Help to Buy: Equity Loan - Low-Deposit, Interest-Free for 5 Years

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

A Complete Guide to the UK’s First‑Home Mortgage and Deposit‑Help Schemes

(Based on The Sun’s “First home mortgage 25k help schemes” article, 17 November 2023)

Buying your first house in the UK can feel like a financial marathon, but the government and a handful of private‑sector partners have put together a range of programmes to help new buyers take that first step. The Sun’s recent article breaks down the most popular schemes – from the Help to Buy equity loan to the newer First Home Loan – and explains exactly how each works, who qualifies, and the key pros and cons. Below is a detailed recap of what you need to know.

1. Help to Buy: Equity Loan

What it is

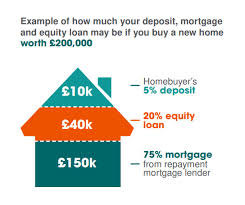

A private‑sector initiative (run by the Housing Associations Agency) that lets you borrow up to 20 % of the value of a newly built or refurbished home (capped at £600,000). No interest is charged for the first five years and you only pay back the loan when you sell, refinance or buy the equity.

Eligibility

- First‑time buyers or those who haven’t owned a home in the last 12 months.

- Property must be in England and be a new build or a refurb (within 25 years of construction).

- You must be able to secure a 5‑10 % deposit (or up to 20 % if you’re a high‑income buyer).

Pros

- Low deposit required (as little as 5 % plus the equity loan).

- Interest‑free for five years.

- You only pay back the loan once you sell or refinance.

Cons

- You’re still responsible for the mortgage and the equity loan together, meaning the combined monthly cost can be high.

- The equity loan has to be repaid when you sell, which can reduce your profit.

- Limited to new or refurbished properties.

2. Help to Buy: Shared Ownership

What it is

A partnership between a Housing Association and a private lender. You buy a share (usually 10–70 %) of a property, pay a mortgage on that share, and then pay rent on the remaining share.

Eligibility

- First‑time buyers or those who haven’t owned a home in the last 12 months.

- Must be able to secure at least a 5 % deposit on the share you buy.

- The property must be available for shared ownership (often in council or mixed‑tenancy areas).

Pros

- You get onto the property ladder with a smaller deposit.

- You can ‘staircase’ (buy a larger share) later on.

- The rent you pay on the unowned share is usually below market rates.

Cons

- You’re still subject to the mortgage and the rent.

- Stacking onto a full purchase can be costly, and the property’s resale value can be affected by the share you own.

- There are often waiting lists, and the scheme isn’t available in every area.

3. First Home Loan (Grant & Loan)

What it is

Launched in 2021 as a government grant/loan hybrid, the First Home Loan offers up to £25 000 to help with your deposit. The money is given as a grant that you do not repay, but you will have to repay a small portion (usually £25) if you sell the property.

Eligibility

- First‑time buyers earning up to £80,000 (or £120,000 for couples) and households earning up to £115,000 (or £140,000 for couples).

- You must live in the UK and be buying a property for yourself or a family member.

- The property must be a house or a flat, and you must be able to buy the home outright (no mortgage on the entire purchase price – you can still have a mortgage for the portion of the purchase price that you do not cover with the grant).

Pros

- No repayment beyond a tiny portion if you sell.

- Can be combined with a mortgage, allowing you to buy a home you otherwise could’t afford.

- No interest, no strict repayment plan.

Cons

- It’s a one‑time grant – you can’t use it for subsequent purchases.

- It only covers a portion of the deposit; you still need to provide the rest.

- The application process can be slow and involves a “first‑time buyer” check that can take weeks.

4. Starter Homes (Local Council Initiative)

What it is

Local authorities are buying or building homes and selling them at a discount – typically 30 % less than market price – to first‑time buyers who can’t get a mortgage on a full‑price property.

Eligibility

- Must be a first‑time buyer and able to pay a deposit (often 5 % of the discounted price).

- Usually only available to those buying within the council’s catchment area.

- The council sets the eligibility criteria, which can vary widely.

Pros

- Significantly cheaper than comparable homes on the open market.

- Some councils also offer flexible financing or a small grant to help with the deposit.

Cons

- Limited supply – you may have to wait for a suitable property.

- The homes can be small and located in less desirable areas.

- The council’s discount doesn’t cover the entire purchase, so you’ll still need to secure a mortgage for the remainder.

5. Help to Buy: Starter Homes (National Level)

This national version of the Starter Homes scheme is run by the government in partnership with private developers. Similar to the local council version, but the discount is usually a flat 30 % off the list price.

Pros

- Easier to access (you don’t have to live in a particular council area).

- Developers guarantee a minimum quality standard.

Cons

- Still only covers a portion of the purchase price.

- Limited to newly built or refurbished properties.

6. Other Useful Resources

- First Home Loans – government website: Provides details on the grant, application process, and frequently asked questions.

- Help to Buy – official site: Offers an interactive calculator for the equity loan and shared ownership, plus eligibility checklists.

- Starter Homes portal: Lists available discounted homes and the application requirements for each council.

How to Choose the Right Scheme

| Criterion | Equity Loan | Shared Ownership | First Home Loan | Starter Homes |

|---|---|---|---|---|

| Deposit | Low (5‑10 %) | Low (5 % of share) | £25 k grant | Discounted price (often 30 % off) |

| Property Type | New build/renovation | Any available shared ownership property | Any property (subject to income) | New build or council‑owned |

| Interest | 0 % for 5 yrs | Standard mortgage interest | No interest on grant | Standard mortgage interest |

| Repayment | Repay loan on sale | Pay rent on shared share | No repayment (except minimal if sold) | Standard mortgage repayment |

| Long‑term ownership | Full purchase after equity repaid | Staircasing possible | Full purchase after mortgage | Full purchase after mortgage |

If you’re a first‑time buyer with a limited deposit but a strong mortgage, the Help to Buy equity loan is a great way to reduce upfront costs, especially for newly built homes.

If you want a smaller initial investment and plan to stay in the same area, shared ownership lets you get onto the ladder with a modest deposit, though the monthly costs can be higher because you’re paying rent on a portion of the property.

For those who can’t secure a mortgage for the full price but have the means to cover a £25 k grant, the First Home Loan is the simplest route – it does not add any extra debt.

Finally, if you’re comfortable with a smaller home in a council area and can wait for a discounted starter home, the Starter Homes schemes offer significant savings on the purchase price itself.

Final Takeaway

The UK’s first‑home mortgage help landscape is more varied than it appears at first glance. Each scheme has its own set of rules, eligibility thresholds, and long‑term implications. The key is to align the scheme with your personal circumstances: your income, your savings, your desired property type, and your long‑term plans. By understanding the differences and applying for the right combination – many buyers find that pairing a First Home Loan grant with a standard mortgage, or combining a shared ownership share with an equity loan – you can get onto the property ladder sooner and with less financial strain.

The Sun’s article serves as a useful primer, but remember to consult the official government pages or a qualified mortgage adviser before making any decisions. Happy house‑hunting!

Read the Full The Sun Article at:

[ https://www.thesun.co.uk/money/37366819/first-home-mortgage-25-k-help-schemes/ ]