts noting a noticeable shift in market dynamics.

The Triad of Challenges: Rates, Inventory, and Affordability

Let's break down the key drivers behind this slowdown:

- Mortgage Rate Pressure: The persistently high mortgage rates have dramatically reduced affordability for potential homebuyers. Many who were actively searching in 2024 have been priced out of the market, forcing them to postpone their homeownership goals.

- Inventory Scarcity: While a slight uptick in available homes has been observed, the overall inventory remains inadequate to meet demand. This continues to put upward pressure on prices and limits buyer choices.

- Shrinking Affordability: The combination of elevated home prices and high borrowing costs has created a significant affordability hurdle. The dream of homeownership is increasingly out of reach for a substantial segment of the population.

Looking Ahead: A Balanced Market in 2026?

Despite the current headwinds, economists are generally predicting a slowdown rather than a crash. The inherent shortage of housing provides a floor under prices, preventing a catastrophic collapse. However, a more balanced market is anticipated for 2026, providing buyers with increased negotiating leverage.

"We're moving towards a landscape where buyers will have more power," explains Jeff Tucker, a Zillow economist. "While significant price drops are unlikely given the inventory shortage, we anticipate a moderation in price appreciation and potential corrections in certain markets."

The Federal Reserve's Influence: The future of the housing market is inextricably linked to the Federal Reserve's monetary policy. Any decisions regarding interest rate adjustments will have a direct and immediate impact on mortgage rates and, consequently, on buyer demand.

Price Trends and Expectations:

While the rapid price appreciation of recent years has subsided, home values remain considerably above pre-pandemic levels. The median existing-home price in December 2025 stood at $382,800, a 1.8% increase year-over-year. This represents a dramatic slowdown compared to the double-digit gains observed previously, reflecting a shift in market sentiment.

What to Expect for Potential Buyers and Sellers:

- Buyers: Expect more time to shop around, negotiate prices, and potentially secure better terms. Don't anticipate the frantic bidding wars of 2021-2023.

- Sellers: Be prepared for a longer time on the market and potentially having to adjust your asking price to attract buyers. Staging and competitive pricing will be crucial.

The U.S. housing market is at a pivotal juncture. While challenges remain, the anticipated shift towards a more balanced market in 2026 offers opportunities and adjustments for all involved. Keeping a close eye on mortgage rate trends and inventory levels will be key to navigating this evolving landscape.

Read the Full USA Today Article at:

[ https://www.usatoday.com/story/money/personalfinance/real-estate/2026/01/14/home-sales-lower-2025/88156492007/ ]