The Housing Market Hangs On: Why Mortgage Applications Are Still Struggling

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

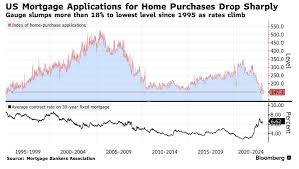

The dream of homeownership feels increasingly out of reach for many Americans, and recent data paints a picture of continued uncertainty in the housing market. While headlines occasionally suggest glimmers of hope, the reality is that mortgage applications remain stubbornly low, signaling persistent challenges for potential homebuyers and impacting the overall health of the real estate sector. The latest figures, released by the Mortgage Bankers Association (MBA), reveal a landscape still heavily influenced by high interest rates and ongoing economic anxieties.

For those hoping to purchase a home, the current situation is frustrating. The average 30-year fixed mortgage rate currently hovers around 7%, significantly higher than the lows seen during the pandemic. This jump in rates has dramatically increased borrowing costs, effectively pricing many potential buyers out of the market. A $200,000 loan at 6% interest carries a substantially different monthly payment than one at 7%. That difference can be hundreds of dollars, making a significant impact on affordability and forcing individuals to either postpone their homebuying plans or adjust their expectations regarding the size and location of the homes they can realistically afford.

The MBA’s weekly survey consistently reflects this trend. Applications for purchase mortgages have been trending downward for months, hitting levels not seen since 2015. This isn't just a minor dip; it represents a significant contraction in demand. While some argue that existing homeowners are hesitant to sell and trade up – "locked-in" by their lower mortgage rates – the underlying issue is a lack of buyers willing and able to enter the market at current price points and interest rates.

Refinance applications, unsurprisingly, remain near historic lows. With interest rates significantly higher than those held by most existing homeowners, there’s little incentive to refinance. This further underscores the stagnation in the mortgage market; fewer people are buying, and even fewer are looking to adjust their existing loans.

However, it's not all doom and gloom. There are some nuances within these broader trends that offer a glimmer of potential for future improvement. The MBA’s data also tracks applications for home equity lines of credit (HELOCs), which have seen a modest increase. This suggests homeowners are still tapping into the equity they’ve built up in their homes, potentially for renovations or other expenses. While not directly indicative of increased home sales, it does demonstrate continued confidence in the value of real estate assets.

Furthermore, economists and industry analysts are closely watching inflation data and Federal Reserve policy decisions. The hope is that as inflation cools, the Fed will begin to ease its monetary tightening measures, potentially leading to a decrease in mortgage rates. Even a slight reduction in rates could provide a much-needed boost to buyer confidence and spur increased demand. However, predictions remain cautious; many anticipate rates remaining elevated for some time.

The inventory of homes available for sale remains another critical factor. While the number of homes on the market has improved slightly from the record lows seen during the pandemic, it’s still significantly below historical averages. This limited supply continues to support home prices, even in the face of reduced demand. A significant increase in housing inventory would likely put downward pressure on prices, potentially making homes more accessible to a wider range of buyers.

The situation is further complicated by regional variations. Some areas are experiencing greater price declines than others, reflecting local economic conditions and demographic shifts. Understanding these localized trends is crucial for both potential homebuyers and sellers.

Ultimately, the future trajectory of the housing market hinges on several interconnected factors: inflation, interest rates, inventory levels, and consumer confidence. While a significant rebound in mortgage applications isn't expected anytime soon, any positive developments on these fronts could signal a gradual thawing of the frozen market. For now, potential homebuyers should prepare for continued challenges, while those looking to sell may need to adjust their expectations regarding pricing and timelines. The dream of homeownership remains attainable, but it requires patience, careful planning, and a realistic assessment of the current economic landscape. The article also mentions that first-time homebuyers are particularly impacted by these conditions, as they often have limited savings for down payments and are more sensitive to changes in interest rates. This demographic group is crucial for sustaining housing market activity, and their continued absence from the market poses a significant challenge.