Understanding Adjustable-Rate Mortgages (ARMs)

Fortune

FortuneLocales: California, Virginia, Texas, UNITED STATES

The Allure and Mechanics of ARMs

An adjustable-rate mortgage differentiates itself from a traditional fixed-rate mortgage by offering an initial period of fixed interest, typically ranging from 3 to 10 years. This introductory period provides borrowers with predictable payments for a set duration. However, once this fixed period expires, the interest rate is subject to adjustments, usually annually, tied to a benchmark index - currently, the Secured Overnight Financing Rate (SOFR) is the primary driver. The appeal of ARMs often lies in their initially lower interest rates compared to fixed-rate mortgages, potentially offering significant savings in the early years of the loan.

However, this benefit comes with inherent risk. The rate adjustments are not unlimited; they are governed by both periodic and lifetime caps. A periodic cap limits the maximum amount the interest rate can increase at each adjustment period. For example, a 2% periodic cap on a loan with a 5% rate means the rate cannot jump above 7% in any single year. A lifetime cap establishes the maximum interest rate the loan can reach over its entire term. These caps offer a degree of protection against runaway interest rates, but it's vital to understand the specifics of each loan's limitations.

Current ARM Rate Snapshot (February 14, 2026)

As of today, February 14th, 2026, here's a general overview of ARM rates. Please note these are averages and can vary significantly based on lender, borrower creditworthiness, and other factors.

- 5/1 ARM: 6.25% - 7.00% (Fixed for 5 years, adjusts annually thereafter)

- 7/1 ARM: 6.50% - 7.25% (Fixed for 7 years, adjusts annually thereafter)

- 10/1 ARM: 6.75% - 7.50% (Fixed for 10 years, adjusts annually thereafter)

These rates reflect a slight increase from the December 23, 2025 figures, primarily attributed to stronger-than-expected inflation data released earlier this week and growing expectations that the Federal Reserve may delay its anticipated interest rate cuts.

ARM vs. Fixed-Rate: A Comparative Overview

| Feature | ARM | Fixed-Rate |

|---|---|---|

| Initial Interest Rate | Lower | Higher |

| Rate Stability | Less Stable | More Stable |

| Risk | Higher | Lower |

| Monthly Payment Predictability | Lower | Higher |

| Best For | Borrowers planning to move or refinance within the fixed-rate period; borrowers comfortable with some risk | Borrowers prioritizing long-term stability and predictable payments |

The Forces Driving ARM Rates

Several interconnected factors contribute to the fluctuations in ARM rates. Understanding these dynamics is essential for making informed borrowing decisions.

- Macroeconomic Indicators: Key economic data points, including inflation rates, employment figures, and Gross Domestic Product (GDP) growth, significantly influence ARM rates. Strong economic growth and rising inflation typically lead to higher rates, while economic slowdowns and falling inflation tend to push rates downward.

- Federal Reserve Monetary Policy: The Federal Reserve's actions regarding interest rates have a direct and substantial impact on ARM rates. When the Fed raises interest rates, ARM rates generally follow suit. Conversely, when the Fed lowers rates, ARM rates tend to decrease. The market is currently keenly watching the Fed for signals regarding the timing and magnitude of future rate adjustments.

- Market Sentiment and Investor Confidence: Overall investor sentiment and confidence in the market can also play a role. Periods of economic uncertainty or market volatility may lead to increased risk aversion and higher ARM rates.

- SOFR Index: As the primary benchmark index, movements in SOFR directly affect ARM rates. Monitoring SOFR trends is crucial for understanding the direction of ARM rates.

Is an ARM Right for You? A February 2026 Perspective

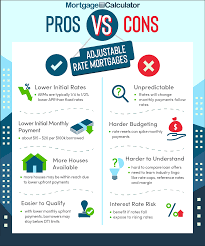

Deciding whether an ARM is the appropriate mortgage option requires careful consideration of your individual circumstances and risk tolerance. If you anticipate moving or refinancing your home before the fixed-rate period expires, an ARM can provide substantial savings. The lower initial rate allows you to build equity faster or allocate funds to other financial goals. However, if you plan to remain in your home for the long term and prioritize predictable monthly payments, a fixed-rate mortgage is generally the more prudent choice.

Furthermore, thoroughly analyze the terms of the ARM, including the initial fixed-rate period, the index used for adjustments, the periodic and lifetime caps, and any associated fees. Consult with a qualified mortgage professional to explore your options and determine the best mortgage solution for your needs.

Read the Full Fortune Article at:

[ https://fortune.com/article/current-arm-mortgage-rates-12-23-2025/ ]