China's Real Estate Market Shows Signs of Stabilization

Locales:

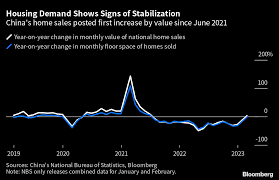

Shanghai, February 20th, 2026 - After a prolonged period of struggle, China's real estate market appears to be exhibiting initial signs of stabilization, with new home prices rising in January across a majority of major cities, according to a recent survey. The data, released by the National Bureau of Statistics (NBS), indicates a potential shift in the trajectory of the sector, following a series of proactive measures implemented by the Chinese government.

The NBS survey revealed that new home prices increased in 50 out of the 70 cities monitored - a notable improvement from the 44 cities that saw price gains in December. This uptick, while moderate, is being interpreted by analysts as a possible inflection point after a sustained downturn that has weighed heavily on the nation's economic performance. The positive movement comes after Beijing began signalling increased support for both the private sector and, crucially, the embattled real estate industry.

For decades, the property sector has been a cornerstone of China's economic growth. However, a confluence of factors - including a broader economic slowdown, a significant accumulation of debt amongst property developers, and increasingly stringent government regulations - created a perfect storm that brought the market to its knees. The 'three red lines' policy, implemented in 2020 to curb excessive borrowing by developers, proved particularly impactful, severely limiting access to financing and contributing to liquidity crises for major players like Evergrande and Country Garden. These issues not only threatened the solvency of developers but also instilled a lack of confidence among potential homebuyers.

Recognizing the systemic risks, the government has begun to unwind some of its stricter policies. In recent months, measures have been rolled out to ease mortgage restrictions, encouraging banks to extend credit to both homebuyers and developers. This shift in policy represents a departure from the previous emphasis on deleveraging and controlling property speculation. The aim is to restore confidence in the market, prevent widespread defaults, and stimulate economic activity. Analysts note that the government is attempting a delicate balancing act: providing enough support to prevent a collapse, without reigniting the speculative bubbles that plagued the market in the past.

Despite the positive signals from the January data, significant challenges remain. The NBS survey, while informative, doesn't provide a completely comprehensive picture of the market. Other recent economic indicators, such as a contraction in manufacturing activity reported earlier this month, suggest broader economic headwinds persist. The high levels of debt held by property developers remain a major concern. While the easing of financing conditions provides some relief, it doesn't address the underlying problem of over-indebtedness. Many developers are still struggling to meet their financial obligations, and the risk of defaults, although lessened, hasn't entirely disappeared.

Furthermore, consumer confidence remains fragile. The economic uncertainty, coupled with concerns about job security and the ongoing impact of the COVID-19 pandemic, is leading many potential buyers to delay purchases. The rise in prices, while encouraging for developers, could also dampen demand if it's not accompanied by a corresponding increase in disposable income.

The current situation demands continued monitoring and careful calibration of government policies. Analysts predict that the government will likely maintain a supportive stance in the near term, but with a focus on targeted measures designed to address specific vulnerabilities. This could include further easing of mortgage restrictions, continued encouragement of bank lending to developers, and potentially, limited fiscal stimulus to boost demand. However, any substantial recovery is contingent on a broader economic rebound and a sustained improvement in consumer confidence. The January price increase offers a cautious glimmer of hope, but it's too early to declare a definitive turnaround in China's property market. The road to recovery will likely be long and uneven.

Read the Full KELO Article at:

[ https://kelo.com/2026/01/31/china-new-home-prices-rise-in-january-as-government-signals-support-private-survey-says/ ]