China Property Market Shows Signs of Stabilization

Locales:

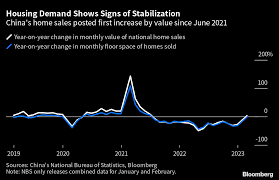

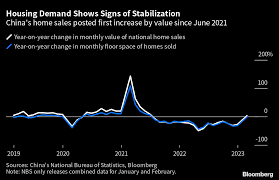

Beijing, China - February 20, 2026 - China's beleaguered property market offered a glimmer of hope today with the release of a private survey indicating a rise in new home prices in January. The data, published by the China Real Estate Index (CREI), showed a 0.2% month-on-month increase in average new home prices across 100 major cities, a welcome change after a 0.1% decline in December 2025. This modest uptick suggests a potential, albeit tentative, stabilization in a sector that has long been a key engine of China's economic growth, but more recently, a significant source of concern.

The property market's struggles have been well-documented, stemming from a confluence of factors including overdevelopment, tightened regulatory controls aimed at curbing speculation, and the financial difficulties of major developers like Evergrande and Country Garden. These issues contributed to a slowdown in investment, weakened consumer confidence, and raised fears of systemic risk within the Chinese economy. For years, property investment has accounted for a substantial portion of China's GDP, making its health vitally important.

However, recent weeks have seen a shift in tone from the central government, signaling a renewed commitment to supporting both the private sector and, specifically, the property market. These signals have manifested in several ways. Reports indicate easing restrictions on mortgage approvals, making it easier for potential homebuyers to secure financing. Simultaneously, Beijing has hinted at potential adjustments to developer financing rules, a move that could alleviate the liquidity crisis gripping many companies in the sector. This potential loosening of restrictions, while carefully managed, represents a departure from the stricter regulatory environment of the past few years.

According to Dr. Li Wei, a senior economist at CREI, "The data suggests that government measures are starting to have a limited but positive impact." Dr. Wei cautioned, however, that it's premature to celebrate a full recovery. "The market remains fragile and heavily dependent on continued government support. A sustainable turnaround requires more than just short-term interventions; it demands a comprehensive approach to address the underlying structural imbalances."

Analysts are quick to point out the potential for this price increase to be a temporary blip, driven by pent-up demand following the Lunar New Year holiday and speculative buying fueled by expectations of further government support. Real estate is often sensitive to sentiment and government policies; a perceived shift in favour of the sector can quickly attract investors hoping to capitalize on potential gains. Determining whether this is a genuine revival in underlying market fundamentals will require close monitoring of key indicators, particularly sales volume, construction activity, and inventory levels. A sustained increase in sales, coupled with a healthy level of new construction, would indicate a more robust recovery.

The CREI report also highlighted significant regional variations in price performance. Cities in the eastern coastal regions, traditionally economic powerhouses, demonstrated stronger growth than those in the interior provinces. This disparity reflects the ongoing economic divergence within China, with coastal areas benefiting from greater access to capital, infrastructure, and export markets. Understanding these regional nuances is crucial for policymakers seeking to tailor policies to specific local conditions.

Beyond the Numbers: A Deeper Look at China's Property Challenges

The current situation represents more than just a cyclical downturn in the property market. It's a symptom of deeper structural issues within the Chinese economy. Years of rapid growth and investment have led to overcapacity in many sectors, including real estate. This has resulted in a glut of unsold properties in some areas, putting downward pressure on prices. The reliance on land sales as a primary revenue source for local governments also creates a perverse incentive to overdevelop and prioritize short-term gains over long-term sustainability.

Addressing these challenges will require a multifaceted approach. This could include diversifying local government revenue streams, promoting more sustainable urban development patterns, and fostering a more balanced economic model that relies less on investment and more on domestic consumption. Furthermore, strengthening consumer protections and improving transparency in the property market are essential to building trust and fostering a healthier investment climate.

Looking forward, the government's policy stance will undoubtedly be pivotal in shaping the trajectory of the property market. While the current signals of support are encouraging, deeper structural reforms are likely necessary to ensure long-term stability and sustainable growth. The coming months will be critical in determining whether China can successfully navigate this challenging period and restore its property market to a path of sustainable prosperity.

Read the Full Asia One Article at:

[ https://www.asiaone.com/china/china-new-home-prices-rise-january-government-signals-support-private-survey-says ]