New Zealand Housing Market Offers Hope for First-Time Buyers

rnz

rnzLocales: Auckland, Canterbury, NEW ZEALAND

A Shifting Tide: How New Zealand's Housing Market is Finally Opening Doors for First-Time Buyers

For years, the New Zealand dream of homeownership felt increasingly out of reach for many, particularly first-home buyers. A relentless climb in property prices, fueled by low interest rates and limited supply, created a fiercely competitive market. However, as Valentine's Day 2026 dawns, a noticeable shift is underway, offering a glimmer of hope to those aspiring to own their first home. While challenges certainly remain, a confluence of factors is creating a more favorable environment for newcomers to the property ladder.

Westpac chief economist David Coles points to a significant increase in property availability. "There's a lot more properties available than there were a couple of years ago," he explains. This rise in supply, combined with a cooling in demand, is easing the pressure that previously characterized the market. This increased supply isn't simply a case of homeowners delaying sales; it's a multifaceted situation driven by new construction and a reassessment of property values.

Central to this changing landscape is the fall in interest rates. After reaching a peak in late 2023, the Reserve Bank of New Zealand (RBNZ) has begun to cautiously lower rates, responding to slowing economic growth and a moderating inflation rate. This has a direct impact on mortgage repayments, making homeownership more affordable. While rates are still higher than the exceptionally low levels seen during the pandemic, the reduction is significant enough to alleviate some of the financial burden on prospective buyers. The RBNZ's recent commentary suggests a continued, albeit gradual, easing of monetary policy throughout 2026, potentially offering further relief to borrowers.

Beyond interest rates, the surge in new builds is also playing a crucial role. Government initiatives aimed at boosting housing supply, coupled with private sector development, have added a substantial number of properties to the market, particularly in major urban areas like Auckland, Wellington, and Christchurch. These new developments often offer more affordable options compared to established homes, further widening the range of choices for first-home buyers. Data from Stats NZ indicates a consistent increase in building consents over the past year, although concerns remain about the pace of construction keeping up with long-term demand.

The Real Estate Institute of New Zealand (REINZ) data reinforces this optimistic outlook. Their January 2024 figures revealed a median house price of $826,000 - a 10.8% decrease year-on-year. This is a substantial drop and signals a clear softening in the market. Crucially, the 'days to sell' metric has also increased, indicating that properties are staying on the market for longer. This translates to less frantic bidding wars and gives buyers more time to conduct due diligence and negotiate a fair price. Sellers are demonstrably more willing to consider offers below their initial asking price, a stark contrast to the overheated conditions of just a few years ago.

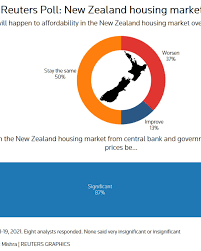

However, economists are quick to emphasize that these changes are cyclical. The New Zealand housing market is notoriously volatile and susceptible to external shocks. The RBNZ's future decisions regarding interest rates will undoubtedly continue to exert a significant influence. A resurgence in inflation, for example, could prompt the RBNZ to reverse course and raise rates again, potentially dampening the current positive trend. Similarly, shifts in migration patterns - whether an increase in net immigration or an exodus of residents - could significantly impact demand.

Furthermore, the global economic outlook remains uncertain. Events such as geopolitical instability or a slowdown in key trading partners could have ripple effects on the New Zealand economy and, consequently, the housing market. The impact of potential changes to lending regulations, such as alterations to loan-to-value ratio (LVR) restrictions, also needs to be considered.

Despite these caveats, the current window of opportunity for first-home buyers is undeniable. The combination of increased supply, moderating prices, and falling interest rates creates a more favorable buying environment. For those who have been patiently waiting for the right time to enter the market, now may be the moment to strike. It's crucial for prospective buyers to conduct thorough research, secure pre-approval for a mortgage, and work with a knowledgeable real estate agent to navigate the complexities of the market. While homeownership remains a significant financial commitment, the path to achieving that dream is becoming demonstrably less arduous than it once was.

Read the Full rnz Article at:

[ https://www.rnz.co.nz/news/business/578583/why-the-current-housing-market-is-working-for-first-home-buyers ]