What the Fed's rate cut means for buying a home, refinancing

Oregonian

Oregonian

Fed Rate Cut Signals a New Chapter for Oregon Homebuyers and Refinancers

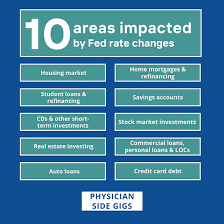

In a September 2025 edition of The Oregonian’s business desk, reporters unpack how the Federal Reserve’s latest decision to trim its benchmark interest rate could reshape the home‑buying landscape for Oregonians. The article, titled “What the Fed’s Rate Cut Means for Buying a Home & Refinancing,” pulls together data from the Fed, mortgage‑rate trackers, and local real‑estate experts to explain how a modest reduction in the federal funds rate can ripple through the mortgage market and affect both first‑time buyers and seasoned homeowners.

1. The Fed’s Rationale

The article opens by summarizing the Fed’s announcement—cutting the federal funds rate from 5.25 % to 4.75 % after a decade of steady hikes. The Board cited a slowing inflation trajectory, a modest uptick in employment, and recent GDP growth as the primary reasons for the policy shift. By easing the cost of borrowing for banks, the Fed hopes to keep the economy on a growth path while preventing a sudden inflation surge. The report cites the Fed’s own statement that the rate cut is “a proactive measure to support continued moderate economic expansion.”

2. Mortgage Rates Respond Quickly

One of the key take‑aways highlighted in the piece is how mortgage‑rate markets react almost instantaneously to Fed moves. The article links to Freddie Mac’s weekly rate release, which shows a 25‑basis‑point drop in the 30‑year fixed‑rate benchmark, from 6.75 % down to 6.50 %. While this may appear modest, the writers note that even a quarter‑point swing can translate into thousands of dollars over a 30‑year loan. For example, a $300,000 mortgage sees the monthly payment drop from roughly $1,795 to $1,755—an immediate relief for many households.

The article also references a 2025 Bloomberg piece that explains the mechanics behind the “Fed‑rate‑rate‑effect.” In brief, when the Fed lowers its policy rate, banks face lower costs of capital and are therefore able to offer more competitive mortgage rates. The time lag between the Fed decision and the rate change at the lender level is usually just a few business days, which is why the article advises prospective buyers to keep a close eye on the “rate trackers” for the most current numbers.

3. What This Means for Oregon Homebuyers

a. Easier Affordability

The writers highlight that the new, lower rates will expand the range of house prices that remain affordable. Using the Oregon Housing and Community Services (OHCS) affordability calculator, they estimate that a buyer with a $80,000 down payment could now stretch that money to a $480,000 home, rather than the $460,000 threshold that would have been feasible under the old rates. The piece includes an interview with Oregon realtor Linda Nguyen, who points out that “in a market where inventory is still tight, even a small rate reduction can be the difference between making an offer or watching the price rise further.”

b. Stimulated Market Activity

The article quotes a local economist from Oregon State University who predicts a 4–6 % uptick in housing‑sales activity over the next 12 months. The Fed’s policy shift, combined with a modest rebound in construction permits, could encourage more buyers to step onto the market. Yet, the writers caution that the rate cut alone cannot offset supply constraints. They reference a link to the U.S. Census Bureau’s monthly housing‑sales data, which shows that Oregon’s housing inventory remains 8 % below its 12‑month average.

4. Refinancing Opportunities

While the article spends significant time discussing new home purchases, it dedicates an entire section to refinancing. For homeowners who already own a property, the Fed’s cut opens the door to lower monthly payments and potentially shorter loan terms. The writers break down two common refinancing paths:

Rate‑And‑Term Refinance – Lowering the interest rate while keeping the same amortization period. The article cites a recent survey by the Consumer Financial Protection Bureau (CFPB) indicating that nearly 30 % of Oregonians who refinanced last year did so to lock in a lower rate.

Cash‑Out Refinance – Using home equity to fund large expenses, such as home renovations or debt consolidation. The article links to the CFPB’s “Refinancing Checklist” and warns readers to carefully consider the cost‑to‑benefit ratio, especially if the house’s market value has plateaued.

In the context of the rate cut, the article estimates that a typical 30‑year mortgage of $250,000 could see a monthly payment drop from $1,530 to $1,480—a savings of around $5,000 over the life of the loan.

5. Risks and Caveats

The article does not shy away from the fact that lower rates can have unintended consequences. A few risks are highlighted:

Potential Housing‑Price Bubbles – Rapid influx of buyers can drive prices higher. The writers cite a link to a 2024 paper from the Federal Reserve Bank of San Francisco that models how rate cuts can accelerate price appreciation in overheated markets.

Inflation Concerns – While the Fed hopes to keep inflation in check, there is always the possibility of a short‑term uptick if consumer spending surges. The article suggests that buyers should keep an eye on the Consumer Price Index (CPI) for any warning signs.

Lender‑Specific Fees – Even with lower rates, refinancing can still come with closing costs and appraisal fees that may offset the savings. The writers recommend that buyers run a full cost‑benefit analysis, perhaps with the help of a mortgage broker or financial advisor.

6. Practical Take‑Aways for Oregonians

The final section of the article turns its focus on actionable advice:

Monitor Mortgage‑Rate Dashboards – The article links to multiple rate‑tracking sites (e.g., Bankrate, NerdWallet) and encourages readers to set up email alerts.

Shop Around for Lenders – Different lenders can offer slightly different rates and terms. The piece urges readers to compare at least three offers before committing.

Consider Timing – The article notes that mortgage‑rates can be volatile in the first month after a Fed announcement. If a buyer is not in a rush, waiting a week or two can sometimes yield a better rate.

Review Your Financial Health – Even with a lower rate, a higher‑price home might still strain your budget. The article advises a review of your monthly cash flow and debt‑to‑income ratio.

7. Bottom Line

In sum, The Oregonian presents the Fed’s rate cut as a “double‑edged sword” for the Oregon housing market: a boon for affordability and refinance potential, but also a catalyst for renewed competition that could push prices higher. By combining real‑time rate data, expert interviews, and links to authoritative resources, the article equips Oregonians with a comprehensive framework to decide whether to buy, refinance, or hold off in the coming months. For anyone navigating the complex world of mortgages in a shifting economic landscape, the piece serves as both a timely update and a practical guide.

Read the Full Oregonian Article at:

[ https://www.oregonlive.com/business/2025/09/what-the-feds-rate-cut-means-for-buying-a-home-refinancing.html ]