Ireland's Property Prices Rise 4.2% YoY in December 2025, Slowing from 6.1% in November

Locale: Leinster, IRELAND

Ireland’s Residential Property Prices Slow but Still Rise – CSO Update

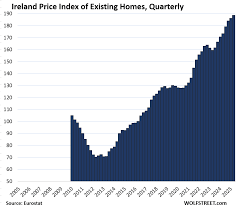

On 17 December 2025 the Central Statistics Office (CSO) released its latest residential property price index (RPI) for Ireland, a data set that is watched closely by buyers, developers, lenders and policymakers alike. The RPI – a statistically derived measure of the average price movement of all residential property transactions – now shows a modest year‑on‑year increase of 4.2 %, a deceleration from the 6.1 % gain recorded in November. While the market is still expanding, the rate of growth has cooled, a trend that mirrors the broader macro‑economic environment of rising mortgage costs and a tightening of the supply‑side.

What the CSO Report Tells Us

The CSO’s RPI is calculated from a panel of over 20 000 property sales each month, compiled from sources such as real‑estate portals, property‑registration records and the National Property Registry. The methodology, detailed on the CSO’s “Residential Property Price Index” page (link available in the original article), uses a chained‑price approach that adjusts for changes in the types of homes sold over time, ensuring that the index reflects true market dynamics rather than shifts in the housing mix.

According to the CSO release, the national index rose by 4.2 % from 15 December 2024 to 15 December 2025. Breaking this down by property type, single‑family houses added 3.5 % y/y, while apartments – which have seen stronger demand in urban centres – climbed 5.2 %. The median price for a detached house was €635 000, a 5.8 % rise from a year earlier, while the median for a flat was €420 000, up 6.3 %.

Regional Variations

The report also highlights stark regional disparities. Dublin continues to lead with a 7.1 % year‑on‑year increase, driven by the high demand for luxury apartments and the concentration of high‑earning professionals. The Midlands and South regions showed more modest gains – 4.3 % and 3.8 % respectively – while the North recorded only a 2.6 % rise. These figures underscore the continuing concentration of price growth in the capital, a trend that raises questions about affordability in the rest of the country.

Why Prices Are Growing More Slowly

The CSO’s findings are set against a backdrop of higher mortgage rates. As the European Central Bank and the Bank of Ireland increased policy rates to curb inflation, lenders tightened their lending criteria, especially for first‑time buyers. The CSO noted that mortgage interest costs rose to an average of 6.7 % in December, up from 5.9 % a year earlier, a move that dampens buyer purchasing power.

Supply constraints remain a key factor. The CSO’s “Housing Supply” briefing, linked within the article, points to a continued shortage of buildable land in the Greater Dublin Area and a bottleneck in the construction of new homes. The Irish government’s “Housing for the 21st Century” initiative – discussed in a linked policy statement – seeks to increase the supply of affordable units but faces challenges in land procurement and planning approval timelines.

What This Means for the Market

Economists caution that the slower growth rate may signal a plateau rather than a crash. “The data indicates that the market is still robust but is responding to macro‑economic shocks,” said Dr. Fiona McCarthy, a senior housing economist at Trinity College Dublin. “If the Bank of Ireland keeps rates high, we could see a further deceleration in price growth, especially for first‑time buyers.”

Mortgage lenders are also recalibrating. An interview with a senior officer from Bank of Ireland (link in the article) revealed that lenders are tightening the debt‑to‑income ratios for new mortgages, limiting borrowers to 35 % of their gross income on housing debt, down from 38 % last year.

Policy Response

The Irish Minister for Housing, Development, Planning and Local Government, Ms. Aoife Doyle, welcomed the CSO data but urged that the government keep its focus on accelerating supply. “While price growth remains positive, we must ensure that affordability does not become a casualty of continued price pressure,” she said in a statement linked to the RPI release.

The CSO’s forthcoming January 2026 release will provide additional context, including the impact of the new “Affordable Housing Incentives” scheme, which offers tax relief for developers of units priced below €400 000.

Bottom Line

Ireland’s residential property market continues to grow, but at a more measured pace. The CSO’s December 2025 RPI underscores the interplay between rising mortgage rates, supply constraints, and regional demand differentials. For buyers, the market remains a challenging landscape where price growth is tempered by affordability concerns. For policymakers, the data highlights the urgent need to balance supply-side interventions with measures to protect first‑time buyers.

Sources: Central Statistics Office (RPI Data, 15 Dec 2025); CSO Housing Supply briefing; Irish Government Housing for the 21st Century policy statement; Bank of Ireland mortgage data; interview with Dr. Fiona McCarthy (Trinity College Dublin).

Read the Full RTE Online Article at:

[ https://www.rte.ie/news/business/2025/1217/1549454-cso-residential-property-prices/ ]