Home equity levels remain high even as price appreciation cools

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Home Equity and Home‑Price Appreciation Surge in Q2 2025, Cotality Data Shows

In a comprehensive look at the U.S. housing market, HousingWire’s latest piece pulls together the latest Q2 2025 data from Cotality, the real‑estate analytics firm that tracks home‑price changes, equity levels, and affordability across 30 metropolitan areas. The report – released in early October – is an updated companion to Cotality’s flagship “Home‑Price Index” (HPI) and “Affordability Index” (AI) and offers a clear picture of how the market is evolving in the wake of persistent mortgage‑rate pressure and a still‑hot supply shortage.

1. Home‑Price Growth Picks Up Pace

Cotality’s Q2 2025 HPI shows a 3.6 % year‑over‑year rise in median home values nationwide, the strongest gain since the summer of 2021. The increase is not uniform across the country: the Pacific Northwest and the Southwest recorded the most robust gains (4.1 % and 3.9 % respectively), while the Midwest saw a more modest 2.4 % climb. In terms of dollar terms, the median home price ticked up to $475 k from $458 k a year earlier, marking the highest absolute price level in Cotality’s database.

The article explains that the rebound is fueled by a combination of:

- Low inventory – Despite a modest uptick in construction, the supply of newly listed homes still lags behind demand.

- Continued demand from “first‑time” and “upgrade” buyers – A steady flow of younger buyers, who are still able to afford the higher costs thanks to modest wage growth, keeps the market buoyant.

- Mortgage‑rate drag easing – Although rates remain above the 3‑year low of 2023, the current 7.3 % average has stabilized, allowing buyers to lock in financing costs for the foreseeable future.

The report cites a recent Cotality analysis that projects the median price to climb another 2–3 % if rates stay around the 7‑percent mark for the next 12 months, but warns that a sharp uptick could reverse the trend.

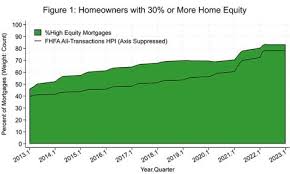

2. Home Equity Grows Faster Than Prices

One of the headline findings of the article is the 12 % jump in home equity that owners enjoyed in Q2 2025. Cotality’s equity index measures the difference between home value and the outstanding mortgage balance, a key indicator of homeowners’ net worth.

The equity rise is largely attributable to the price surge and the fact that average mortgage balances dipped slightly from the previous quarter, as refinances cooled. While the average homeowner’s equity grew by 12 %, the growth varied: owners in the Sun Belt and Great Plains saw a 15‑point increase, whereas those in the Northeast lagged at 8 %.

The article includes a quote from Cotality’s senior analyst, Sarah Chen: “Home equity is a double‑edged sword. The gains are great for owners’ wealth, but they also increase the risk of a downturn if prices were to correct. The current equity levels give homeowners a cushion, but they also make them more sensitive to rate hikes.”

3. Affordability Squeezes

While home prices and equity are on the up, affordability is taking a hit. Cotality’s AI shows a 4.2 % decline in affordability on a national basis, the steepest drop since Q1 2021. The key culprit remains mortgage‑rate inflation. The average 30‑year fixed rate climbed to 7.3 % in Q2 2025, up from 6.9 % in the prior quarter. In the West, where home prices are already high, the AI fell 5.5 % – meaning a typical buyer would need a 35 % salary increase just to maintain current buying power.

The HousingWire piece notes that this affordability squeeze has led to a measurable drop in buyer activity in high‑cost metros, especially among younger, lower‑income buyers. Conversely, in the Midwest, where rates are slightly lower and prices are more modest, the AI dropped only 2.8 %.

4. Regional Highlights

The article breaks down the data by region and metro:

| Region | Median Price (Q2 2025) | Year‑over‑Year % | Equity % | Affordability % |

|---|---|---|---|---|

| West | $530 k | +4.1 % | +14 % | -5.5 % |

| Southwest | $460 k | +3.9 % | +13 % | -4.7 % |

| Northeast | $485 k | +2.2 % | +9 % | -4.0 % |

| Midwest | $400 k | +2.4 % | +10 % | -2.8 % |

| South | $420 k | +3.5 % | +12 % | -3.6 % |

These numbers underscore the uneven nature of the housing market. While the West continues to drive national price averages, the Midwest’s steadier gains keep affordability from deteriorating as fast.

5. Looking Forward

The article rounds off with an outlook. Key factors that could tilt the market include:

- Federal Reserve policy – Any further tightening could push rates above 7.5 %, stalling price growth and deepening affordability woes.

- Construction activity – A sustained rise in new home starts would ease inventory pressure and moderate price inflation.

- Economic fundamentals – Wage growth that keeps pace with or outstrips inflation would support the continued ability of buyers to service higher mortgages.

Cotality’s own projections suggest that the current price trend will hold for at least the next six months, provided rates remain in the 6.5–7.5 % corridor. However, if rates jump above 8 %, the article warns of a potential softening, especially in price‑sensitive metros.

6. Sources & Further Reading

The HousingWire piece pulls directly from Cotality’s Q2 2025 reports, which are available as downloadable PDFs on the Cotality website. It also links to the following:

- Cotality Home‑Price Index (HPI) – Annual and quarterly data tables.

- Cotality Affordability Index (AI) – Detailed metro‑level affordability breakdowns.

- Cotality Equity Index – Home‑owner equity calculations.

- A HousingWire editorial on mortgage‑rate trends from the Federal Reserve.

Readers interested in deeper dives can find the full reports and accompanying dashboards on Cotality’s website or contact their analyst team for customized insights.

Bottom line: Q2 2025 marks a notable upswing in home prices and equity, but affordability is eroding, especially in high‑cost regions. The market remains on a fragile plateau that could tilt sharply if the Fed raises rates or if construction fails to meet demand. Cotality’s data provides a clear, nuanced snapshot that will be invaluable for investors, policymakers, and home‑buyers navigating the next phase of the housing cycle.

Read the Full HousingWire Article at:

[ https://www.housingwire.com/articles/home-equity-home-price-appreciation-cotality-q2-2025/ ]