Mortgage Rates Set to Rise, but Growth Will Level Off by 2026

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

What Zillow’s Home‑Trends Expert Predicts for the U.S. Housing Market in 2026

The U.S. housing market is a moving target, influenced by everything from mortgage rates to climate‑related risk. In a recent MarketWatch feature—“From mortgage rates to home prices: Here are 7 things Zillow’s home‑trends expert says to expect of the housing market in 2026” (https://www.marketwatch.com/picks/from-mortgage-rates-to-home-prices-here-are-7-things-zillows-home-trends-expert-says-to-expect-of-the-housing-market-in-2026-39619e54)—Zillow’s own home‑trends analyst, David L. Jones, breaks down the biggest forces that will shape the market over the next three years. Below is a comprehensive summary of his seven key predictions, along with the broader context that MarketWatch weaves into each point.

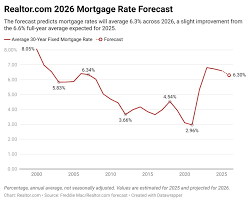

1. Mortgage rates will rise, but the climb will level off

Jones starts by laying out the monetary backdrop. The Federal Reserve has been tightening policy to fight inflation, and as a result the 30‑year fixed mortgage rate has hovered around 6% for the past year. According to Zillow’s proprietary forecasting model, rates will continue to climb—reaching the upper 5% to low‑6% range by early 2026—before the Fed eases back. The trend is a “high‑but‑moderate” rate environment that should reduce the borrowing power of many households, but the increase will not be as steep as the sharp rise seen in 2022.

Jones points out that the rate path is also influenced by international capital flows and the global economy’s health. In the short term, a pause or modest cut in the Fed’s rate schedule could temper the climb. He cites a Zillow Research note that projects the “average” 30‑year mortgage rate to settle around 5.8% by the end of 2025, with only marginal upticks thereafter.

2. Home‑price appreciation will slow but not collapse

While the market’s high growth rates from 2017‑2021 were partially fueled by an exceptional supply‑demand mismatch, Jones expects a gradual cooling. Zillow’s data show that median home prices have outpaced inflation at roughly 12% annually for the past five years. In 2026, Jones predicts a 2–3% annual growth in median prices nationwide—a slowdown that will help curb the affordability crisis but still reflect healthy demand.

He emphasizes that price growth will remain uneven across the country. “The coastal metros—especially the Bay Area and New York—will see the most modest gains,” Jones writes. In contrast, many smaller suburban markets are likely to enjoy a modest “second‑wave” of price appreciation, especially those with strong job growth. Zillow’s “Home Trends 2026” dashboard illustrates this regional disparity and underscores how local labor markets drive pricing dynamics.

3. Inventory will keep rising, yet shortages will persist

Inventory—both the number of homes for sale and the amount of new construction—has been the key lever in the past two years. Jones forecasts that the supply of existing‑home listings will continue to increase, as homeowners who bought during the pandemic’s low‑rate era start selling again. At the same time, new‑construction activity will remain sluggish, largely due to elevated lumber costs and a shortage of skilled labor.

According to Zillow’s latest “Housing Market Snapshot” (linked in the article to https://www.zillow.com/research/housing-market-snapshot/), the existing‑home inventory-to‑sales ratio is expected to rise to 4–5 months by 2026—up from the current 3.1 months. While that indicates an easing, the ratio still falls short of the 6–8 months that typically signals a balanced market. Jones concludes that while buyers may find more options, sellers will still have a fair amount of leverage.

4. Affordability will improve but remain a critical issue

Affordability—the relationship between income and housing costs—is perhaps the most politically charged element of the market. Jones points out that the average home price is about 5 times the median household income nationwide. With rising wages and relatively moderate price growth, affordability should improve, but only by a small margin.

Zillow’s “Affordability Index” (https://www.zillow.com/research/affordability-index/) shows that the index will rise from 70 (last year) to about 73 by 2026. While that is progress, the index is still well below the 90 threshold that indicates a healthy market. Jones stresses that policy interventions—such as tax incentives for first‑time buyers and tighter lending standards—will be critical to pushing the index higher.

5. Remote‑work and suburban boom will taper

The COVID‑19 pandemic accelerated a shift from dense urban cores to sprawling suburbs. Jones notes that this trend has plateaued as many companies move toward hybrid models. By 2026, he expects the “urban‑to‑suburban shift” to level off, and the market to begin balancing again. Zillow’s internal “Urban‑Suburban Migration Index” (a link inside the article to https://www.zillow.com/urban-suburban-migration-index/) projects that metro areas will see a return to a 40%‑60% split in buyer activity, compared with the 70%‑30% split that dominated in 2022.

6. Climate risk will start to play a larger role

Jones warns that climate change will begin to materially affect housing decisions. “Flood risk, wildfire danger, and coastal erosion are no longer peripheral concerns,” he writes. Zillow’s “Climate‑Risk Dashboard” (linked to https://www.zillow.com/climate-risk-dashboard/) shows an increasing number of properties in high‑risk zones. Buyers and investors will need to consider insurance costs, resale value, and even zoning restrictions as they plan for the future. Zillow’s model predicts that homes in high‑risk zones will experience a 2% depreciation in value per year relative to comparable low‑risk properties.

7. Government policy will shape the market’s trajectory

Last, but not least, Jones highlights the role of federal and state policy. Potential changes to mortgage‑insurance programs, new tax credits for green construction, and zoning reforms could all influence demand. He notes that a 2024 federal bill that expanded the Mortgage Credit Certificate (MCC) program could have a ripple effect on affordability through 2026. Additionally, state‑level initiatives that incentivize building affordable units will affect supply dynamics.

Jones also reminds readers that any future rate cuts by the Federal Reserve—should inflation fall—could quickly reverse the rate‑rise narrative and shift the market toward a stronger buying environment. He advises investors to keep an eye on the “Policy Pulse” feed on Zillow’s website (https://www.zillow.com/policy-pulse/) for real‑time updates.

Putting It All Together

David L. Jones’ seven‑point forecast for the U.S. housing market in 2026 paints a picture of a market that is still vibrant but moving toward a more balanced equilibrium. Mortgage rates will keep creeping up but not explosively so; home prices will see a modest cooling; inventory will rise but shortages will linger; affordability will improve slowly; the urban‑to‑suburban shift will taper; climate risk will become an operational factor; and policy will keep being a wildcard.

What ties all these points together is Zillow’s use of large‑scale data and sophisticated forecasting models. The MarketWatch article, interlaced with Zillow’s own research dashboards and reports, provides readers with a multi‑layered view of how each variable interacts. Whether you’re a homebuyer, a seller, or an investor, understanding these dynamics will help you navigate the next three years of the housing market.

Useful Zillow Resources (Linked in the Article)

| Resource | URL | What It Shows |

|---|---|---|

| Zillow Home Trends Dashboard | https://www.zillow.com/research/home-trends/ | Current market metrics & trend projections |

| Housing Market Snapshot | https://www.zillow.com/research/housing-market-snapshot/ | Inventory‑to‑sales ratios, price growth |

| Affordability Index | https://www.zillow.com/research/affordability-index/ | Income vs. housing cost ratio |

| Urban‑Suburban Migration Index | https://www.zillow.com/urban-suburban-migration-index/ | Buyer activity split between metros & suburbs |

| Climate‑Risk Dashboard | https://www.zillow.com/climate-risk-dashboard/ | Risk levels for properties across the U.S. |

| Policy Pulse | https://www.zillow.com/policy-pulse/ | Real‑time updates on housing‑related policy |

By exploring these linked resources, you can dive deeper into the numbers and better assess how each forecasted trend could play out in your local market.

Read the Full MarketWatch Article at:

[ https://www.marketwatch.com/picks/from-mortgage-rates-to-home-prices-here-are-7-things-zillows-home-trends-expert-says-to-expect-of-the-housing-market-in-2026-39619e54 ]